Commentary

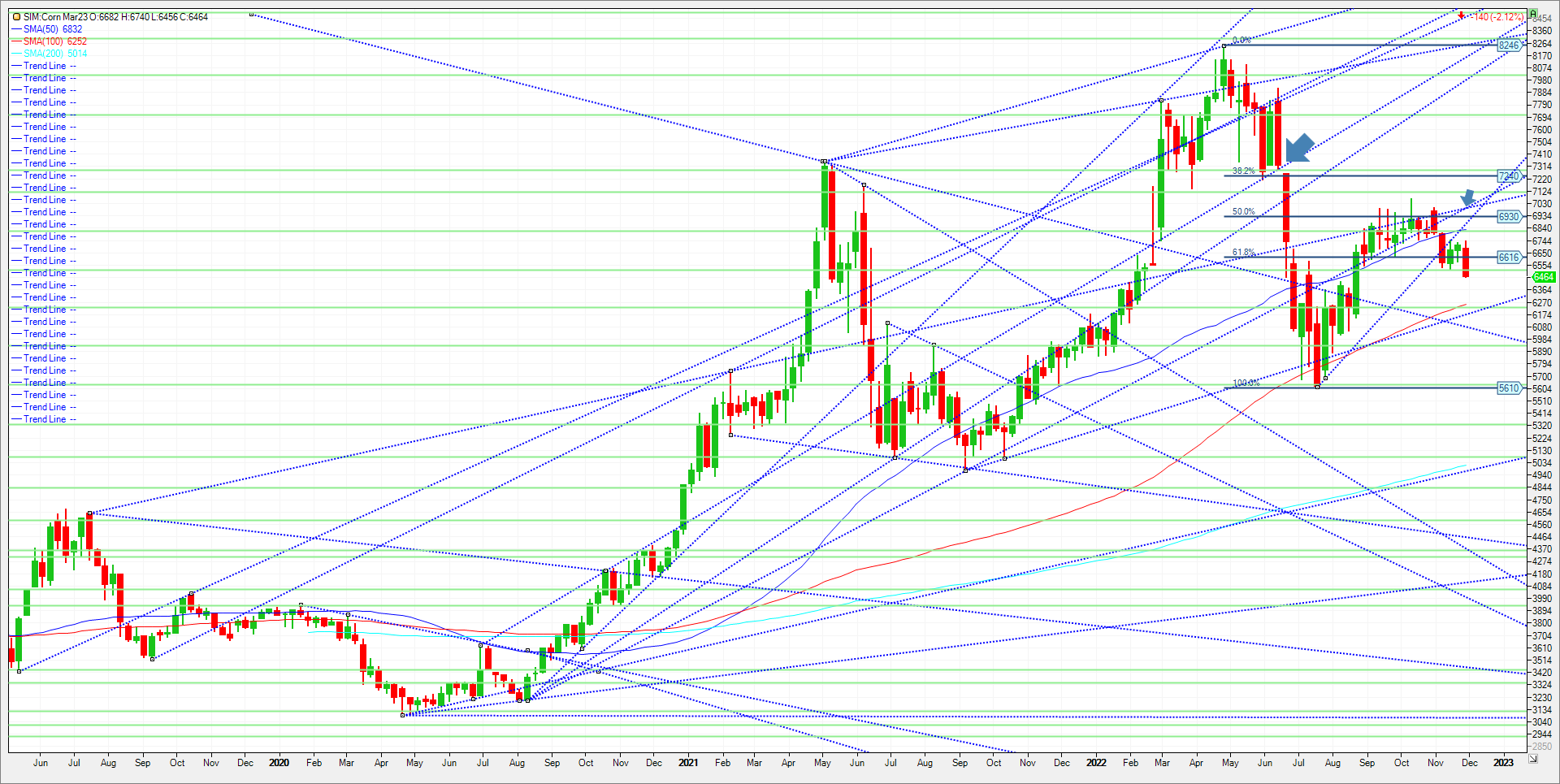

The corn market broke down technically this week, falling to the lowest levels since August. Fundamentally, weak export demand is potentially telling traders lower prices are needed to encourage more sales. Given tight ending stocks forecast in 2022-23, the downside could be relatively limited but the near-term path of least resistance is lower in my opinion. Demand or lack thereof continues to drive longs to unwind or liquidate in my view. Export sales outperformed low expectations but just marginally this week. At 603K metric tons this week it was 400K under the volume sold at this time a year ago. Mexico drove most of the activity this week but not enough to make any headway to closing the gap vs last year. China was also virtually absent from the corn market. China retains an 8.5 million metric ton (330 million bushel) lag vs its purchases last year. Non-China corn business lags last year by 8.6 million metric tons. After adjusting for the smaller program, the US is behind pace by 12 million metric tons (470 million bushels). It is my belief that the trade is looking for the USDA to adjust the balance sheet by raising ending stocks in subsequent reports starting in January, due to lack of demand. This assumes demand doesn’t pick up. Technical levels for next week come in as follows for March 23 corn. Support is first at 6.34. This level represents the fifty percent retracement of the October high at 7.06 to the July low at 5.61. A close under 6.34 and the market could test the 100 week (M.A.) at 6.25. Under 6.25, it is trendline support at 6.19. A close under 6.19 and its katy bar the door down to 5.93. Resistance is just 5 cents higher at 6.52. A close over and we could see corn retrace to 6.73. A clover 6.73 could push the market to 6.84.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me each Thursday at 3pm Central for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax