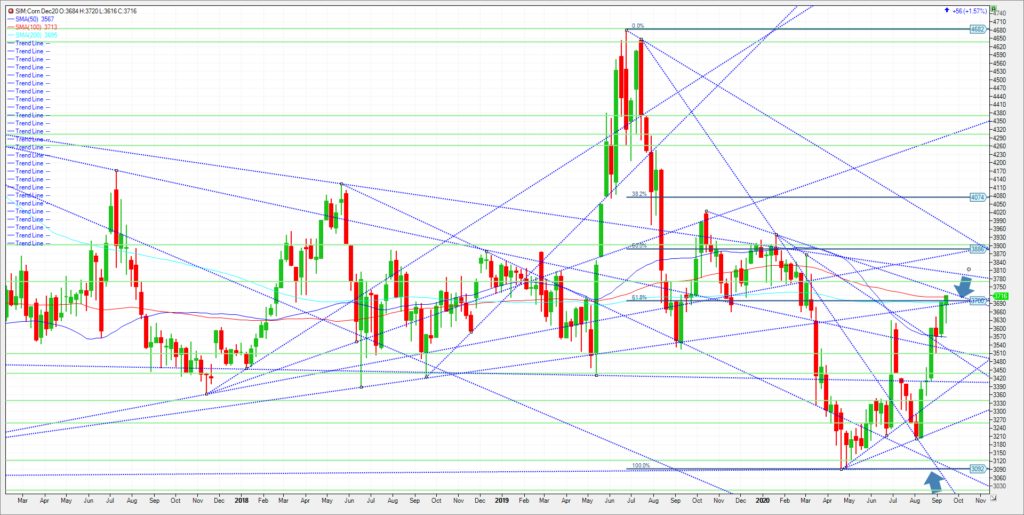

Corn futures finally broke rallied past the 3.70 level for its highest close since March. A long time coming. 10.00 beans one reason why along with trend and index following funds that have flipped from a sizable short to approximately a 40 to 50K contract long. Funds and speculators in my view are taking note of crop damage in China stemming from three late-season typhoons following flooding earlier in the season. That issue combined with high Chinese corn prices and reports of depleted stockpiles has some analysts calling for a potential jump in Chinese corn imports. Industry sources are signaling China could bring in 15 MMT to 30 MMT of corn, with most estimates coming in the 20 MMT to 25 MMT range. In contrast, USDA last week projected China would import just 7 MMT of corn in 2020-21. A potential could knock down ending stocks below 2 billion bushels. In my view, funds could rally corn to pre-covid levels or a least push the market to unchanged on the year at the 50 percent Fibonacci level at 3.88. A continued rally push corn to the 4.00 level. (See Chart) In my opinion I think a close over 373 is needed to prod funds and specs to increase their longs in the market. Todays close puts the market over the 50 and 200 moving average, over 373 and we clear a big trendline and over the 100 day as well. I know the market may see some harvest pressure upcoming as we come in 5 percent harvested as of Monday. However thoughts of Chinese buying amid inflationary pressures may keep this market bid in the near term.

Trade Ideas

Futures-Buy the Dec 20 Corn futures on a close over 373.

Options-N/A

Risk/Reward

Futures-Place a stop under 3.64 risking 9 cents or $450.00 plus commissions and fees. Its a pretty generic strategy here but sometimes its best to keep it simple. Im looking for a move to 3.88 and if that gets taken out a move near 4.00.

Please join me each and every Thursday at 3pm Central for a free grain and livestock webinar. Signup is free and a recording link will be sent upon signup. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.