Commentary

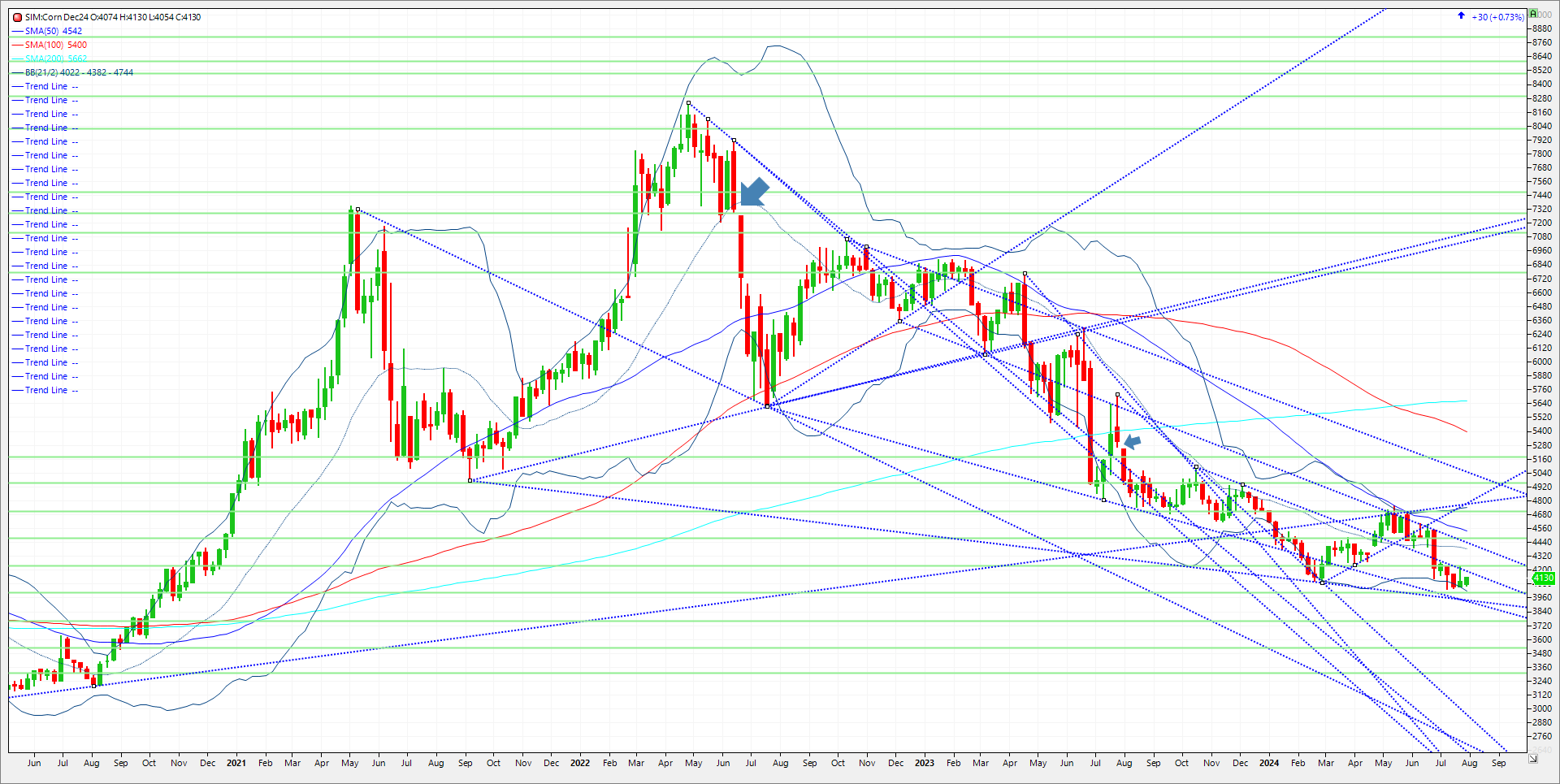

Good to excellent conditions for corn rose 1 point his week to 68 percent good to excellent. There simply hasn’t been a weather threat for corn during the key pollination month of July in the Midwest in my view. Weather models are now diverging in the near-term forecast with the US model turning hotter and Euro cooler. Both agree that the 6 to 10 day turns hot and dry, but both also agree that it turns wetter in the 11 to 15 day. This non-threatening outlook looks to boost support for good corn and bean yields for now in my opinion. If there were any areas under significant threat of yield loss it would be the in the Southern plains like Kansas and Oklahoma and Indiana and Ohio areas. The area due for the least rain in the next 15 days in the Southern Plains. The Indiana and Ohio area in my view would have the most impact of yield losses built there. We are splitting hairs though at this point given then unpredictable nature of weather. The next WASDE report likely offers funds with the most potential to cover if FSA finds 1.5 to 2 million acres less corn in its updated harvested acres release. It’s a wild card that could offset higher yields as a 180 yield would be offset by a 2 million acre cut that could push ending stocks to 1.8 billion bushels from the current 2.1 billion. Until then technicals need to be eyed closely. Key support is 4.03/4.00. A close under and we trade to trendline support at 393/94. A close under that level and its Katy bar the door to 3,76, which represents 20% down for year. Resistance is 4.19 then 4.24. A close over 4.24 and I wouldn’t be short as we might see some itchy fund managers short 300K futures and options come out of their positions. Next resistance levels are 4.38 to 4.43.

Trade Ideas

Futures-N/A

Options-Buy the Nov 2024 corn 420 put and sell the 5.00 July 25 call for even money plus trade costs and fees. The spread settled today at a 7-cent debit, so a push higher near 4.20 is needed to get filled.

Risk/Reward

Futures-N/A

Options-The risk is unlimited and should really be used by corn producers only as hedge. It puts a floor of protection at 4.20 into last October amid harvest. Unlimited risk at 5.00 basis July, but if one is holding bushels in storage, one may not care to have the right to be short july corn at 5.00 if the options exercise. Big “if”.

Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606