Major commodity bull markets historically happen every 20 to 25 years, with the last one coming 12 years ago. The Bull cycle that followed the housing crash recession of 2008/09, resulted in a bullish commodity rally in 2010 and 2011. In my view one needs to study prices in 2010 and 2011, from the deflationary panic in late 2008/09. Im talking grain and livestock prices that may be still deemed as cheap now, opposite from gold and silver which have already put in decade highs in 2020.

Fed Chair Jerome Powell provided plenty of fodder for fund managers feeding the inflation play in the markets on Thursday when he unveiled the framework of the central bank’s monetary policy shift for managing the economy in a low-interest rate environment. The Fed is no longer as concerned with making sure that its policies do not lead to inflation exceeding the 2% mandate, but now focus more on that mandate being an average inflation target. That means it sees value in pursuing a more aggressive dovish monetary policy stance that could push inflation beyond the mandate to average 2% over a period of time. The markets heard that to mean low interest rates and a cheap dollar for an extended time.

As we head into the 2020 election, I see external events getting crazier amid this never-ending global pandemic. While we are in a much better place than we were in the Spring regarding the understanding of this disease with treatable options that work, we still have a way to go to return to some normalcy. Food inflation is where I see the most opportunity. Pricing fundamentals of supply/demand will mean less than they used to in my view as tangible commodity asset classes will be sought by the funds amid a still uncertain future. I think the odds are greater that we may not know who wins the Presidency on November 4th with a similar outcome like the 2000 election debacle becoming more likely.

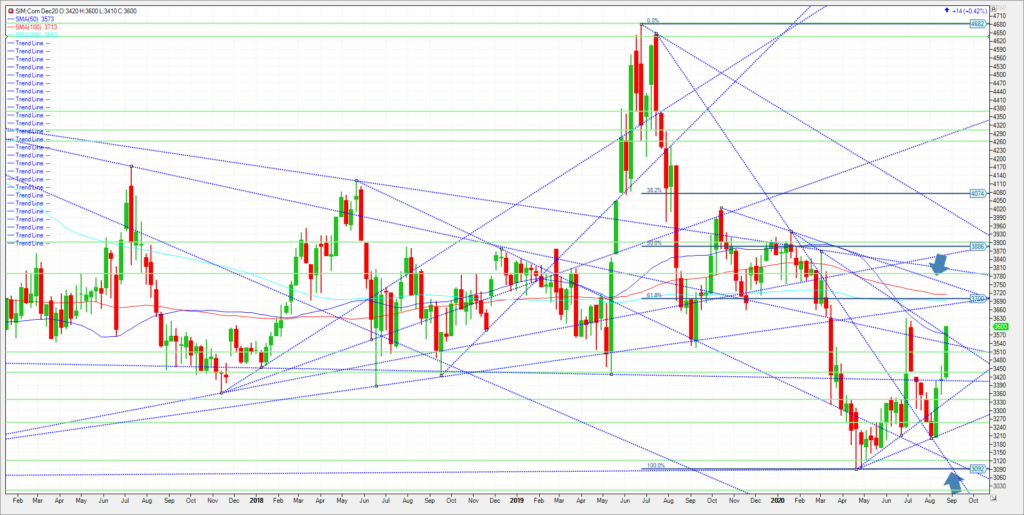

Here are just three markets I am looking at. Soymeal, Corn and Hogs. There are many more that one can play to the upside, but these are cheap bets in my view and from a risk to reward standpoint, perhaps the best bang for your buck in my view. In short I think we are closer to the bottom than the top.

Trade Idea

Futures-N/A

Options-Buy the February 21 Hogs 70.00 call and sell the 80/70 put spread to finance. Bid negative -900.

Risk

Futures-N/A

Options-The risk in this trade is 100 points or $400.00 per 3 way spread. One is collecting 900 points or $3600 upon entry. The max loss is 4K. So the risk is $400.00 plus trade costs and fees. There is a possibility of one collecting on the way out if futures trade from 62 cents up near 75 cents basis Feb Hogs.

Futures-N/A

Options-Buy the July 2021 Meal 350 call. Sell the 4.00/350 put spread. Collect 40 points upon entry

Risk

Futures-N/A

Options-One is collecting 40 points or 4k upon entry. The max loss in 50 points , so the risk is 10 points or 1K per spread. An expanded move could take the market to 370/380 here as we move into 2021. If that happened one would keep the collection and possibly collect on exit.

Futures-N/A

Options-Sell the 5.00/4.00 put for Sep 21 corn for 90 cents or a 4500 collection. Use the collection to buy the Sep 21 corn 450 call for 6 cents.

Risk

Options-The risk is 16 cents or $800.00 plus commissions and fees.

One is collecting 4200 upon entry on the three way option strategy.

These are static inflationary plays in my view. They are just one way to play a possible inflationary theme through the remainder of 2020 into 2021. They have reduced margin and risk than outright futures in my view. I like them because we get paid on entry, putting ones money management tools to the test. Given the whipsaw nature of these volatile markets, I like these defined static longs where the gameplan in to sell high and buy back low. If we get sizable rallies, it is possible one can collect on the way in and when exiting. Call or email me with questions.

Please join me each and every Thursday for a free grainand livestock webinar. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.