Commentary

The Quarterly Grain Stocks report showed September 1 soybean stocks at 342 million bushels (the highest since 2020) versus an average expectation of 347 million bushels and a range of expectations from 323

to 360 million. September 1, 2023, stocks were 264 million bushels. On- farm soybean stocks were 111 million bushels, up 54% from a year ago. Off-farm stocks were 231 million bushels, up 20% from a year ago. USDA

revised 2023/24 bean production down 2.62 million bushels and lowered harvested area slightly to 82.3 million acres.

Soybeans ended up following corn slightly higher before pulling back near the close. There was nothing bullish in this report for beans or wheat. Corn was a different story with on farm stocks lower by 80 million bushels versus the average trade guess.

Harvest though advances and in the big production areas it is still a massive crop vs weak demand. Dryness in South America seems to be one of the biggest issues pushing funds out of their shorts. Drought like conditions continue to plague Central Brazil although a small respite is coming the next 5 days. Brazil turns dry again in 80% of the corn/soy belt in the 6-10 day. Argentina’s grain belt is forecast to see 70% rain coverage in the 6-10. Brazil is 3% planted vs 4% last year. As the numbers indicate, planting isn’t a problem yet in my opinion as October begins.

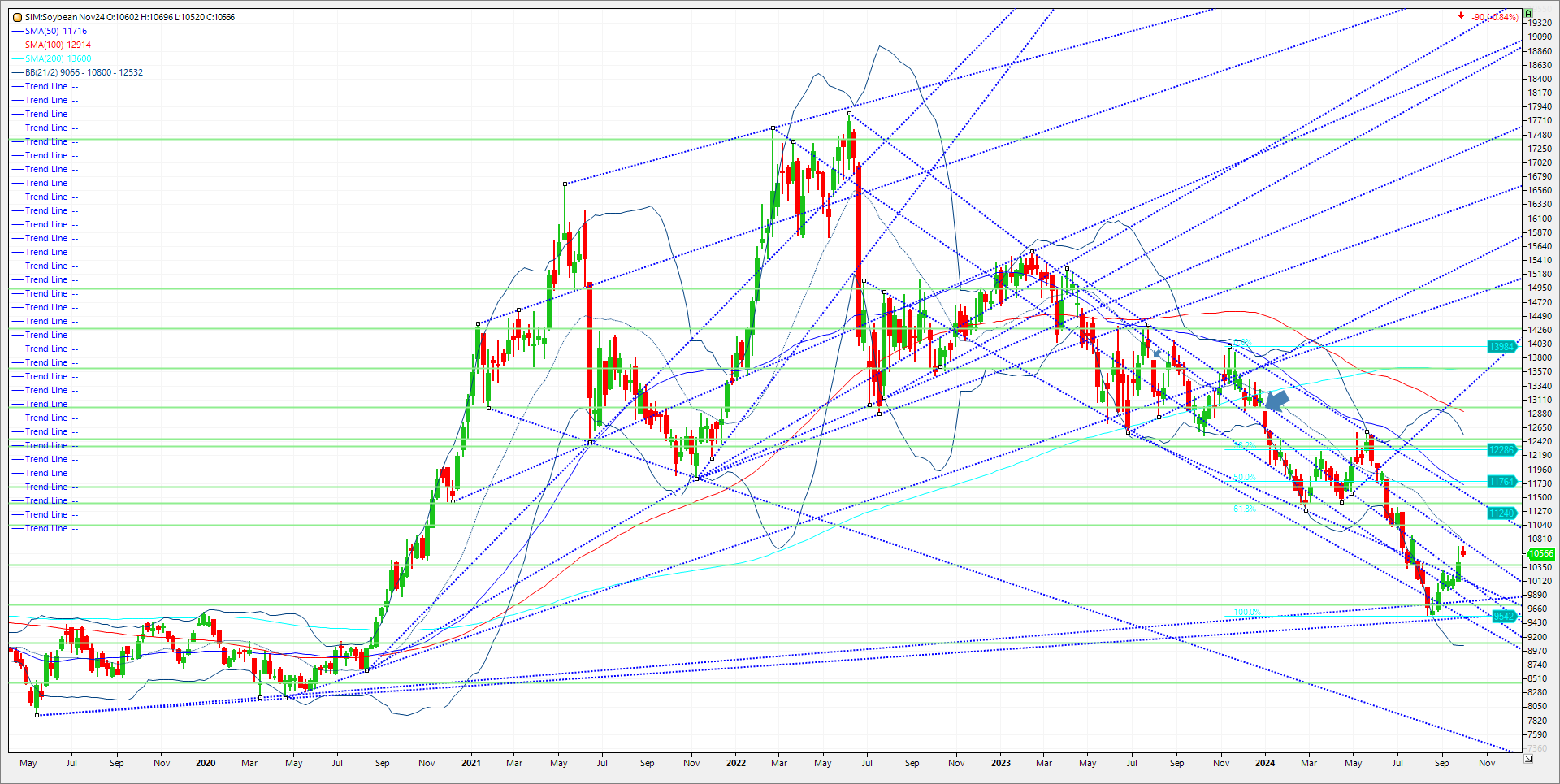

Weekly technical levels are as follows. Bean resistance is at 1073 and then 1080 basis November. A close over and its 11.03, and then 11.25. Support isn’t seen until 10.38 to 10.34. A close under 10.34 and its 10.17 to 10.13. Trade the charts!

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.