Commentary:

Corn bulls may have breathed a sigh of relief as the March futures settled 9 cents off the lows. Given last weeks close, we are still down close to a dime for the week. However, the Thanksgiving holiday in my view sees pre and post-holiday grain buying in seasonal fashion. So the fact that we have a sizable long in the market per the last CFTC report at 287,599 managed money longs, it makes sense that we most likely have seen a few days of profit taking. Its hard to know given the potential for tax avoidance issues into 2021, that these funds liquidate further, or that the speculative long of 141,779 contracts per the last CFTC may liquidate further amid year end profit taking.

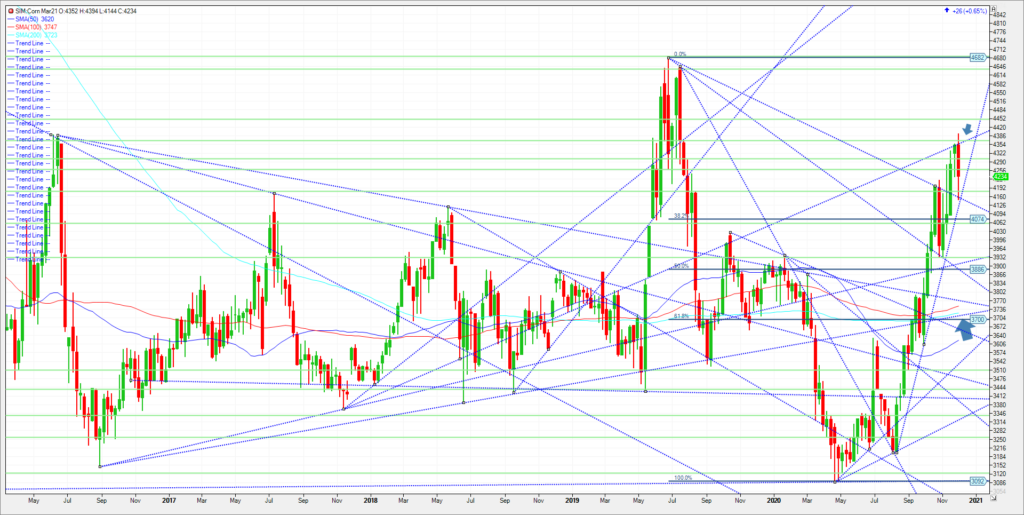

For now dips seem as buying opportunities, unless key support is taken out. See chart. We traded down to the 414 area last night before recovering in the day session. That level should it not hold in my view would send March corn to trade down to 4.06/07 area and then the 3.91/3.93 area. Resistance very near term is 4.26. that level as we have noted for months has been an upside target as it represents 10 percent higher on the year. Given that we are a few weeks from turning the calendar and moving into 2021, funds will be more attentive to trendlines than percentage levels for now. That said I don’t see corn cratering lower and going negative for the year below 3.87 prior to year-end. My reasoning stems from the continued weather issues in South America. Recent rains in South America were seen as a near term negative source for price, so in my view any further variances in the forecasts back to hot and dry for an extended period should support the corn and to a greater extend beans. Keep in mind that the last USDA update increased China corn imports at 13 million tonnes. Note: the USDA attaché there believes the buying could result in as much as 22 million metric tons bought. If the US receives the majority of the business, say three quarters of it, the USDA would lower ending stocks by another 260-270 million bushels putting US ending stocks at or below 1.5 billion bushels. That would be the tightest ending stocks in probably six to seven years and in my view would warrant an eventual rally to test last years highs near 4.70. In any event, trade the charts!

Trade Recommendations

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.