The economic news this week hasn’t been great when it comes to inflation. Wednesday’s CPI (Consumer Price Index) Year on Year data increased 6.2%, the largest gain since 1990. Any year-to-year comparison data must be marked with an asterisk, because 2020 was such an outlier. However, the 6.2% increase is a sign that we are experiencing inflation at the highest level we have seen in a long time.

The Fed doesn’t have too many options when it comes to fighting off inflation. The most obvious, and most likely in my opinion is a move away from the current near zero interest rate environment. The Fed has remained “patient”, to use their term when it comes to any potential rate hike. If the trend in in CPI numbers continues, I don’ t think they will be able to sit back and wait much longer.

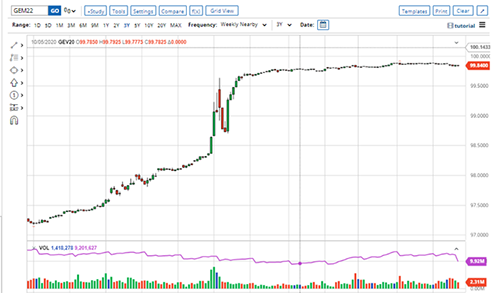

One way to take of any advantage of any possible rate increase is the CME’s Eurodollar contract. Eurodollars are an interest rate-based futures contract, with an inverse relationship to the fed funds rate. Generally, as Fed rates move higher, Eurodollars move lower, and vice versa. If one is looking for an increase in the current fed funds rate, you are likely taking a bearish view of Eurodollars.

The FOMC will meet three times before June 2022. Observers will be closely paying attention to see if the Fed starts to tip its hat as if and when they may raise rates the current .25 %level. In my opinion they will likely take action at the June meeting, but could act sooner if the data supports being more aggressive.

Pre pandemic, in March of 2020, fed rates were near 1.75 %. At that time the June 22 Eurodollar futures were near 98.60. In my opinion a potential rate hike could see the contract close to that level from its current 99.80 area. I am trying to take advantage of this possible move using Eurodollar options.

Feel free to contact me if you have any questions about this trade or the markets in general.

Trade Suggestion(s)

Risk/Reward

Futures –

Options – Buy the June 2022 Eurodollar 9850 put at 20 points ($50.00) or better. We are trying to take this as close to expiration in June as possible, with an initial target exit at 200 points ($500.00) Risk is limited to the cost of entry plus fees and commissions.

John Weyer

Director Commercial Hedging

Toll Free: 1 888 391 7894

Direct: 1 312 985 0934

Fax: 1 312 256 0109

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.