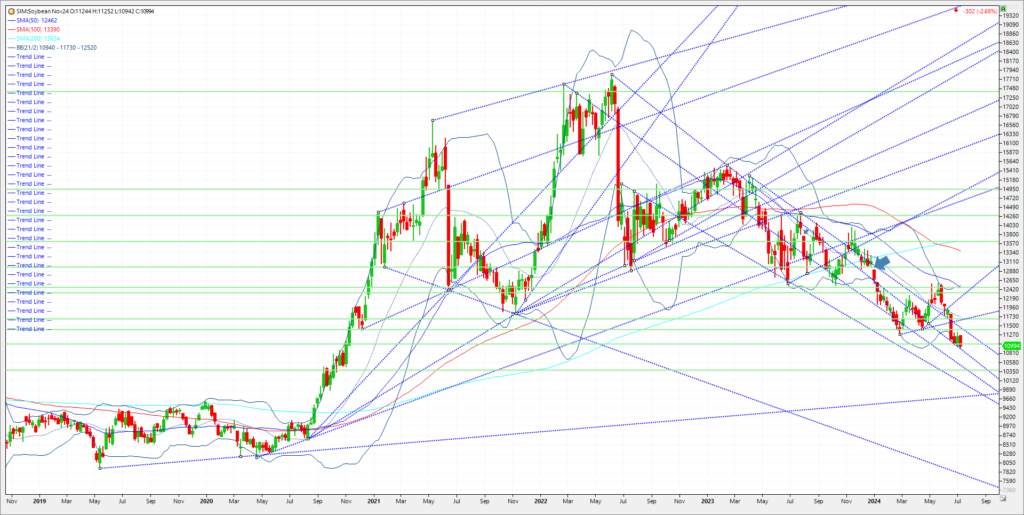

Cooler and wetter forecasts into Mid July sent corn and beans significantly lower as both markets made new lows today. Condition ratings for both crops improved by 1 point in the good to excellent category, while new crop demand remains non-existent. Last week’s relief rally in beans that sent November futures to 11.30 looks like a great selling opportunity. Right now, managed funds in my view don’t have much of a reason to short cover. That may change as we get deeper into Summer if forecasts flip back to hot and dry ahead of pod setting stage in August. For now, the La Nina that was predicted to show up by many crop scouts in late Winter/early Spring has been eliminated. WX Risk, the prominent AG weather site said a La Nina model showing up late Summer/Fall is out of the question. That doesn’t mean we can’t turn hotter and dryer at some point this Summer but that the severity of such a weather scare is somewhat diminished. The question one must ask in my view is what is going to cause the USDA to adjust their carry out significantly lower than 440 million bushels currently? That is a sizable carry out and a stock to usage percentage that is more than comfortable. The market needs something to enter in to turn corn and beans higher. We have weak new crop demand, and the weather is ideal for most so far. Funds are now record short corn in my opinion given todays updated commitment of traders report. They are near a record short in beans. So here we are at 11.00 Nov 24 beans. When we have had ending stocks at 400 million bushels or higher over the years, beans were trading with a “9” handle into harvest. We will have an updated look at the crop from the USDA on Friday. There will also be an acreage adjustment from USDA from FSA that should give us a more realistic look at harvested acres for both crops instead of that nonsense report from the USDA on June 28th. Look for managed funds to short cover some ahead of that report, especially for corn as funds are record short, with acreage adjustments that could come in lower given all the flood and hail damage that was unaccounted for on the June 28th report.

Trade Ideas

Futures-N/A

Options-Buy the October 2024 10.00 puts for 4 cents OB.

Risk/Reward

Futures-N/A

Options-The risk is the price paid ($200) plus all commissions and fees. The option settled 5.1/8 cents today. We need a small rally to buy at the suggested price. I have other more aggressive trade ideas as this is just one example to take a short position. If filled at 4 cents, offer the option at 40 cents to exit.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

slusk@walshtrading.com

www.walshtrading.com

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604