Commentary

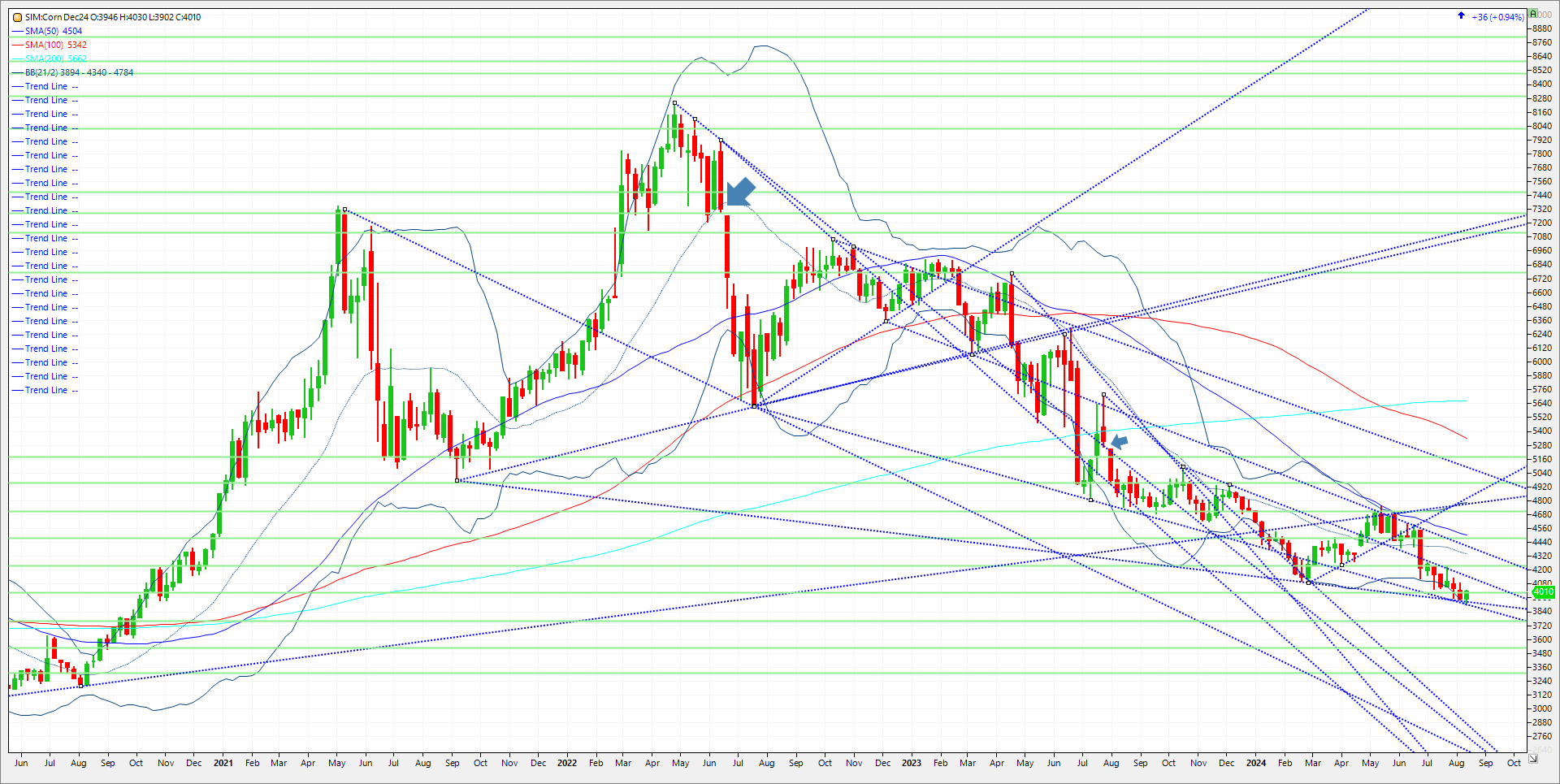

Corn tagged along with the soybean market again in what appears to be a recovery bounce for the grain and oilseed markets today, following recent losses. Selling slowed today for corn with the market nestling back to the 4.00 area which represents 15 percent lower on year. We also may have seen some bottom picking or end user buying at or below the 4.00 level in December corn along with some potential fund profit taking to provide support. For now, it doesn’t appear that fund managers don’t fear holding big, short positions when the farmer is the long in the market, as is the case currently for corn, soybeans, and wheat. The reason they may not be scared is weather in my opinion. If anything, weather forecasts have improved in the 10-day outlook. The models inserted a rain system in the 6-10 that was not in the 11-15 yesterday. In my opinion if the cooler and wetter pattern holds it will only give thoughts to this crop getting bigger not smaller. Therefore, it is my opinion rallies need to be sold unless something else enters into the market which at this point could be seen as a rarity or black swan event. A geo-political event or Middle East war, and early frost, or derecho for example. That in my view is what it might take to sustain a rally in grains or else rallies are confined to a few sessions of profit taking. Look at the chart below. For corn for now the market has held key trendline support at 3.92/3.90. A close under and the market in my view will trade down to 3.76, which represents 20% down for the year. Underneath that its katy bar the door to 3.53, which is 25% down for the year. Resistance is up at 4.14. A close above and its 4.24. A close above 4,24 and the market could challenge the 21-week moving average at 4.34. For those with unpriced bushels, please consider the following hedge idea.

Trade Ideas

Futures-N/A

Options-Buy the 4.00 Nov corn puts and sell the July 25 calls at even money minus trade costs and fees.

Risk/Reward

Futures-N/A

Options-Unlimited risk here as one is short a July 25 call versus the long Nov 24 put. This trade settled at a 3-cent debit today, so the market needs to trade a little higher for the spread to get filled at even money. The goal here for the producer is to put a floor in their corn at 4.00 until late October.

Please join me for free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.