Commentary

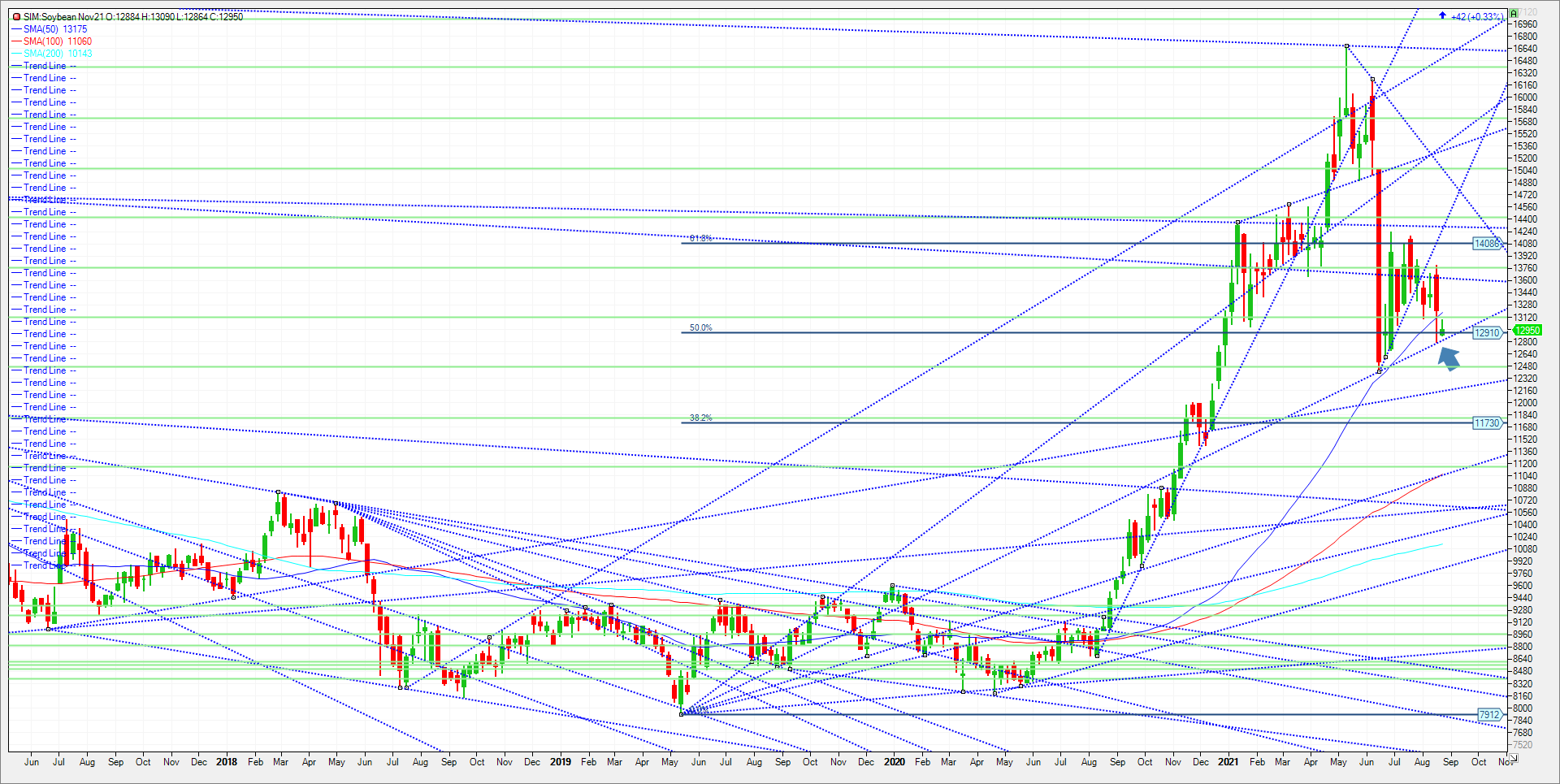

Beans staying in the teens into harvest maybe in jeopardy moving forward. I’m not saying its for certain, just my opinion, but a story here is setting up for a decent correction if key trend line support for November beans at 1282.0 doesn’t hold. A close under could lead to a deeper correction to the 1245/1240 area which were this summers lows. 1245 represents 5 percent down for the year , and if that area doesn’t hold I think the market could test 11.80, which is 10 percent down for the year. The Pro Farmer tour pegged the bean crop at 51.2 BPA vs the USDA at 50. Production came in at 4.436 billion bushels versus the USDA at 4.339 billion. If the USDA verifies the Pro Farmer Data in its September or October report and raises yield and production while keeping demand and crush unchanged, bean ending stocks could swell to 250 million from 155. Next week’s crop rating may verify a crop getting bigger as forecasted rains showed up in areas of need over the weekend with more rain events coming this week that features potential 1 to 5 inch rains in the Dakotas, much of Iowa, Minnesota, and Wisconsin. Should rains fail to show and conditions decline, we could push higher. A close over 13.12 is a must in November beans. That is where we closed 2020 and for any chance of a late season rally, beans need to turn back higher on year. Major resistance after that level in my view is 1360 and then 1376.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3 pm central. We discuss supply, demand, weather and the charts.Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604