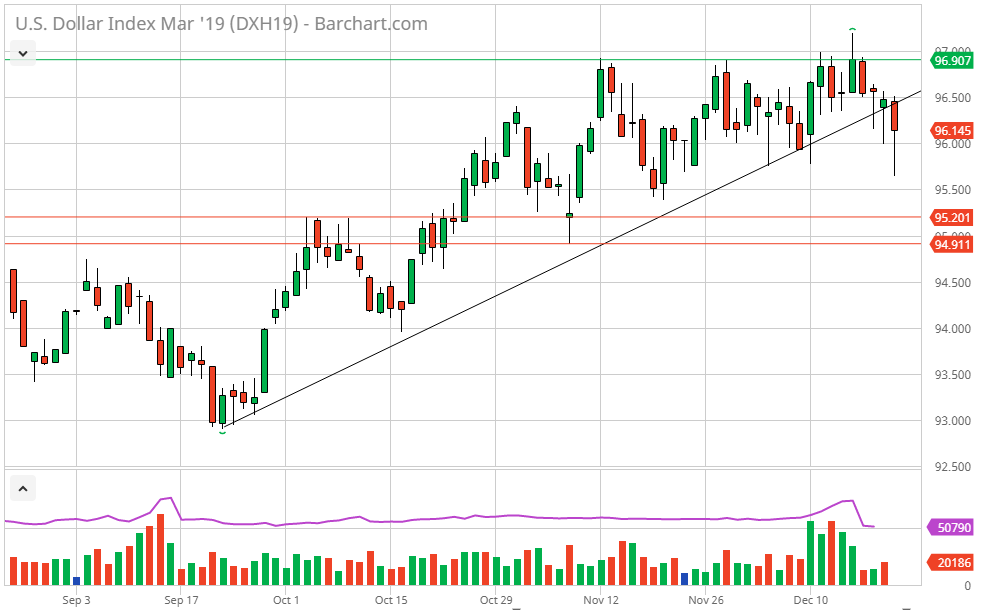

In my opinion the Dollar Index has the potential to move lower. Equity weakness, Fed slowing(stopping?) rate hikes to only two next year and repatriation going into the new year should all weigh on the Greenback going into year end.

March futures on the Dollar Index last at 96.15 as of this writing, can potentially move lower to 95.00 and potentially 94.50 In my opinion, getting short with a stop at 9675 risks $600.00 to make $1150.00 and potentially $1650.00

Also consider Options on the Dollar Index, the February 9550 Put cost .475 = $475.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, also the 9500 Put cost .340 = $340.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade and the 9450 Put cost .245 = $245.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

For upside protection consider the February 9700 Call cost .860 = $860.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

MARCH FUTURES ARE THE UNDERLYING CONTRACT

FEBRUARY OPTIONS EXPIRE IN 50 DAYS 2/8/2019

To discuss any strategies feel free to call 888-391-7894 or email me peterori@walshtrading.com

………………………………………………………………….

Walsh Trading, Inc. is registered as an Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. The information contained on this site is the opinion of the writer and obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in current market prices.