Commentary

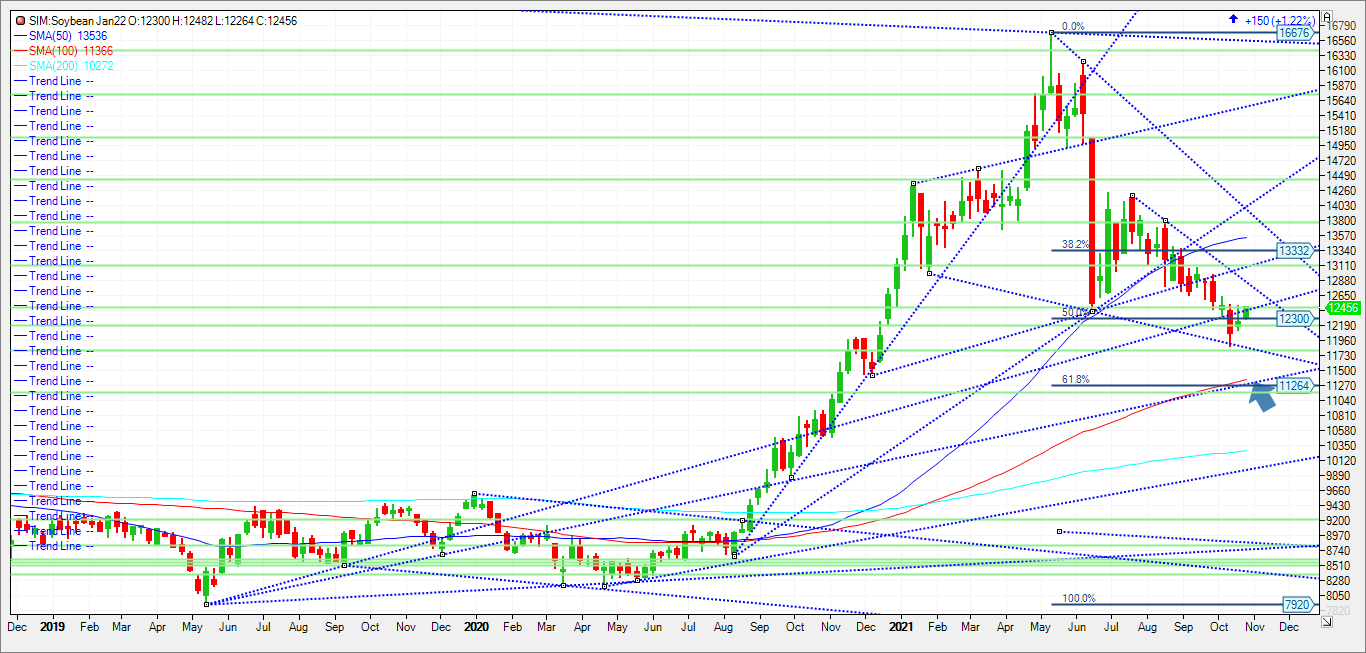

Private forecasters pegged Brazilian soybean planting at 36% complete as of Friday, double last year’s pace and ahead of the 27% five-year average pace at this point. AgRural another forecaster had that number at 38% as of late last week, the second-fastest historical planting pace behind the 2018/19 season. Private crop scouts estimated first crop corn planting at 64% done as of Friday. This is different than last year when the crop was planted late bringing late season bids in beans higher amid more unknowns in my opinion. Today’s inspections for beans showed 77.3 million bushels of soybeans for export shipment in the week ending October 21st. Marketing year to date soybean shipments fall short of the seasonal pace needed to hit USDA’s target by 100 million bushels, versus being short by 91 million the previous week. Demand needs to pick up soon in my opinion or we could get shut out of the export window by the end of January. With Brazil planting the largest bean acres ever and in my view increased talk that US farmers will plant more beans next year due to the high input costs for corn, a story could develop in the weeks ahead that 12.50 to 13.10 beans are overpriced given big crops are potentially coming. The counter argument against lower prices comes on two fronts. First, is that in my view we have inflation based commodity buying across many sectors and beans are undervalued at the 1245 area. That are represents five percent lower for the year. Currently for the calendar year, Corn is up over ten percent, Kc wheat almost 30 percent higher, Minneapolis wheat over 70 percent higher, and bean oil up almost 50 percent. Crude oil, natural gas, cotton, coffee, and oats are up exponentially on the year. For now beans are possibly seen as discount given the rally in other markets. Second, given we are past 40 percent harvested, so we could potentially be seeing a post-harvest rally in the form of seasonal buying amid light farmer selling. I think the trade is looking at the energy sector for direction as it relates to bean oil and the rally in that sector. While I wouldn’t rule out a rally to let’s say the 1330 area, I’m watching to see if Jan 22 soybeans can hold the 1240/1245 area, which we settled above today. If this level holds, I think funds can push this market to possibly challenge key resistance for January 22 beans at 1284 this week in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a weekly grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604