Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

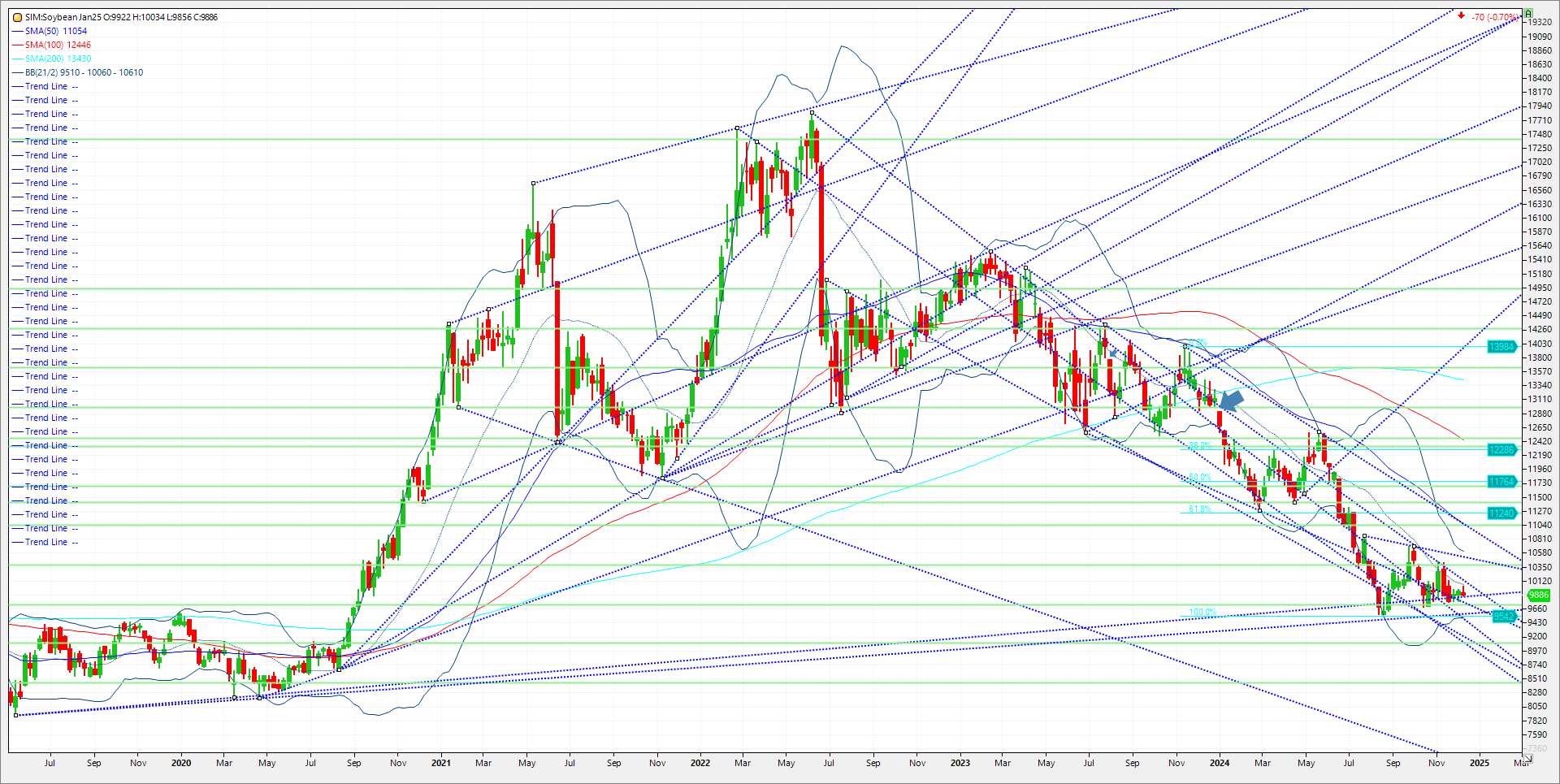

The USDA will present the market with the “final” estimate for the US crop in 30 days. Often, yield and acreage surprises shift trade expectations. The changes over the past decade in my view often defy the pattern in place in the market. This randomness in market revisions puts the market on the defensive going into the report. Near term the soy complex continues struggling, with meal prices again testing recent lows while soy oil futures having only slightly recovered from the rout seen since the election. Blending rates amid the unknown of 45Z remains the open-ended question that has stymied any sustainable bean oil rallies. The market shrugged off soybean sales of 334,000 metric tons to an unknown destination (China) for the second straight day of bean sales into China for future shipment today. Renewed U.S. dollar strength hasn’t helped. Although we sometimes see soybean prices typically move in tandem with corn in December, the bullish spillover hasn’t pushed nearby futures above the pivotal $10.06/1010 level. This is where the 21-week moving average sits and just shows a lack of conviction from the Bulls above 10.00 for soybeans. Ultimately, concerns about a massive Brazilian crop and a Chinese trade war are capping buyer interest this week. Conab maintained its 2024-25 Brazilian export projections at 105.5 MMT for soybeans and 34 MMT for corn. Conab has production at 166 for beans and 127 for corn. USDA left its Brazilian crop projections at 169 MMT for soybeans and 127 MMT for corn. USDA raised its Argentine soybean crop forecast by 1 MMT to 52 MMT. It left the Argentine corn crop peg at 51 MMT. Beans and to a lesser extent corn are going to need a supply side scare further down the road to prevent lower prices in 2025. Beans in my view could drop a $1.00 in the deferred contracts. This is in my view where the best opportunity exists in the grains post holidays. I’m suggesting an aggressive course of action below.

Trade Ideas

Futures-N/A

Options-Buy the May soybean 1020 put. Sell the January 2026, 1220/1160, put spread. Collect 5 cents upon entry or 250 per three way minus trade costs and fees. ZSF26P1200:1160:H25P1000[1-1-1]

Risk/Reward-The risk here is approximately 50 cents or 2500.00 per 3-way option strategy here. The result or success of this trade will be on what the value of the May 1020 soybean put is when liquidated. If May beans trade to the August lows or make new lows is what we are here for. The short put spread using January 26 options sold for 50 cents approximately, has 10 cents max risk and is a longer-term bullish play that is simply used to finance the May 1020 put. Margin is approximately 1675 per spread. Call me with questions.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.