Commentary

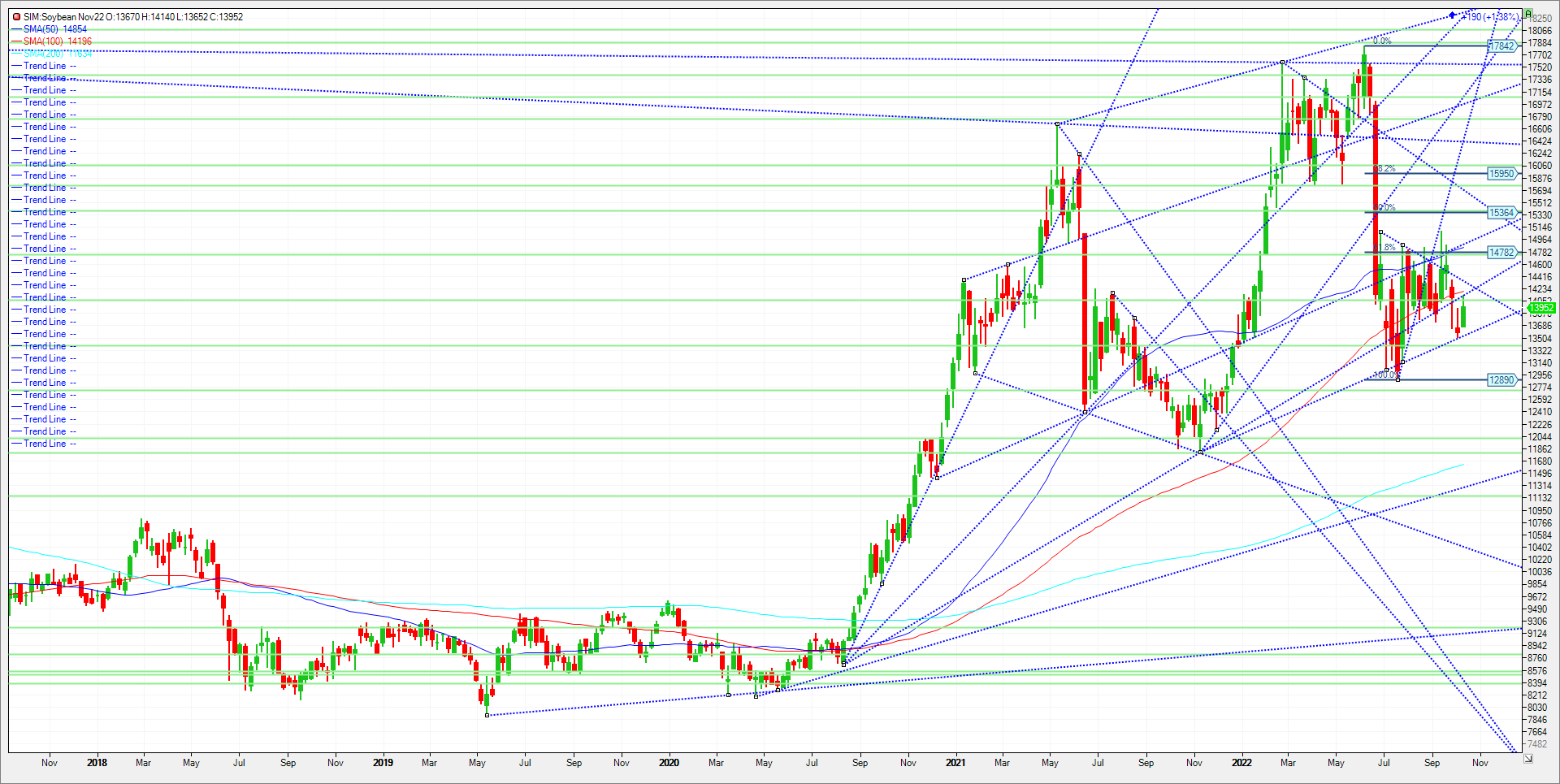

The biggest surprise in my view in today’s WASDE report from USDA in my opinion was a drop in the U.S. soybean yield to 49.8 bushels per acre, which was at the low end of the range of trade guesses. A sub 50 yield had the algos buying with both hands, but trendline resistance at 14.15 held today, with November beans retreating on the close to close below $14.00. New-crop bean carryover of 200 million bushels is unchanged from last month and is 48 million bushels below the average pre-report trade estimate. The 34-million-bushel increase in beginning stocks was more than offset by a 65-million-bushel cut to the crop estimate to drop total 2022-23 supplies 31 million bu. from last month. On the demand side of the balance sheet, USDA projects crush at 2.235 billion bu. (up 10 million bu. from last month), exports at 2.045 billion bu. (down 40 million bu.), seed use at 102 million bu. (unchanged) and residual use at 20 million bu. (down 1 million). Total new-crop use is forecast at 4.402 billion bu., down 31 million bu. from last month and down 63 million bu. from last year. USDA puts the national average on-farm cash bean price for 2022-23 at $14.00, down 35 cents from last month.

Technical levels to watch through next week are as follows. Resistance for November beans comes in at 1419/1420. A close over and the market could rally to 1432. A close over here could send futures to 14.77 and then 14.85, which is the 50-day moving average. Support through next week is at 13.55. A close under and its 13.39. A close under 13.39 and its katy bar the door to test the July lows at 12.88.

Trade Idea

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604