Commentary

The USDA’s January WASDE was released this morning at 11 am Central. They noted for soybeans that harvested acreage fell slightly while yields rose slightly versus last month, resulting in a 10 million bushel production gain overall versus November (about as expected) at 350 million bushels versus 348 million the average trade guess. That data carries through the balance sheet for a 10 million bushel increase in stocks, with export demand unchanged to the surprise of many in my opinion. World soybean carryout falls 7 MMT with production down 9 MMT this month, thanks to South American cuts – Brazil -5.0 MMT, Argentina -3.0 MMT, and Paraguay -1.5 MMT. Total soybean supplies are up 11 million bu. from last month, due to the bigger crop estimate and a 1-million-bu. increase in beginning stocks (2020-21 ending stocks). Total use was increased 1 million bu. from last month with soybean crush unchanged at 2.19 billion bu.; exports unchanged at 2.05 billion bu.; seed use unchanged at 102 million bu.; and residual use up 1 million bu. to 16 million bushels. USDA puts the national average on-farm cash soybean price at $12.60 up 50 cents from last month.

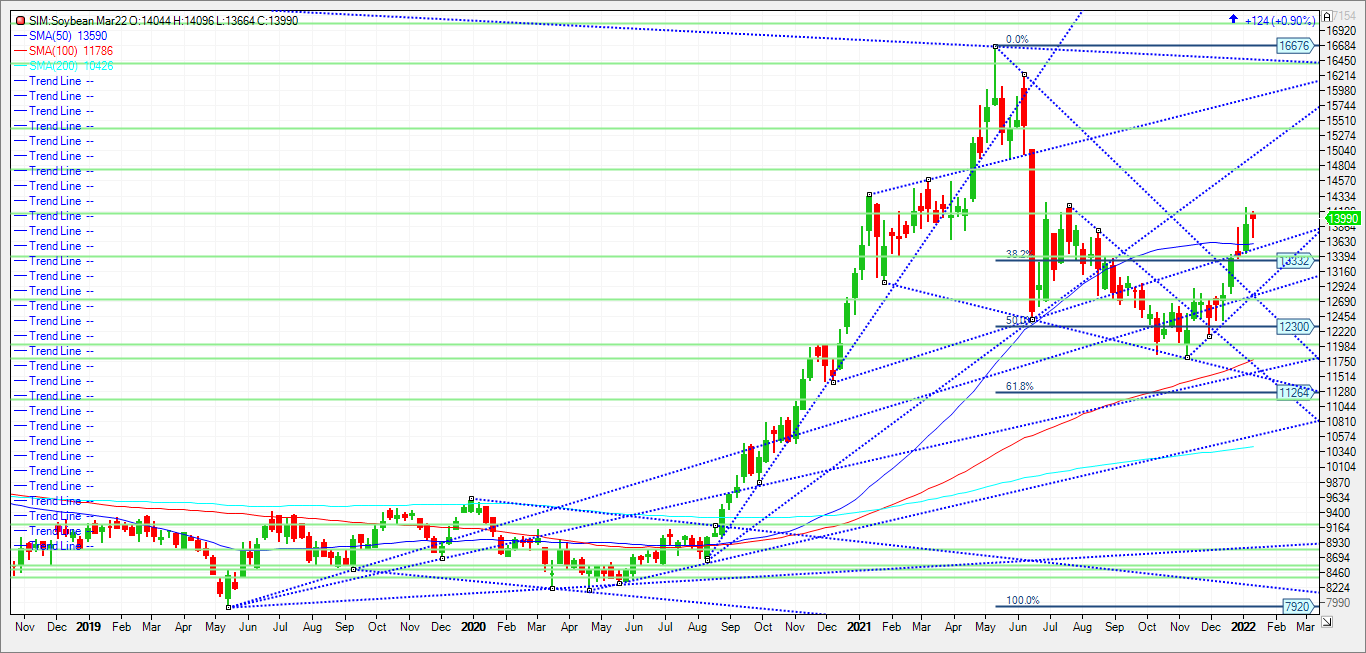

In short the trade in my view doesn’t see any U.S. soybean export cuts while South American production numbers are down a bit more aggressively than expected. In my view that keeps the market in check during a January report date where more stocks numbers come in versus pre report estimates. I included a weekly continuous chart below. The market last week hit a high of 14.15, just missing the late August/Early September 2021 high of 14.23 and 14.18. Should we blow past that level. The next target to the upside could be the ten percent higher for the year threshold at 14.73 and then trendline resistance at 15.03. Support comes in at 1359 , the 50 day moving average and then 1351.6. Unchanged for 2022 comes in at 1339. A close below could push the market to trendline support at 12.96 and 12.93 in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604