Commentary

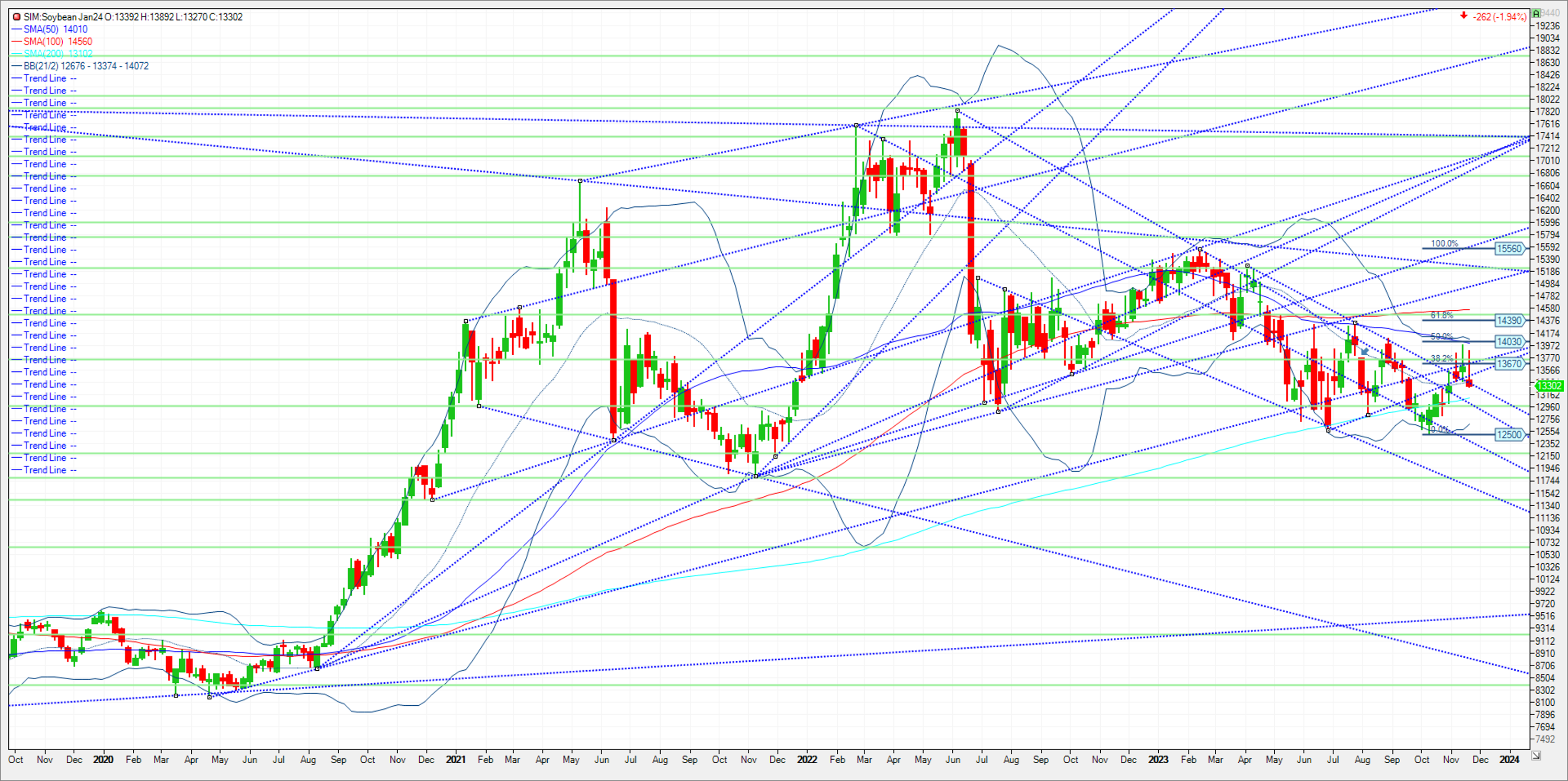

January soybean futures saw heavy selling for the second straight session, falling 25 3/4 cents to $13.30 3/4. That loss marked a 9 1/2 cent loss on the week, despite a rally to $13.89 1/4 mid-week. Weaker volumes were seen in todays session with recent longs booking profits in beans and most meal contracts. December soybean meal futures showed relative strength, though fell 70 cents to $457.4, marking a $4.1 gain on the week. Funds were not impressed daily amid flash sale announcements of continued export demand, as USDA reported daily soybean sales of 129,000 MT to China and 323,400 MT to unknown destinations – all for 2023-24 delivery.

Scattered showers narrowed the areas of immediate crop stress in Brazil’s soybean belt to roughly 20% of its soybean belt, although that 20% includes some highly productive areas of Center-West Brazil. The next seven days see the chances for those showers dry up, allowing the areas under stress to expand to 40% once again, while southern production areas remain under a pattern of excessive rains. Chances for drought relief improve once again for Center-West Brazil for week #2, but confidence in forecasts that far out are lacking, because previous rains in the extended forecast have frequently failed to verify during the current growing season.

Technical levels for next week come in as follows for January Soybeans. Support has to hold at 1331 on consecutive closes in my opinion. We cant hold that level then its 12.95/12.96. Should that level not hold then the funds could target the Oct lows at 12.50. Resistance is at 13.45. A close over and its 13.65. A close over this level and I think the market trades over 14 to 14.03/09.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax