Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

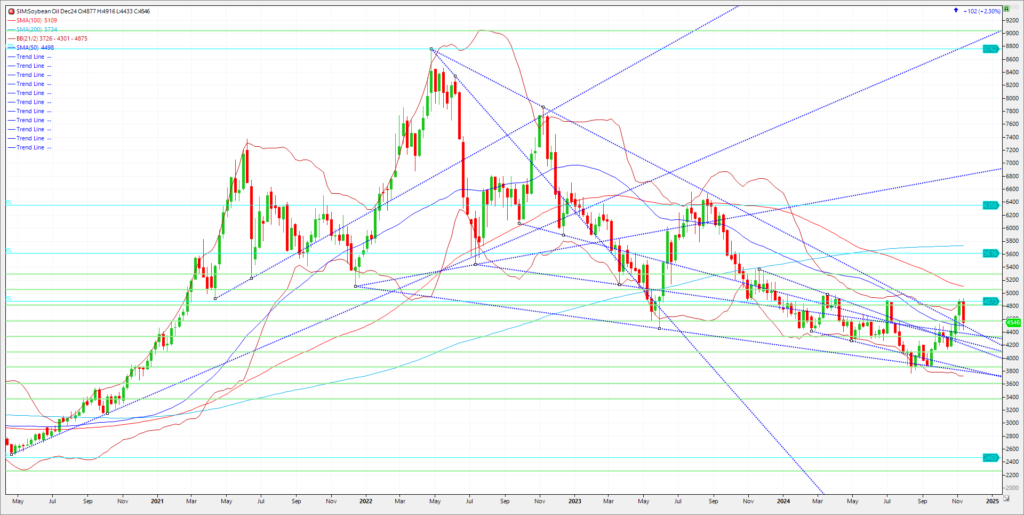

Export sales for corn, beans, and bean oil but yet all three markets put in higher closes today after earlier week deflationary selling pressure. Bean oil sales were down sharply from the prior week but in my view, it wasn’t a surprise to the market. NOPA crush this morning came out at a new all-time record high for October at 199.959 million bushels, above the Reuters average guess of 196.8. October bean oil stocks came in at 1.069 billion pounds, down from the average guess of 1.090. Export sales for bean oil came in at 16,469 tonnes for the current marketing year and none for the next marketing year. Cumulative oil sales have reached 92.6% of the USDA forecast for the 2024/2025 marketing year versus a 5-year average of 23.3%. Sales need to average just 400 tonnes per week to reach the USDA forecast. Bean oil stopped the bleeding today reversing the carnage seen earlier this week. Bean oil rallied on two fronts today after palm oil’s setback this week after making 2.5-year highs. The first headline is the soybean processor and producer lobbies are pushing the new congress to extend 40A which is the Biodiesel and Renewable Tax Blenders credit that expires on Dec 31st. 45Z is slated to take over for the expired incentive, but many industry insiders say it is nowhere near implementation. An extension of 40A may possibly retain value for soybean oil past December and renew enthusiasm to produce advanced biofuels based on vegetable-oils. The second headline came from China. Coincidentally, China is changing its tax rebate system to disfavor certain commodity exports including the very controversial UCO (used cooking oil) exports. Ending the rebate possibly ends the very cheap UCO entering the US and tightens the vegetable oil S/D. Trade idea below.

Trade Ideas

Futures-N/A

Options-sell the August 65.00/55.00 put spread at 900 points.

Risk/Reward

Futures-N/A

Options-The max risk is 100 points or $600 plus trade costs and fees. This is just one idea, not the idea. It’s my view that supply side is constrained over time globally here and dips like the ones we have seen this week, are longer term buying opportunities. Look to buy back at 450 points on a potential run higher.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.