Commentary

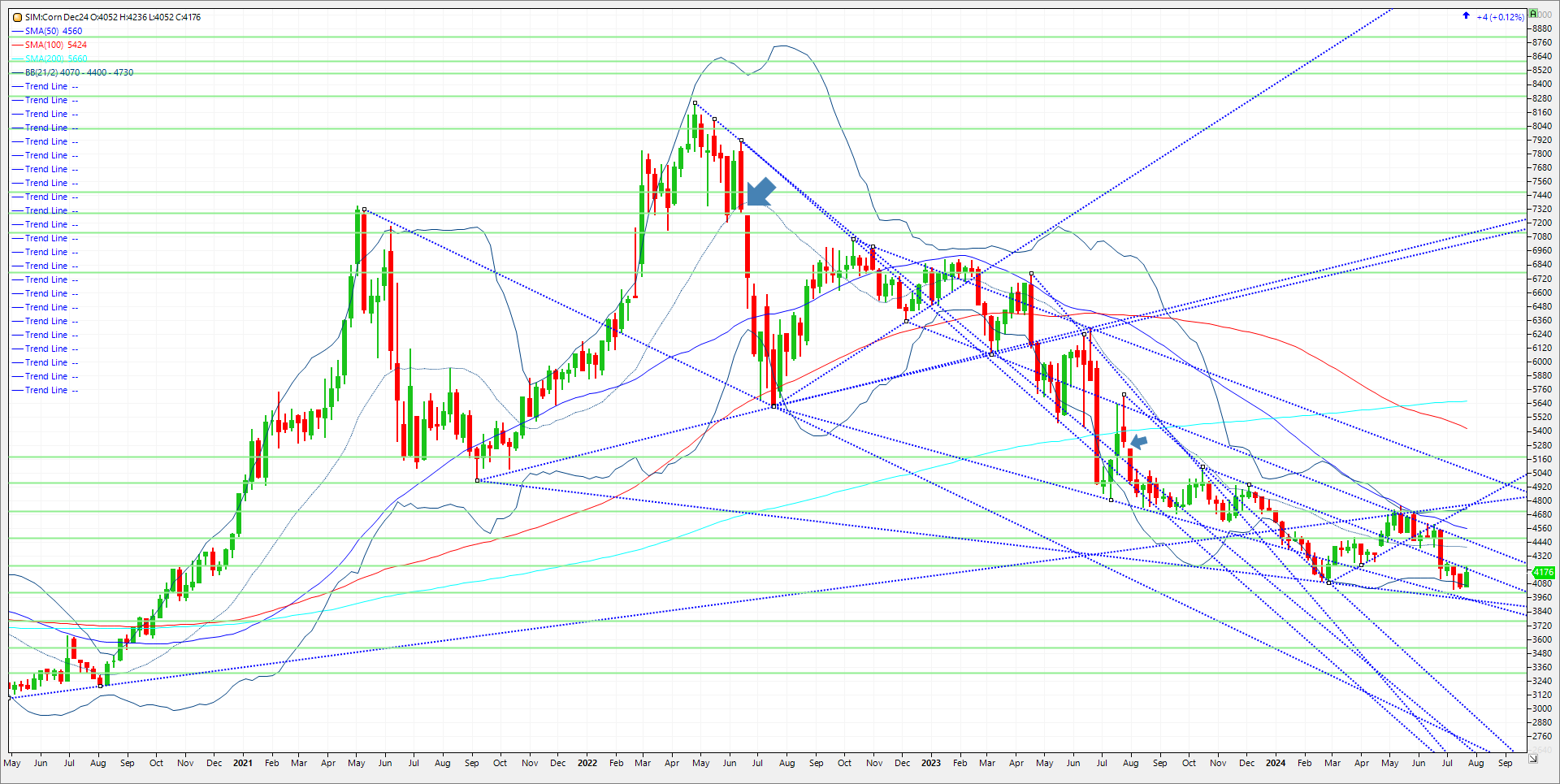

Funds continue to slowly peck away from their record short positions as funds cover another 9 to 10K contracts in corn today in my opinion. Yet the market rallies only a penny on the day. Major resistance is still holding on pushes above 4.20 December 24 corn. Patience is warranted here. FSA is going to adjust acres in the next WASDE report on August 12th. The problem as it always is with USDA is that any announcement on an adjustment of acres is that the real numbers might not show up until a year later than expected. They can say whatever they want whenever they want, totally unpredictable. For example, the USDA in a poorly surveyed acres release on June 28th, put harvested corn acres one million higher than anyone expected, never taking into consideration what might have been lost in the NW corn belt due to flooding and hail damage. Don’t get me wrong, weather has been near perfect, but a potential loss of 1.5 to 2 million acres would offset increases in yield. We will see if we get a more accurate read from FSA data incorporated into the next WASDE as it relates to carry out and stocks to usage. Without the adjustment then in my opinion a hot and dry August is needed for a sustained corn rally that chases beans higher. Hotter temps are forecasted but no heat domes or drought like conditions are predicted to stick around form an extended period as we enter into August. That may change and flip flop a few times so until then focus on technical levels. For Dec 24 corn, support through next week comes in as follows. Support is here at 4.18 and then below at 4.07. A close under and its 4.00 and then double trendline support at 3.94/93. A close under this level and it’s a push to 3.76 (20% down for the year) and then 3.53 (25 % down for 2024). Resistance is at 4.24, consecutive closes are needed to push the market to 4.40 and then 4.43. A close over 4.48 is needed to change trend to push the market to 4.56 and then 4.71.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604