Commentary

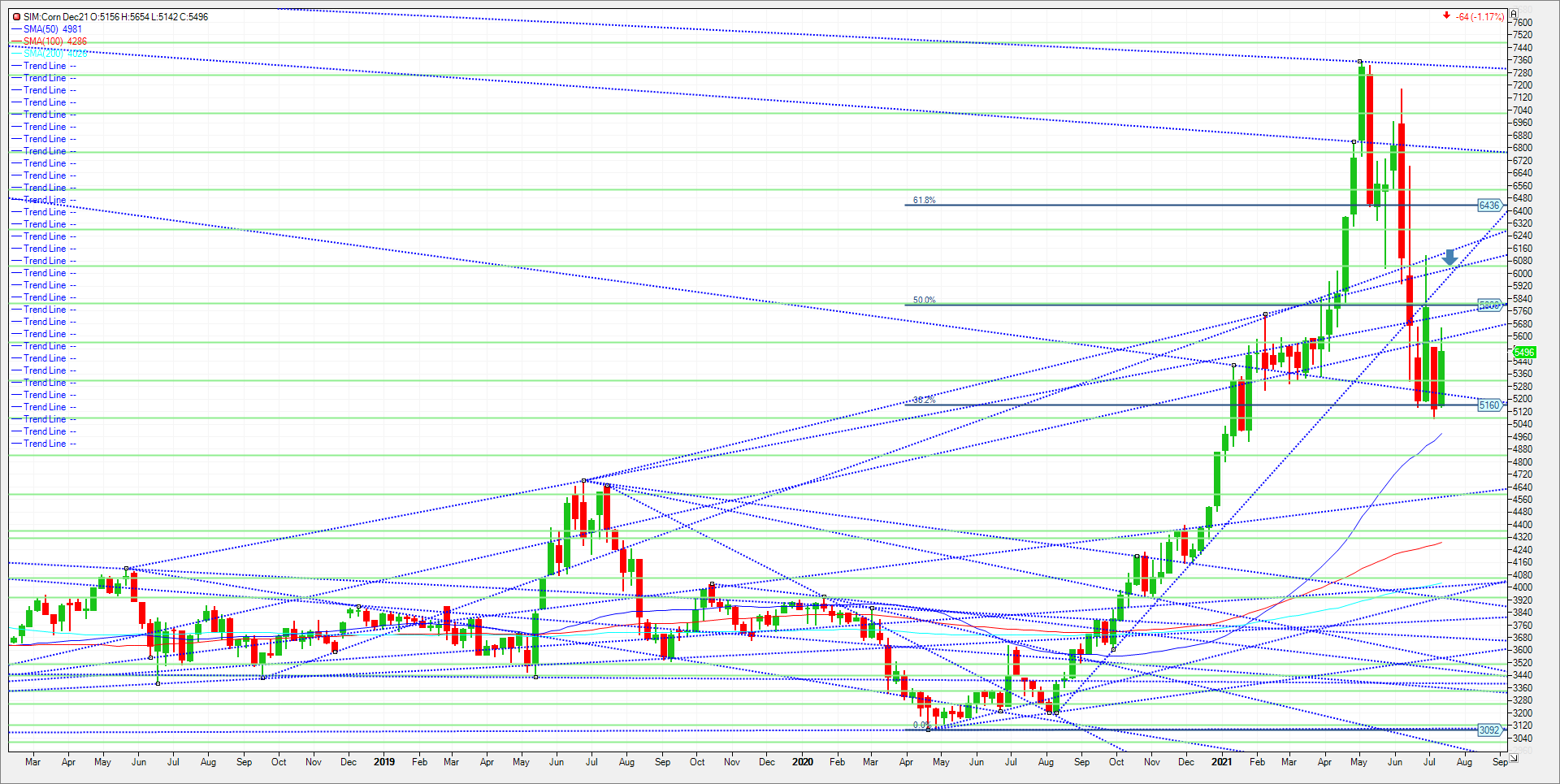

The week heading into 4th of July saw December Corn hit 611.2. Then the market dropped 1.04 to 5.07 last week. A fifty percent retracement took the Corn market to 559, which was hit and surpassed the last two sessions. Today’s settle saw corn flip 12 cents from the high to end the day lower at 552.0, Dec 21 ended up 35 cents on the week. A move back to hot and dry is possible in the corn belt the next two weeks which has put sellers on the sidelines for now. I think the strength in Spring wheat and beans did more for corn than projected weather forecasts the last ten days of July. To me it’s a follower as needed July rains have shown up. However, weather can still hurt this crop and the forecasts can flip flop in a hurry. July is generally regarded as the most critical weather month for the corn crop, but August is also crucial as the crop fills. If forecasts calling for hot temps the final two weeks of July materialize, timely rains will be needed next month in my opinion. Given the tight supply outlook for the 2021-22 marketing year, a lot rides on how this year’s crop produces in my opinion This is one reason why we have seen expanded daily and weekly ranges and I look for it to continue as we move through the growing season. I’m just watching levels here as seen on the weekly continuous chart. Initial support is first at 5.32. Key support is 5.14/5.16. A close under and I thin we could take out last weeks low and move to the 50 day moving average at 4.98. A close under and we go to 4.78/4.84 area in my opinion. Resistance is up at 559/560. A close over and its 574/75. A close over 580 which is the (20 percent threshold higher on year), takes the market to 6.02. 6.02 is the Mother of all resistance. A close over it and we could see an extension significantly higher in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a weekly webinar every Thursday at 3 pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604