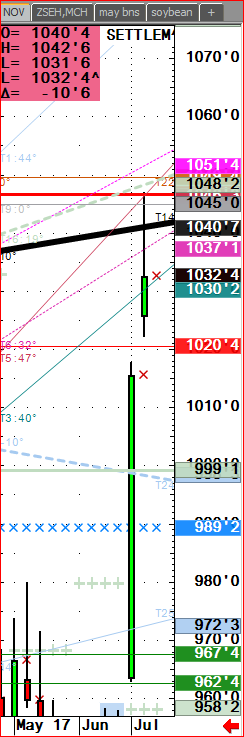

Good afternoon, I hope some of you got a chance to market some of last years crop on this corn rally up at 1st of 3 sell level 415 a bu. This is an orange line, olives are above. If the market is going to top like yesterday these will be your levels but that is my opinion. You’ll see after following for a while. Beancorn ratio spread is on a 80 cent tear since 6.30 USDA.

You use these levels from my experience from the trading floor except I break it down into a DNA type analysis of how computers and hedge funds play these macro trendlines, TL.

312.957.8248

See pm voice today for targets if long feeders. It’s a tiny contract and slippage is not exact like in deep markets like bonds or Spu’s, NASD etc.

Earlier comments below on this page.

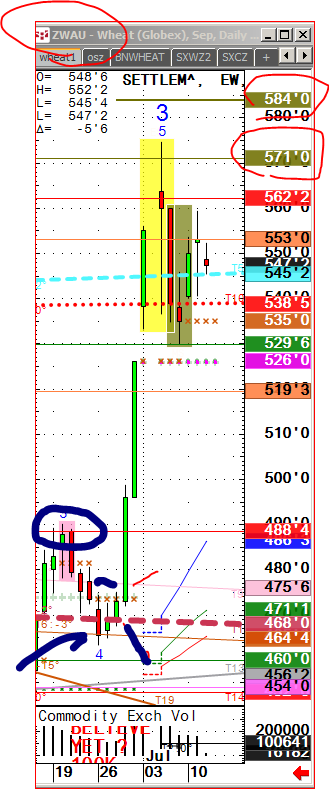

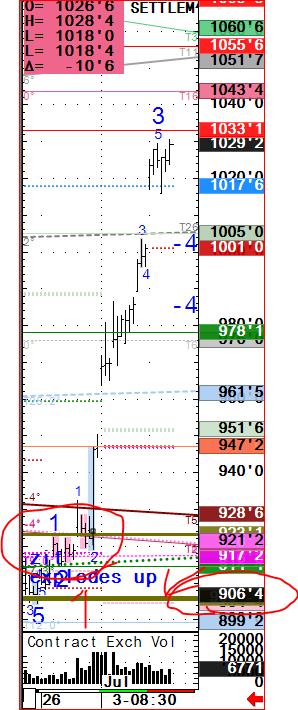

USDA snapshot, 1 min charts immediately after 11am release.

Fundamentals do not matter, see yesterday crude oil ‘automated rhythms’. In case you disagree the soybean bears have just been taught that lesson the last 13 days that no matter how bearish fundamentals are, 1,000 hedge fund guys, computers can produce 15% immediate rallies immediately.

312 957 8248 direct arp@walshtrading.com

USDA S&D report snap immed after.

Good morning,

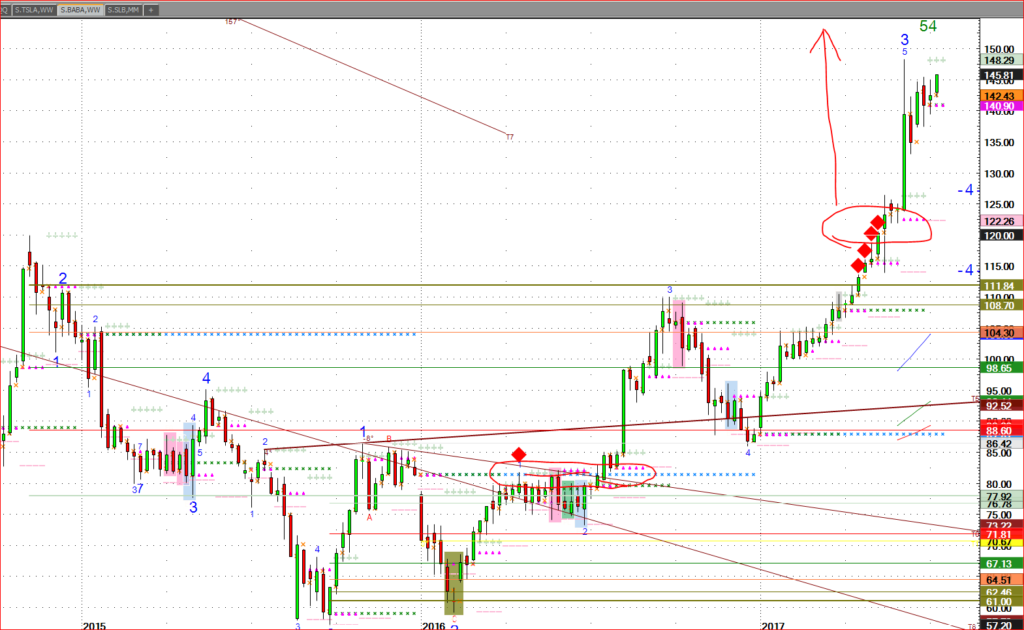

This is just a chart drop early for you to gauge levels which are in right column. Comment later but traders love the chart levels because it is how algo’s slam the markets around.

-Alarm can be trigger for clients ahead of time. Feeders Oct. {{GFV}},96 Last:146.850, Above:146.832 Wave:Windows Beep

THIS CAN ENHANCE THIS BROKER EXPERIENCE.

silver. If your cup of tea this is buy areas.

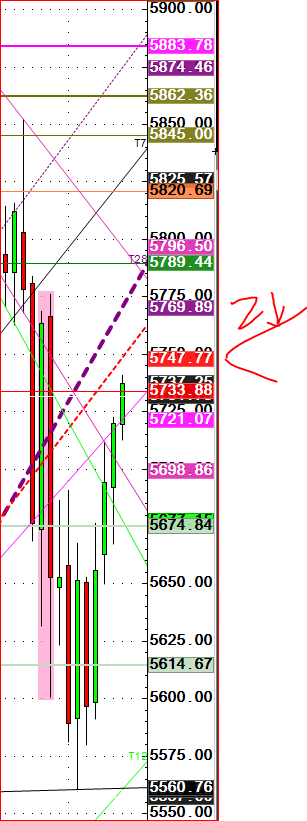

NASD100 FUTURES- This is pre open chart that give clients levels early, purple line is high, off 2 so far as a lot of traders like myself love selling short. This trader profile is short term

h

h

h

h

h

h