Commentary

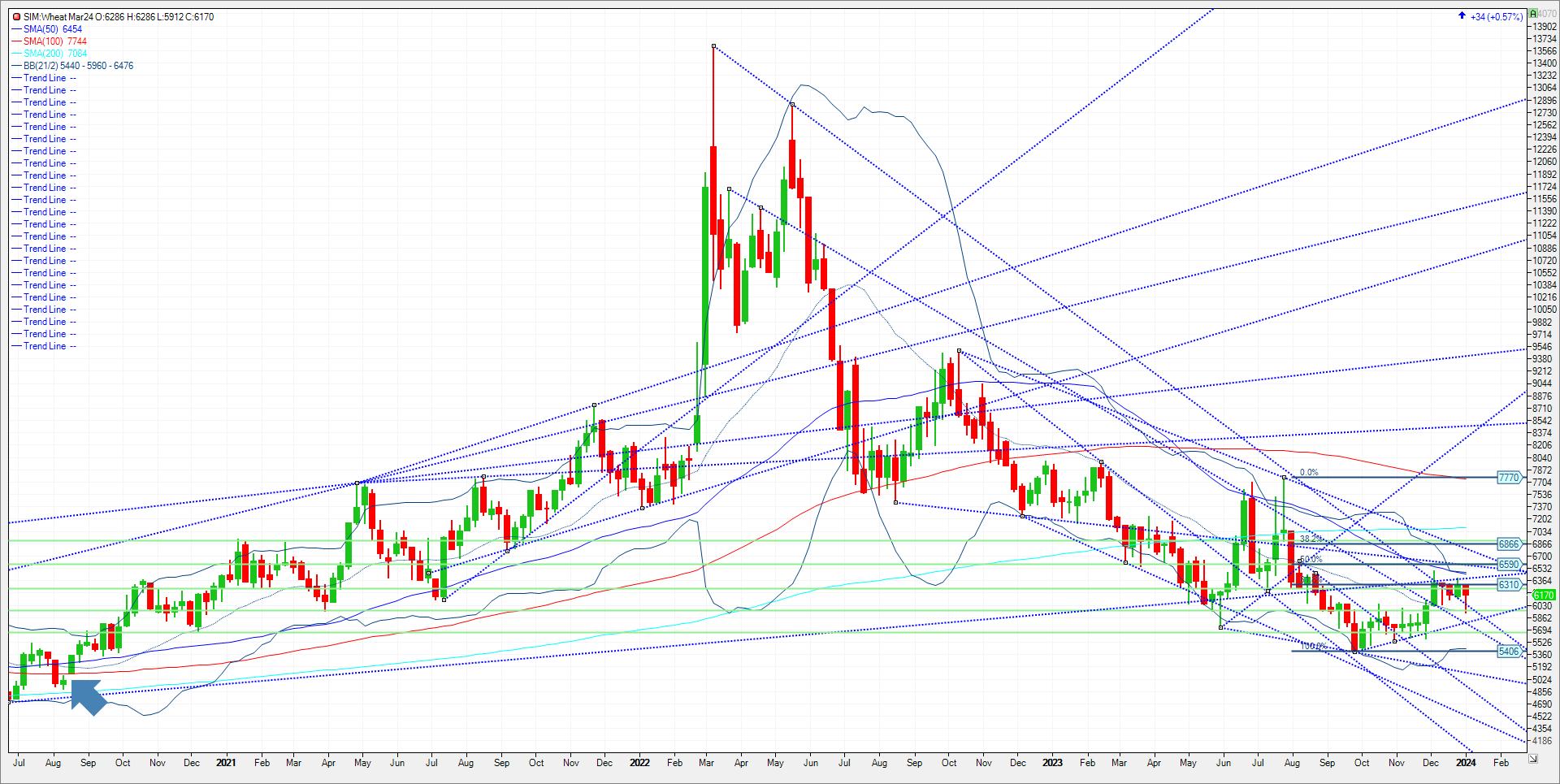

Poor technical action that sent wheat futures to below 5 percent down for the year yesterday was short lived. Market reversed and finished 20 cents off of yesterday’s lows while today saw modest follow through up a few cents. The cause for the reversal in my view was first weather, second potential demand, and lastly geo-political news that was seen as bullish in my view. First, an arctic airmass is forecast to move into the central U.S. over the next two weeks, causing temperatures to gradually drop between 10- and 25-degrees below normal, becoming cold enough to threaten any snow-free winter wheat areas. But World Weather Inc. notes there will be multiple snowfall opportunities ahead of the coldest temps, which could possibly insulate the crop and limit risk of winterkill damage. Second, wheat was subject to whispers of Chinese buying in SRW wheat yesterday and that helped aid a modest volume recovery. The US has only China to hold onto for bullishness in wheat exports. US HRW remains $45/mt over Russian FOB. Third, it was reported that Turkey is preventing two British minesweepers from moving toward the Black Sea. This comes as cold temps move into the Black Sea, Northern Europe, along with the US that are bringing some buying into wheat futures across the globe. Will these issues develop into a story? Also, one the markets most important crop reports gets released next Friday. Funds are heavily net short as despite some short covering in December, managed money remains short the winter wheat markets. With trend and index following Funds holding a near-record net short Spring wheat position. I look for further short covering into next week that could push Chicago prices to the 6.58 area which represents a 50% retracement from the July high to the fall low. (See chart) Trade idea included for your consideration.

Trade Idea

Futures-N/A

Options-Buy the March Chicago wheat 620 call and at the same time sell the Sep Chicago wheat 760 call for a collection of 2 cents OB.

Risk/Reward

Futures-N/A

Options-There is unlimited risk here. We are buying a call four cents out of the money in March options which expire on February 23rd. However, we are selling a call option in September that is $1.24 out of the money but doesn’t expire until late August and carries unlimited risk. Therefore, as we enter in as a spread we exit as a spread. One collects 2 cents or $100.00 upon entry minus trade costs and fees. I’m risking approximately 10 cents on the trade with a mental stop and using support at 5.97 as a trigger to exit the position. We are looking for the market to test the 6.58 area and exit the trade at this level. (See chart). Call me with questions.

Please join me for a free grain webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604