Commentary

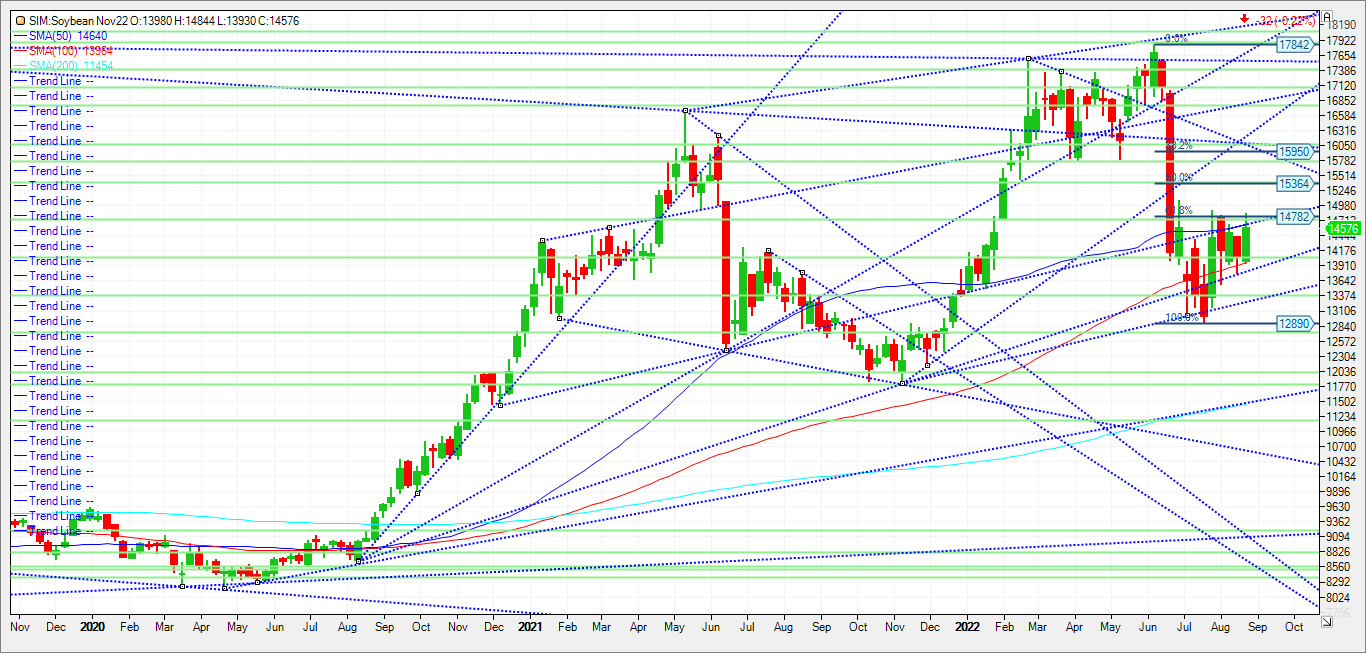

November soybeans also erased an overnight rally that pushed November 22 futures above 14.80 in early AM trading to ultimately settle 4 cents lower to close at 14.57. It is my belief that profit-taking emerged following the market’s climb to two-month highs. Prices gained initial amid concern dryness will curb yield potential in parts of the Midwest. Results from day 2 of the Pro Farmer Crop Tour Tuesday suggested soybean yields in Nebraska and Indiana may trail last year’s. In Nebraska, soybean pod counts in a 3’x3’ square came in at 1,063.72, down from both 1,226.43 in 2021 and the three-year Tour average of 1,245.06. In Indiana, soybean pod counts in a 3’x3’ square totaled 1,165.97, down from 1,239.72 in 2021 but above the three-year average of 1,148,26. Demand has picked up in my opinion. USDA earlier today reported a sale of 517,000 MT of soybeans for delivery to China during the 2022-23 marketing year. A day ago, USDA announced a soybean sale of 110,000 MT for delivery to China during the 2022-23. The declining crop condition report released Monday night from USDA showed crop ratings for beans that are 3 points lower than the 10-year average in the good to excellent category. Coupled with a pickup in demand from China have buoyed the market this week in my view as the drought in central China causes significant damage to their crops in my opinion. No trade ideas in this post. Resistance for November soybeans at 14.62, with next resistance at 14.77, which is the ten percent higher for year threshold. A close above that and I could see the November soybeans rallying to 1536, which the 50 percent retracement from the Spring highs to the July low. Support is at 14.06 and then thee 100-day MA at 13.98. Under that key support is 1381 this week. A close under that level and its katy bar the door until 13.24 in my opinion.

Trade Ideas-

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750