Commentary:

As of Oct. 13, managed money accounts were net long 156,928 corn futures contracts, which was the largest net-long position since the third week of July and the biggest long for this time of year since 2012. Much of the fund-led buying spree has been triggered by aggressive export demand. While there were no new daily export corn sales today, total corn export commitments are 156% ahead of last year and 69% ahead of the five-year average. But the bulk of recent corn purchases have come from Mexico and China. This was highlighted by yesterday’s sale of 345,000 metric tons of corn for delivery to unknown destinations,(CHINA) during the 2020/2021 marketing year; and export sales of 123,000 metric tons of corn for delivery to Mexico during the 2020/2021 marketing year.

Dryness has slowed corn planting in both Brazil and Argentina. Perhaps the bigger concern, however, is that delayed soybean plantings may jeopardize safrinha corn production in Brazil. A delayed soybean harvest means a good portion of safrinha corn acres, which accounts for 70 percent of the Brazilian corn crop, could be planted after the optimal window closes, increasing odds that portion of crop will pollinate and fill after the traditional rainy season ends. La Nina raises additional concerns this year.

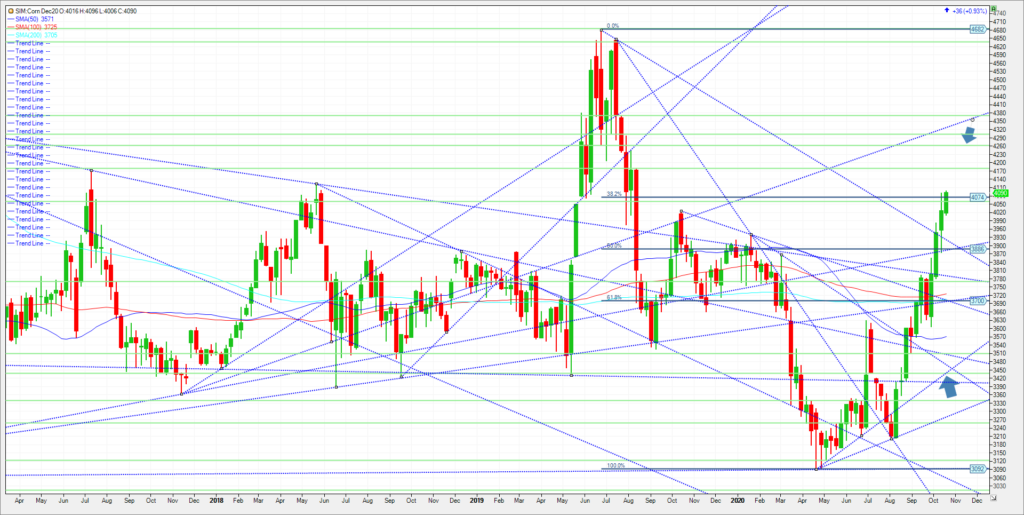

Lower ending stocks per the USDA from data via the Sept 30th quarterly stocks report along with lower production numbers from the October WASDE that could eventually push the corn carry-out under 2 billion bushels has buoyed prices. If one combines this with increased exports, the carry-out could be further reduced 200 to 300 million bushels to 1.8/1.9 billion. If a severe LaNina extends into December/January in South America, this corn market can push to last year’s highs at 468. Don’t rule anything out as far as pricing. Please look at chart below. Todays settle puts us above the 406/07 area. Its a target area we have been touting as its represents a 5 percent higher on the year threshold for corn and a Fibonacci retracement area from last year’s high to this year’s low. We settled just above it today, the highest settle in over a year. In my view I see the volatility increasing moving forward. Either we see a pullback to 390 or a move near 430. 426 is ten percent higher on the year for corn. With this in mind consider the following strangle.

Trade Recommendations

Futures-N/A

Options-Buy the December Corn 390 put and buy the December 430 call for 6.4 cents or $325.00 plus commissions and fees.

Risk/Reward

Options-The risk is the price paid for the options plus trade costs and fees. We want to see volatility continue here and are not interested in a particular direction for corn. I would offer 20 cents for the strangle if filled at 6.4 cents. A big November crop report, election, fund positioning could push the market 20 to 30 cents quickly in my view.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts.

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Sign Up Now

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.