Commentary

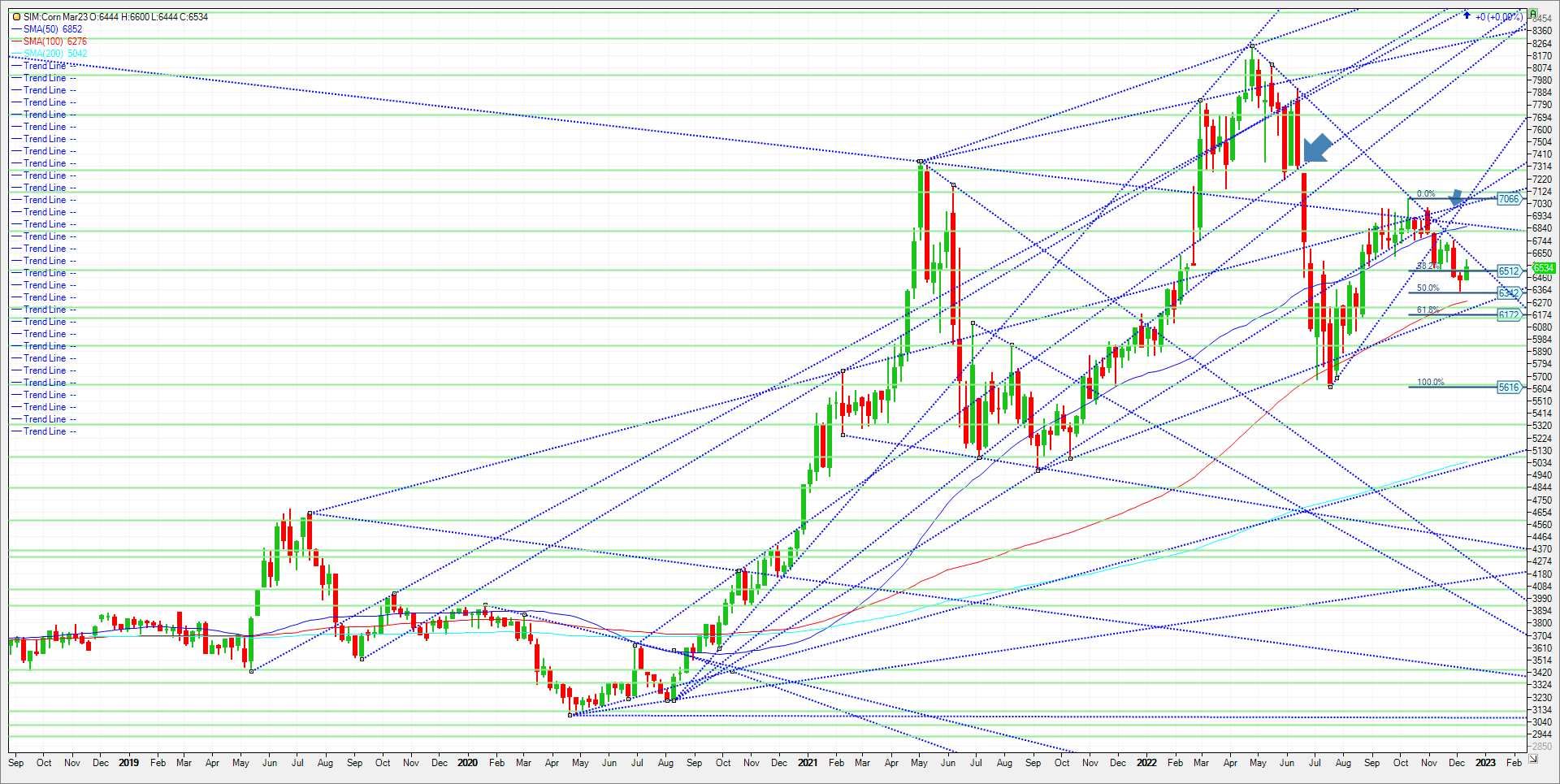

March futures’ modest gain this week could signal that a short-term bottom was forged earlier this month. Time will tell. A stronger-than-expected weekly export sales number seemed to confirm buying interest on price dips. But the bigger export picture remains bearish, with U.S. commitments so far in 2022-23 down 48% from 2021-22. Moreover, the macroeconomic outlook grew cloudier in my opinion after Fed Chair Jerome Powell’s hawkish comments rattled financial markets. Argentine weather leans price-supportive but isn’t concerning enough yet to justify extended rallies. Barring a major market-moving event, price action is likely to be sideways in light trade through year-end and potentially into the January 12th crop report. Technical levels for next week come in as follows. Support is just below this week’s settlement at 6.52. A close under could retest last week’s low at 6.35. A close under 6.35 and 6.28 and then 6.23 could be seen. Resistance is at 6.62. A close over and the market could rally to the 6.83/85 area. A close over 6.85 and next resistance is 6.92.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3om Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax