Commentary

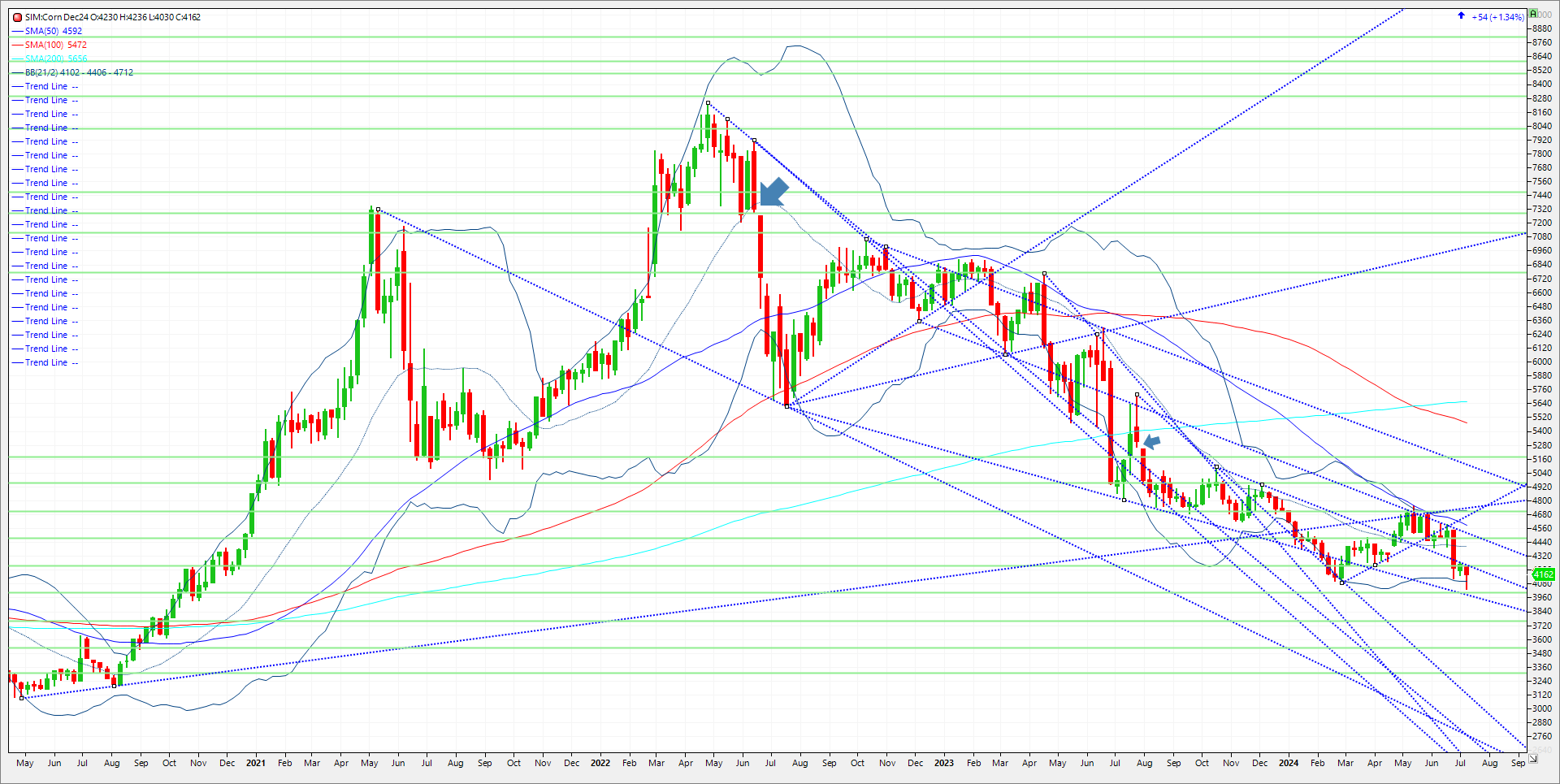

December 24 corn prices have been clobbered since Memorial Day weekend due to mostly perfect weather in the Midwest. Funds are record short at 360K futures and options. Condition ratings are 13 percentage points higher than this time last year. Despite the ridiculous June 28th acreage report that showed one million more acres than previously thought that didn’t taken into account all of the flood damage in the NW corn belt, today’s numbers from USDA may have cemented 4.03 as a near term low until next month’s report. One may remember along with the surprise raise in harvested acres on that June 1 corn stocks also came in 100 million bushels above trade expectations on June 28th. In a surprise today USDA raised its old-crop feed demand estimate by 75 million bushels, essentially throwing out that June 28 on farm stocks report, and then raised its new-crop feed demand estimate by another 75 million bushels. It also raised its old-crop corn export estimate by 75 million bushels. The net result was ending new-crop corn stocks of 2.097 billion bushels, coming in nearly 200 million bushels below trade expectations. The result today a reversal on the charts in corn. Given all these surprises on these reports, I’m starting to wonder if these reports are necessary at all. An argument for another day. Charts and technical levels come in as follows. Resistance is now at 4.22/24. Key level is 4.24, that was the July 5 high, should we close above that level, we should see additional short covering that could push the market to 4.40, then 4.48/49. Support is 4.10, a close under and its 4.00/3.97. A close under 397 and its katy bar the door to 3.76.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604