Commentary

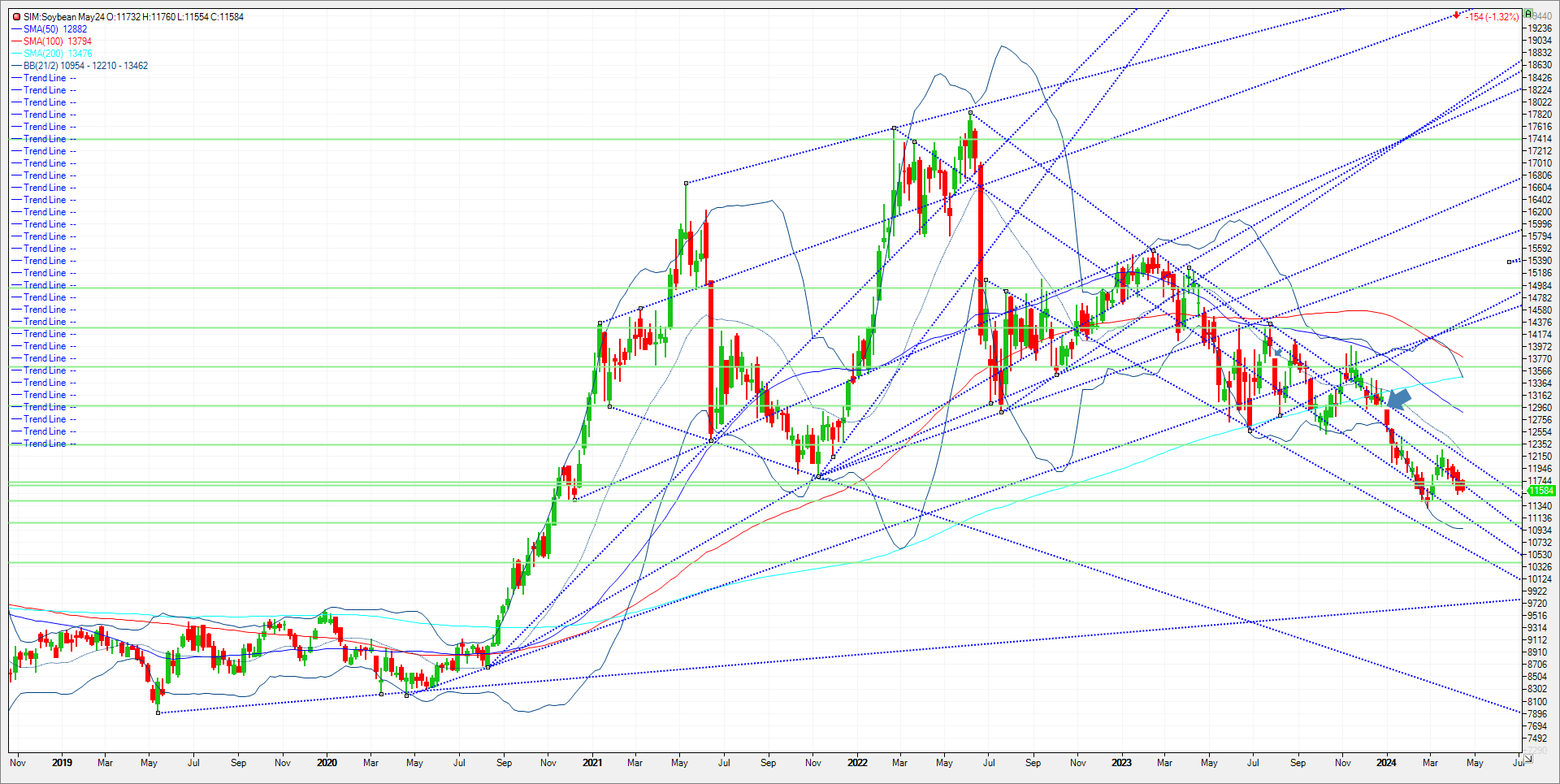

May soybeans finished down over 15 cents which basically nullified Friday’s rallies in today’s session. Price action was weak all session as energy prices retreated following Iran’s attempted strike against Israel over the weekend. This morning’s export inspections showed that the seasonal decline in soy shipments may continue. Loadings last week totaled 430K vs 530K a year ago. The USDA estimates total exports for the year will be 8.4 million metric tons less than last year. To add to the downside pressure today, NOPA came out with their monthly crush estimate. NOPA stated that soybean crush was 196.4 million bushels, but below the average trade guess of 197.8 million bushels. The number is up from 186.2 million bushels last month and 185.8 million bushels last year, and a single-month record for any month of the year, ahead of 195.3 million bushels in December 2023. Cumulative Sept-March crush is up to 1308 million bushels, 78.5 million ahead of last year’s seven-month pace, which is still over 6% ahead of last year, with the USDA looking for a 4% year on year total crush rise. Brazil’s bean basis started the week off unchanged but are also at least a $.50 per bushel discount to US CIFs. Brazil’s crop inventories build with harvest now 87% complete vs 88% a year ago. Planting season has begun in the US for beans as they come in three percent planted while corn is six percent. May soybeans are still the most actively traded contract. Weekly support is at 11.40. A close under and we could test the Feb lows at 1128 quickly. Under 11.28 and its 11.14 and then 11.03. Resistance is 1168/69. Consecutive closes over this level and the market could run up to 12.11. A close over 12.11 and the market could challenge 1221 and 1234.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604