Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

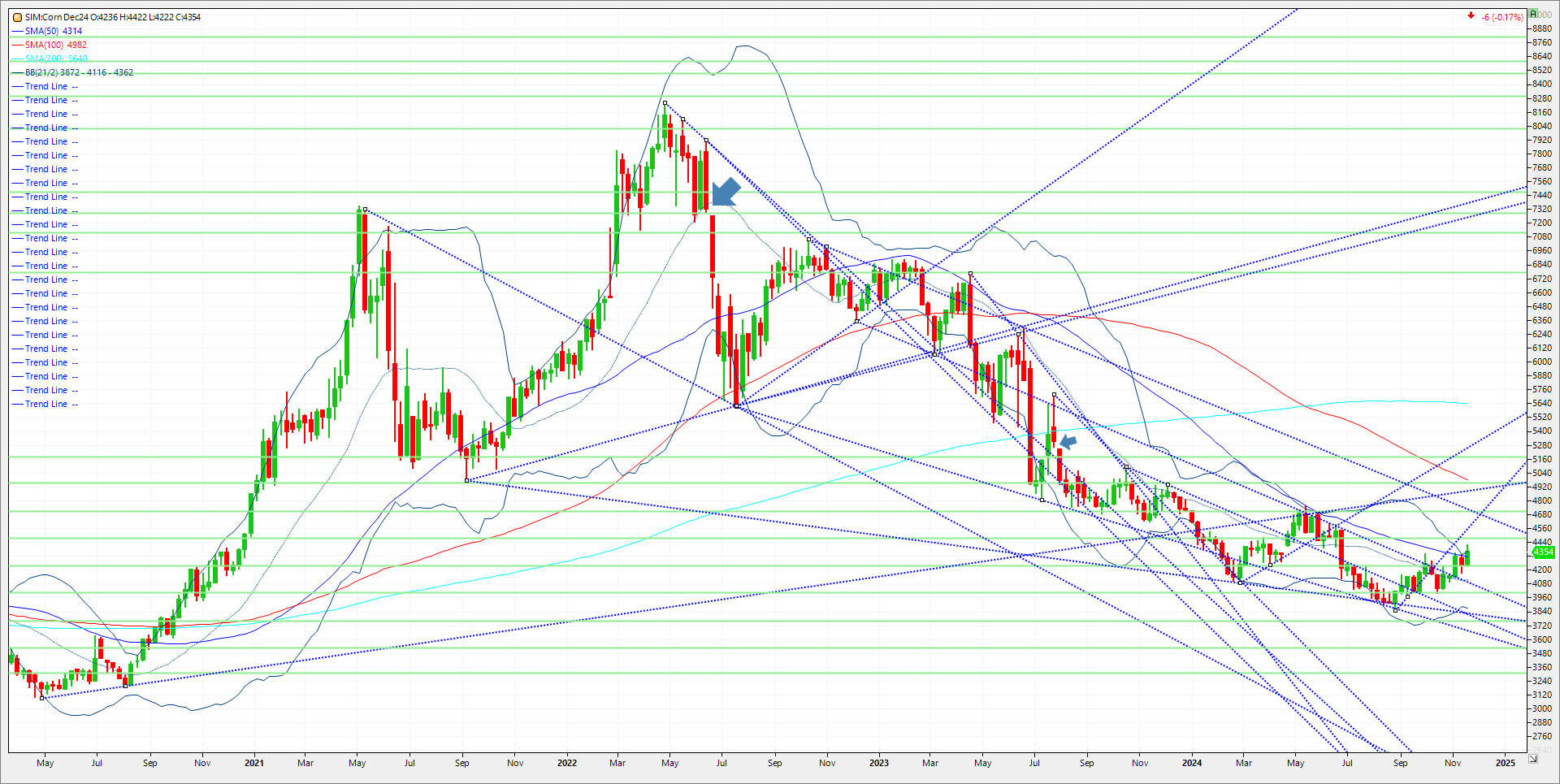

Corn prices remain supported by yesterday’s technical reversal on the charts, while rising palm oil prices continue to support soy oil in my opinion as these two markets have a “Story” to warrant higher prices for now. Corn demand remains strong on a few fronts. First, per Pro Farmer, ethanol usage totaled 460.5 million bushels in October, up 13.2 million bu. (3.0%) from the upwardly revised figure for September but down 1.9 million bu. (0.4%) from year-ago. Through the first two months of 2024-25, corn-for-ethanol use totaled 907.8 million bu., 17.0 million bu. (1.9%) more than the same period last year. Corn sales for future shipment remains robust with apparent front loading of sales ahead of potential tariffs that may enter into the market next year. The latest export sales report showed that for the week ending November 28, net corn sales came in at 1,732,394 Tonnes for the current marketing year and 22,098 for the next marketing year for a total of 1,754,492. Cumulative sales have reached 57.9% of the USDA forecast for the 2024/2025 marketing year versus a 5-year average of 46.3%. Funds long approximately 100K corn have defended their positions below 430 on breaks as we trade back to 440.

How does the demand story play out? In my view it will be up to the USDA to make a call to whether this is a trend or just front loading from the US’s regular importers as exports are over 200 million bushels from USDA’s projections. The Trade into next Tuesday’s WASDE is predicting on little to no change in the demand estimate. The average trades guess for 24/25 US corn carryout is 1.910 billion vs 1.938 billion. A mere drop in the bucket on the balance sheet. With ethanol usage trending up, the same question is raised there. Is the industry front-loading its usage while the corn is cheap, or is this an indicator of a bigger ethanol program? Technical levels for this week come in as follows. Support is first at 430, the 50 week moving average. A close under and its 4.24. A close under 4.24 and I wouldn’t be long as the market will test 4.15 to 4.13. Resistance on the weekly continuous is 442, the top of the bollinger band. If that is taken out look for the market to test 4.48/4.50. Consecutive closes above and its 4.66.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.