Corn/Wheat

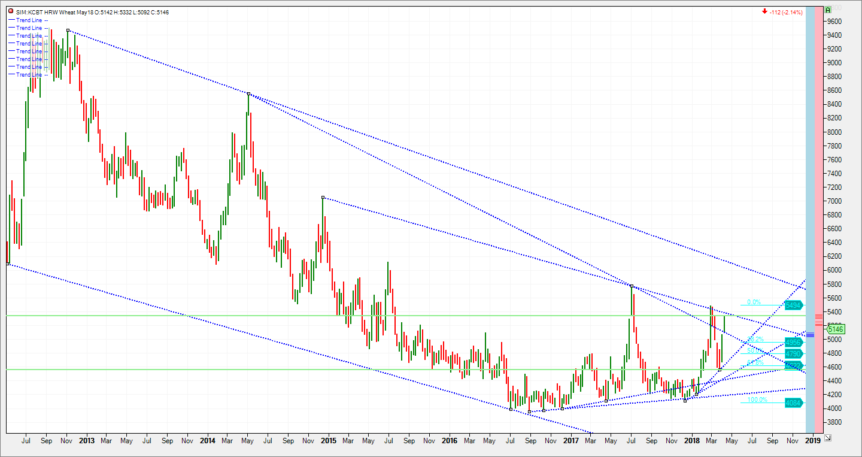

As KC wheat led the market higher last week and gained on Chicago wheat and corn, it also fell apart as increased rain chances for sections of the winter wheat belt are forecasted for next week and beyond. While major storms and rain chances enter into the plains and Midwest, the strongest pieces of energy look to be centered in the central and northern plains and upper great lakes. The storms could bring not inches but feet of snow to parts of the Dakotas and much of Minnesota accompanied by adverse weather from Nebraska and the far reaches of the Eastern corn belt and Delta. Through month end, there are three storms moving across these areas mentioned that tell me we could see not only planting delays for corn and spring wheat but could also miss much of the winter wheat belt that need it the most. We need to watch KC wheat should it hold key support. That support sits next week at 508.6. A close under and the market could work all the way lower to 4.67. However a continued hold of support could see a retest of an upper trend line at 5.38. To me its the weather that will determine the fate of KC as continued dryness will lead an already porous condition lower and more importantly give thoughts to lower ending stocks on subsequent monthly supply and demand reports. If we hold 508.6 next week a trade worth considering is in options.

Trade: Buy the July KC 530 call. Sell 2 July KC wheat 480 puts. This trade settled today at even money. Lets watch it and call or email me if you have questions. slusk@walshtrading.com or 888 391 7894.

Corn simply refuses to take out an upper resistance line at 3.92 basis May. It feels heavy here and the market succumbed to some profit taking albeit we only fell three cents today. I’m staying away from calendar spreads and options at least for now and will look to buy futures at 3.87 basis July. Back to the wheat for a moment, lets consider the Minneapolis contract for a second. Back in February we suggested taking a look at a calendar spread. Buying July 18 and selling Sep 18. Its sitting at negative 3.4. which is basically the level we suggested buying at two months ago. We have seen it move from 9 under to 2 cents under. With heavy snows and adverse weather in the Spring wheat belt pushing back plantings and the potential for a drop in acres, look for this spread to possibly trade from a small carry to an inversion. This spread traded to a whopping 90 cent inversion last June. I’m not looking for that type of action but an inversion nonetheless. Look to buy at 4 cents July under with a 5 cent stop-loss.

Please join me each Thursday for a free grain and livestock webinar at 3 pm. sign-up is free and a recording link will be sent to your email.