Commentary

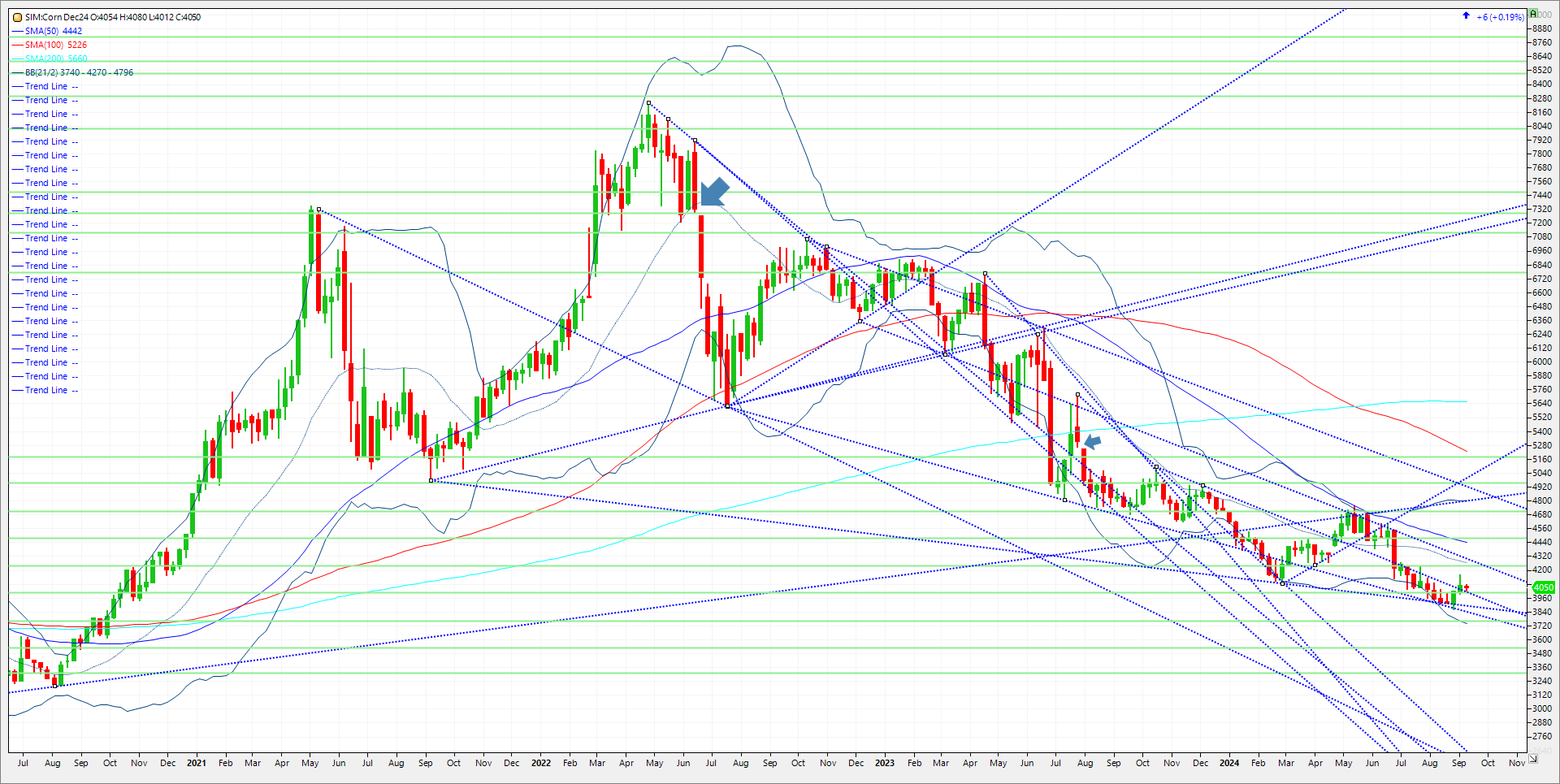

Tomorrows 11am Central WASDE release has the following trade possibilities. The average trade guess for corn yield comes in at 182.4, slightly lower than last month at 183.1. The range of guesstimates is 180.5 on the low and 183.5 on the high. Ending stocks average guess is just over 2 billion at 2.007. This is down 66 million bushels from last month with a wide range of estimates from 1.819 on the low end to a high at 2.133. Th average production is seen at 15.076 billion bushels produced down slightly from last month’s 15.147. Could there be surprises? As always there could be, but corns fortunes could be tied to the reaction in beans and wheat moving forward. This assumes tomorrow’s numbers come in near expectations. This year’s crop is said to be a bin buster in many areas, but the question moving forward is are the August lows at 3.85 the harvest low? Todays close puts the market only 19 cents from that low, where 4.00 is seen as psychological support. Bearish surprises would be an increase in yield tomorrow as late season warmth and dryness boosts crop potential into harvest with state ratings verifying this. The old adage is that big crops get bigger. Bullish surprises could see a decrease in harvested acres coupled with more corn going to ethanol. It’s my opinion that this year’s low corn prices this fall are the biggest subsidy to ethanol production as the EIA data showed today. Ethanol average daily production for the week ending September 6 averaged 1.080 million barrels. This is a new high daily production for this week of the year. The previous high was 1.047 million barrels per day in 2017. The market would need to see this type of continued increase in production to make adjustments on the balance sheet moving forward. Last month the USDA made no new adjustments to ethanol production. However, should we see increases of 3 to 4 percent versus last year we could see another 160/220 million bushels deducted from ending stocks alone. That possibility won’t show up tomorrow but could down the road. I think the likelihood of the producer storing corn awaiting higher prices through harvest could be a key as well as insurance dates than minor possible changes to the balance sheet, just my opinion here. How big is this crop then? We will get some answers tomorrow. Until then follow the technical levels. Through next week support is first at 4.03 to 4.00. A close underneath and the market could push down to 383 and then 376. Resistance is last week’s high at 416. A close over and we could see 4.24, 4.27 and 4.30.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.