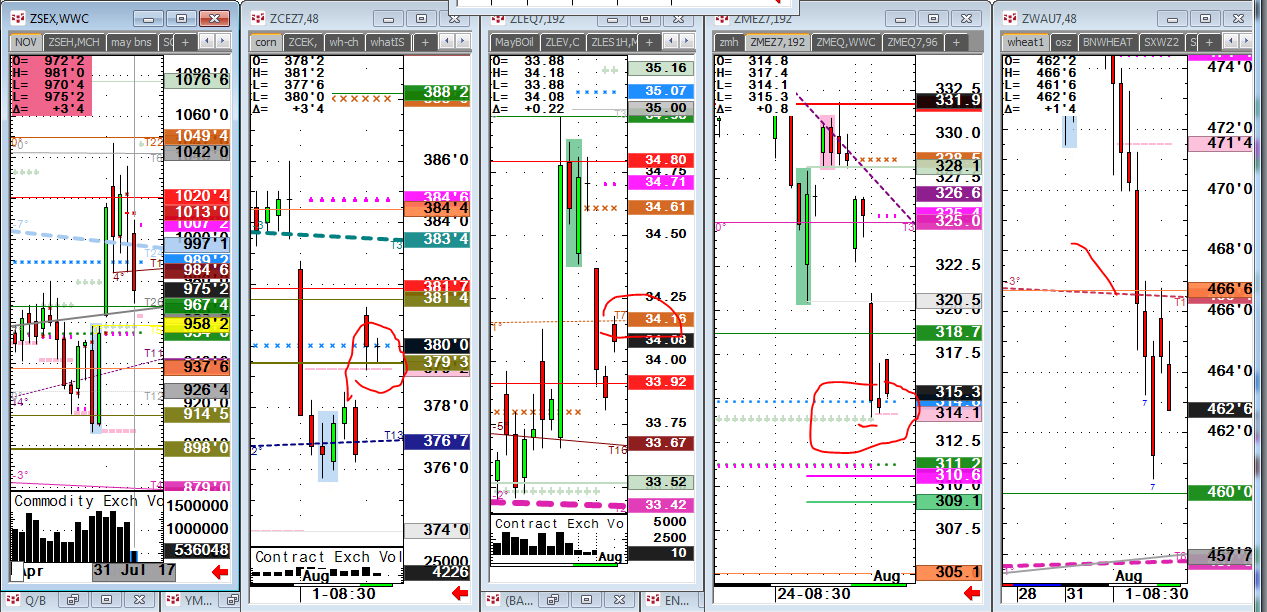

I just did a timely voice a half hour ago, corn buy with 3.78.5 sell stop, meal 313.80 stop,

ARP Wheat Pit

both same setup, very low risk if looking to buy these markets funds are getting slapped around in.

Powder blue xxx’s are powerful pivots.

THIS IS VERY SHORT TERM so this may not apply to yourself. It is an example of how day traders use these support levels.

Corn and meal very low risk buys if throwing money away. The best way.

This Broker tries to give very low risk plays like these?

I do and I know what its like to lose money because I’m the real deal.

Wheat- do your trendlines play like these?

Let’s talk already. Macro speaking these markets are going to bust loose.

Low risk buy meal if looking.

Below is a followup on a post in hogs which is a few buy levels. You can wait for the thick olive or when tight together like this I say you buy the OLB1, thin one if risk appropriate to your trader profile. I have done voice files on old site discussing this in detail and VIP traders have really found this useful, especially the ones in rural areas that are not producers but speculators with nobody out there that speaks their language. Not my words but clients.

HOGS- FRONT MONTH ONLY DID AN ORANGE BUY, DEC WENT DEEPER TO OLIVE LINE ON 2ND DAY OR TESTING SUPPORT.

2

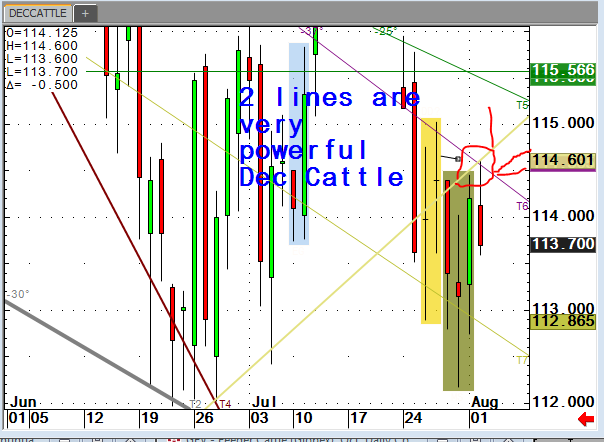

CATTLE- this is displayed as an apex, a sell first time up this am. The reason you use stops is because late in day this market took out this level (a good day trade scalp in morning) then exploded up through this proving how powerful my conditional indicators are.

WHAT IS THE OLIVE LINE

this link is from my old site which I have transitioned from and do not sell or teach anymore. I think it is a decent voice.

https://nasdog.com/2017/04/04/what-is-secret-olive-line-listen-to-what-is/

cattle-apex114.60 powerful