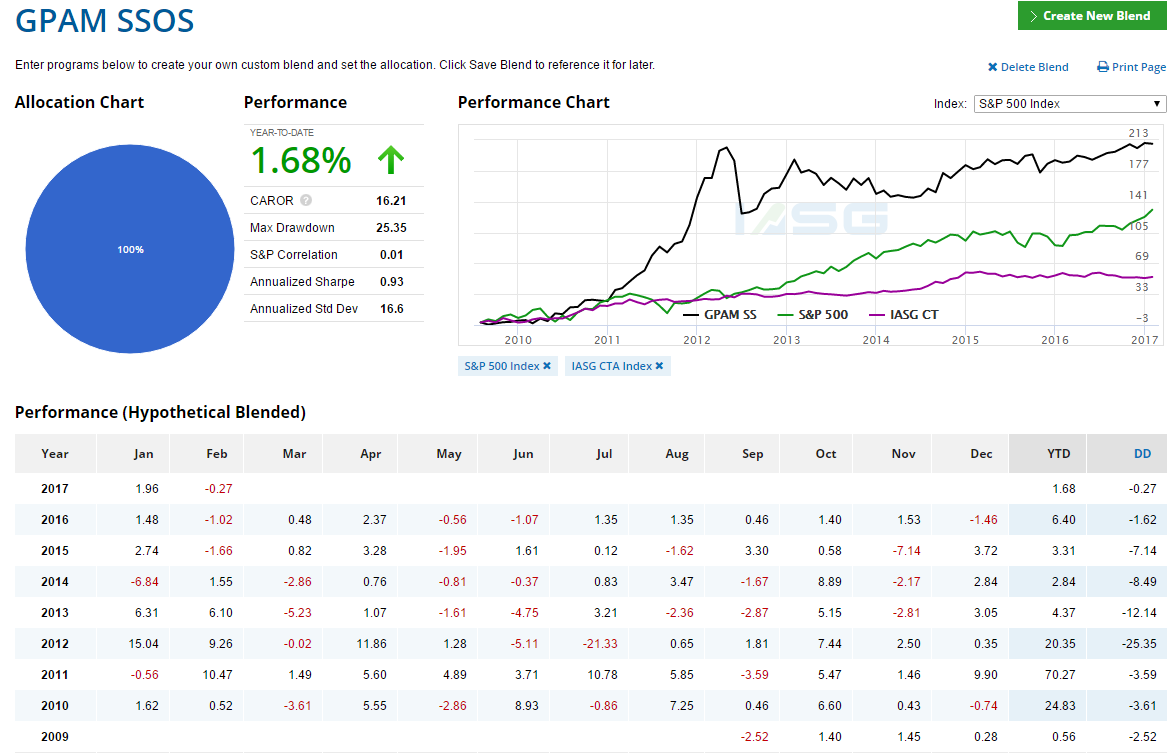

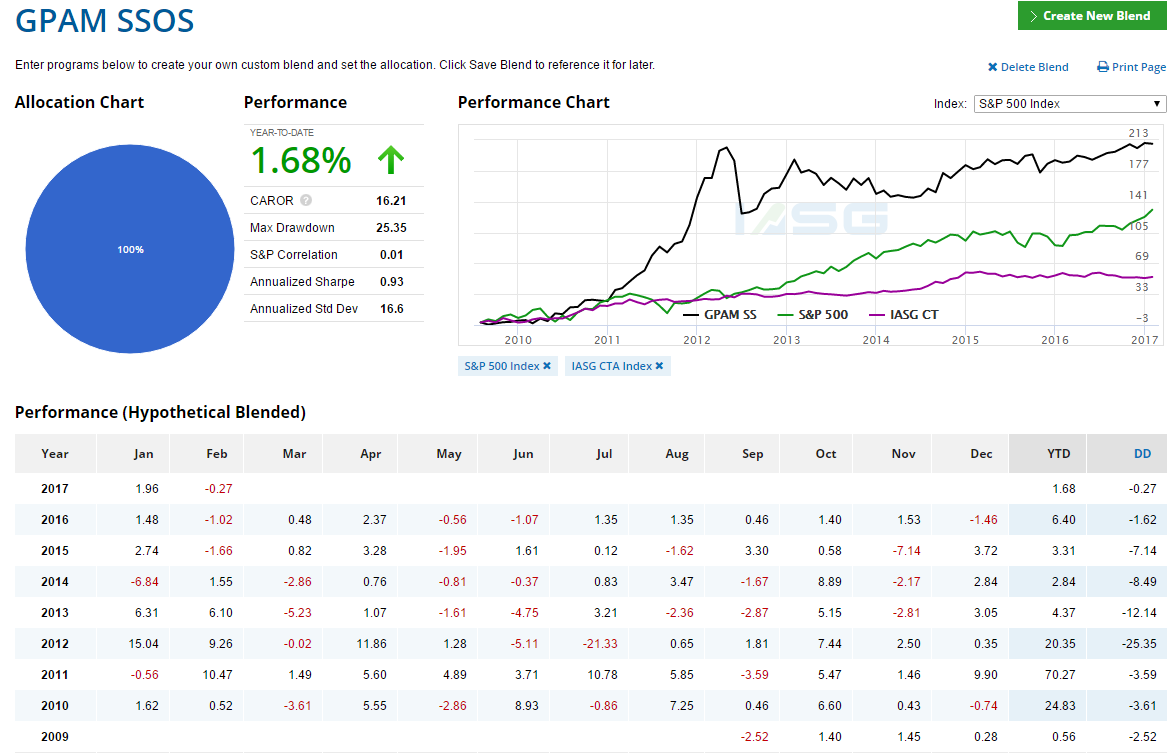

GPAM 2017 YTD 1.68% February -0.27%

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

The above presentation is for informational and comparative purposes only. It is intended only for use by those who are knowledgeable about such comparisons. The index or indices selected to generate the above comparison is/are not available as directly investible product(s). Generally, no individual can purchase an actual index as an investment holding for his or her portfolio. All index comparisons should be considered with the intent to evaluate differences between a singular trading strategy against a designated benchmark.

Performance for the month of February ended flat. Our grain spreads moved against us, initially causing the month of February to slip into negative territory. We still expect to see some market movement in the grains during planting season, and if this happens, we ought to benefit from it. If not, these spreads could move more against us causing a further, yet controlled small loss.

We have a good Eurodollar position in our portfolio. We expect the Federal Reserve to raise rates which, in our opinion, will give us more profit in this Eurodollar spread strategy.

During March we are willing to start some new spread positions in meat futures and in energy futures as the spring season is favorable for these strategies.

Yours Sincerely,

Gregory Placsintar

To hear more about this program contact Bill Reavis, Head of Asset Management at Walsh Trading.

Bill Reavis

312-957-4731

breavis@walshtrading.com

THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL. YOU SHOULD, THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN LEAD TO LARGE LOSSES AS WELL AS GAINS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.