Commentary

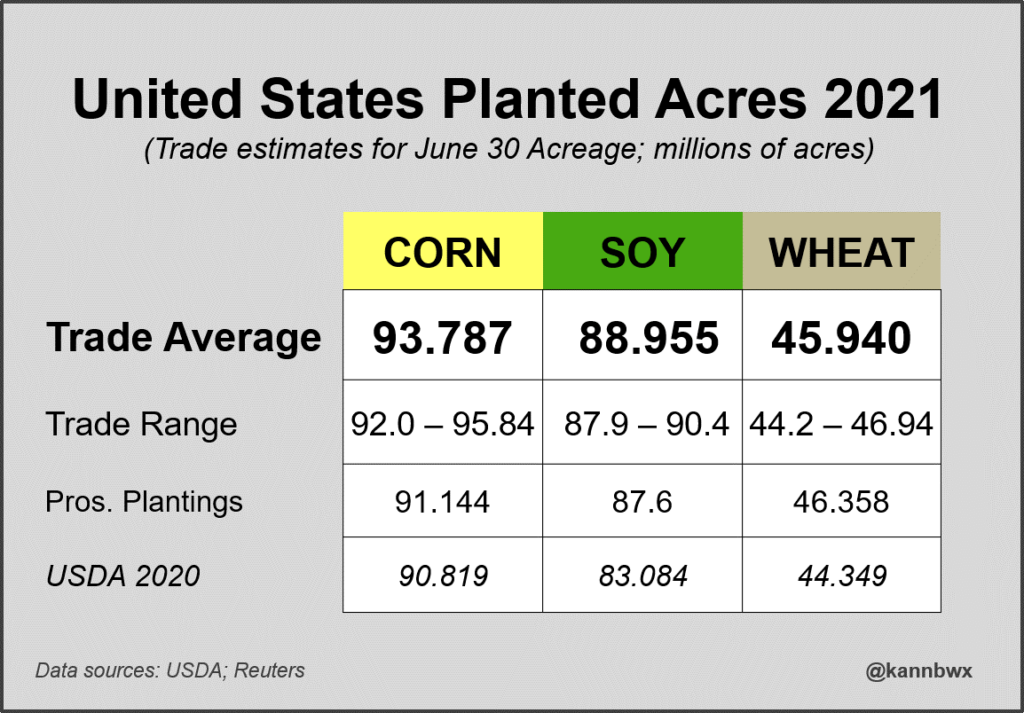

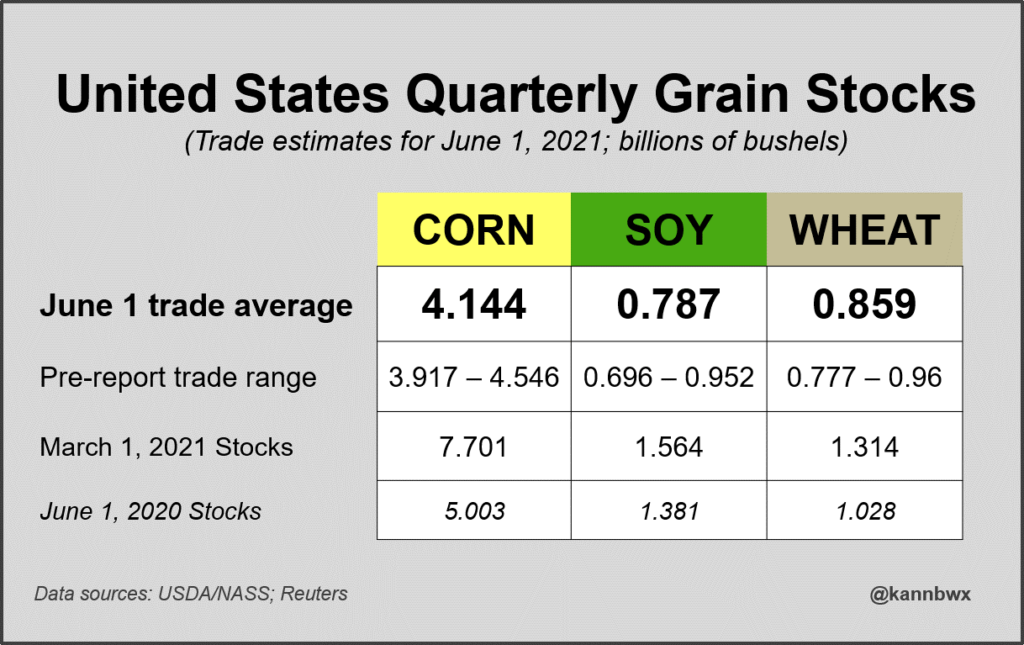

The grain market gets its first look at the much anticipated 11 am planting intentions report and on farm stocks. The USDA in its last quarterly planting intentions report threw the trade a major screwball with the planted acreage number for corn and beans. It was one reason why new crop corn and beans traded significantly higher all of April and the first two weeks of May. From then profit taking set in amid an overbought condition and once June arrived, crop conditions eased in some areas due to beneficial rains. The rains over the last few weeks have aided the Eastern belt for sure as states like Illinois, Indiana and Ohio are showing promising conditions and potential bin buster yields in those areas. The problems as shown in this weeks crop ratings show issues in Iowa, Minnesota, and the Dakotas. Recent rains have benefited half of Iowa so far, but stress remains in some areas. It’s the have’s and have not’s in those states. Tomorrow the trade pushes the weather aside and will focus on updated changes to the new crop acreage and run potential outcomes for future balance sheets. Then its right back to trading weather. Assuming the market comes in within the range of expectations, I look for the market to bend back then buy the dip into the 4th of July weekend. My opinion here. If however updated weather runs into this weekend show a cooler and wetter forecast into July, especially into the NW quadrant that has been beset by drought, the path of least resistance is lower in my opinion. Lots of moving parts here. Pre reprt estimates below per Reuters and USDA.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3 pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604