Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Commentary

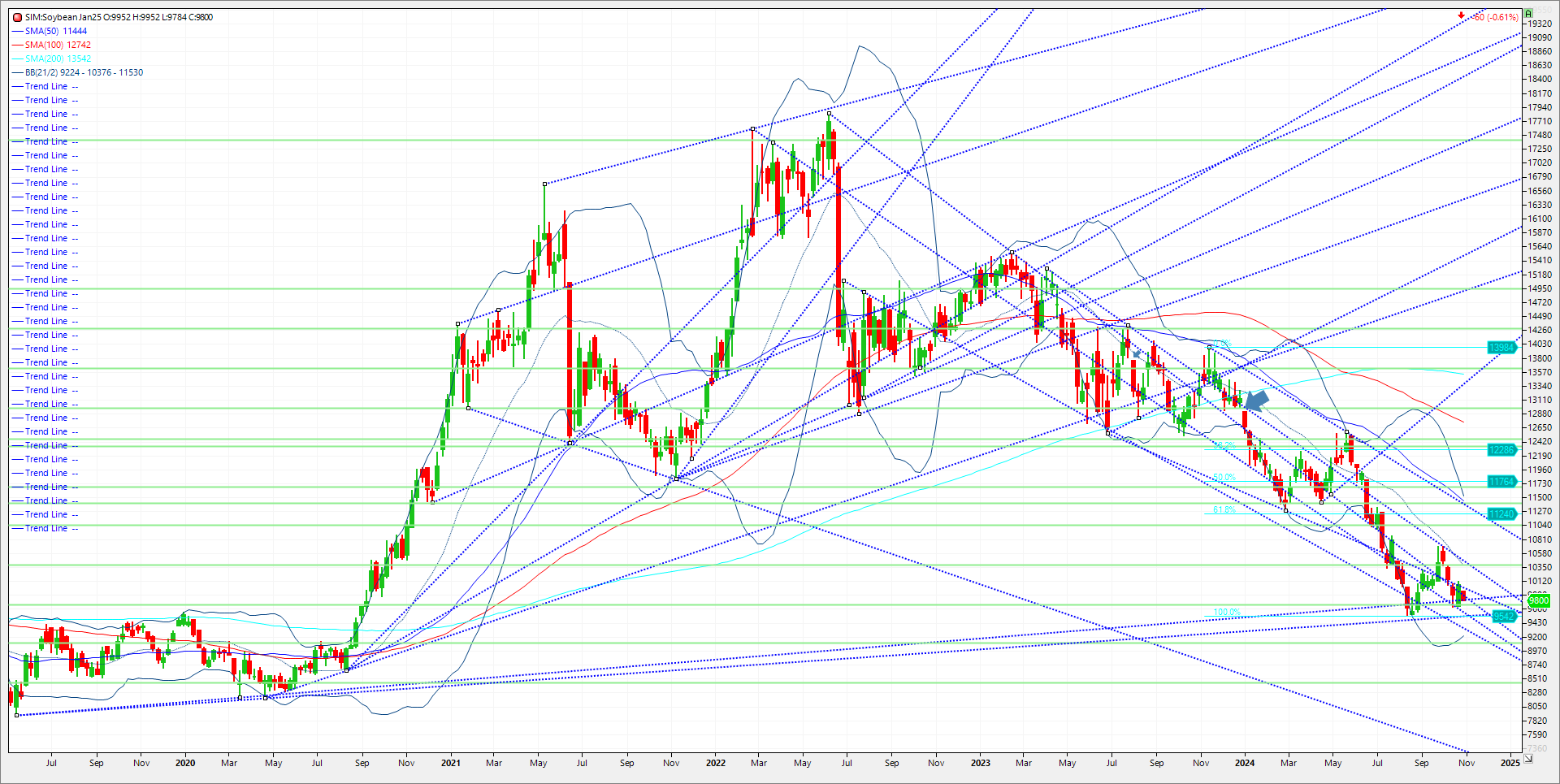

Election jitters, possible China tariff retaliation off a Trump win, rain in Brazil where planting has played catchup versus historical averages are all reasons beans lately cannot sustain a bid in my opinion. Wheat was the only savior today as the first look at condition scores of the year on Monday for the 2025 winter wheat crop. USDA rated 38% of the crop Good to Excellent, down from 47% in the same week last year. That compares to 28% G/E in the same week two years ago, that crop ended up just below trend yields. That said, it’s extremely early. Recent Chinese buying of US Beans closes the shortfall somewhat of what the USDA projects at 1.85 billion. Current pace is approximately 100 million bushels below, but that gap can be closed quickly if Brazil weather turns back to hot and dry. However, should there be a mild growing season in S.A., without many weather threats, then ending stocks will not decrease anywhere below 500 million bushels which is exceedingly high amid a comfortable stocks to usage. Corns balance sheet has dwindled slowly on an aggressive export pace to Mexico and “Unknown Destinations”. Offsetting the increase in demand is a 24/25 corn crop that keeps growing with every monthly supply demand report from USDA. I think corn export demand will ultimately win the day here, but that victory may not be realized until well past harvest. Lots of “ifs” and “maybes” here but I would consider the following hedge trades described below if I was storing corn or beans in the bin. My strategy locks in $10.00 in beans out to late February using March 25 options, while locking in $4.50 in corn out to late April using May 2025 options. For Beans I am selling 40 cent wide put spreads at 38 cents, where the max loss is 2 cents. I am doing that to finance and put a floor at 10.00 long puts until late February 2025. Corn I’m suggesting different months. Buy the May 450 puts. Sell the Dec 25 530/500 put spread for 25 cents. OB. I am trying to finance the May 450 puts at even money by selling the put spread further out on calendar that gives the opportunity long term to buy back the put spread cheaper from where I sold it, and at the same time locking 450 on the May 25 board for what one might have unpriced in the bin.

Beans

Lock in $10.00

Basis March 2025 soybeans

Buy the March 10.00 put 38 cents. Sell the 1160/1200 put spread for 38 cents.

Risk: The max risk here is 40 cents or 2K per spread plus all trade costs and fees.

Corn

Lock in $4.50

Basis May 25 corn

Trade Idea

Buy the May 450 puts for 25 cents. Sell the 5.30 vs 500 Dec 2025 corn put spread for 25 cents. Cost to entry even money minus trade costs and fees.

Risk: the max risk here is 30 cents or $1500.00 per spread plus all commissions and fees.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

7

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.