Commentary

The panic selling witnessed in the energy and equity sectors on Friday didn’t appear to affect Corn futures all that much. In fact on Friday end users most likely bought the dip as December and March corn futures finished the day almost 20 cents higher from the daily lows. Tomorrow is first notice for December corn which makes March 22 the most actively traded contract on the Board. Per CFTC data released today, managed money added 25K longs to increase their net long to 366K. The managed money record long is near 419K. Futures were under profit-taking pressure in my opinion following last week’s climb to the highest levels in nearly five months. Spillover from a selloff in wheat also weighed on corn prices in my view. USDA reported 766,063 MT of corn inspected for export during the week ended Nov. 25, down from 825,650 MT the previous week. Inspections were within trade expectations ranging from 575,000 to 1.2 MMT. So far during the 2021-22 marketing year, corn export inspections totaled 8.581 MMT, down 17% from the same period in 2020-21.

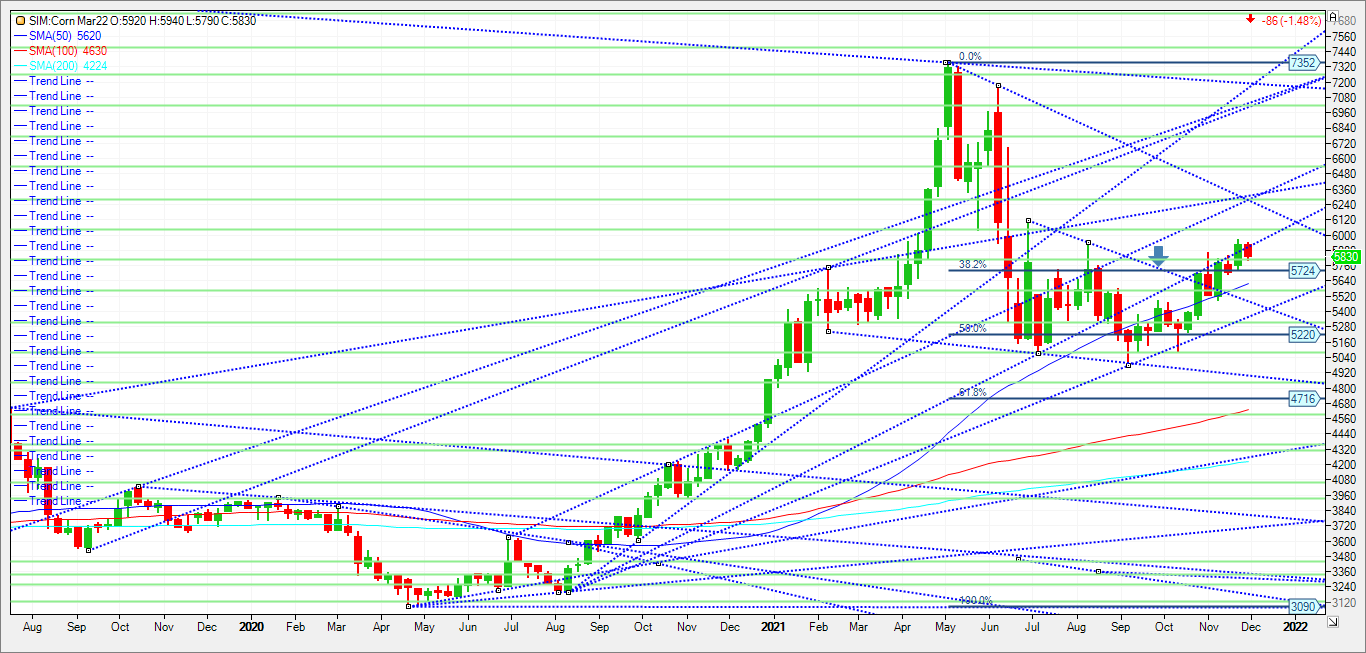

The tug of war in not just corn but other Ag commodities moving forward is new threats and potential lock downs from Covid variants versus inflation inspired buying across the Board. What would or could shake these funds to liquidate their sizable long in corn? Technically in my opinion, the market needs to hold 580 March futures or prices could get pressured down the 50 day moving average in the low 560’s. If that level fails to hold look for trend line support at 5.48 and potentially 5.35 to be tested. A close under 535 and it could be katy bar the door to 5.07, and then 4.84. Key resistance this week at 5.90 a close over and the next target is 6.03. A push above this level and then the next target is the 6.27/6.30 area. This area represents 30 percent higher on year.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604