Will demand push corn prices higher in 2025?

At near $4.40, the 2025 price of corn futures appears to be near or below the cost of production. The National Corn Growers Association, using the USDA cost of production forecast for corn and the 181 bushel per acre yield projection, estimated the average cost of production at $4.80 per bushel for the 2024 crop.

Farm Raise, which provides a financial management platform for farmers, lists the primary factors driving commodity prices in 2025. Weather is critical. The USDA’s Economic Research Service notes that climate variability will continue to affect production.

A second factor is global demand and exports. The U.S. Department of Agriculture (USDA) expects growing demand from countries such as Mexico for U.S. corn and soybeans.

Farm Raise also notes that rising costs for fuel, fertilizers and other essentials greatly affect farm income. The cost of production also has increased due to higher interest rates and energy costs, pushing futures prices higher.

Other factors are government policies and any changes to the Farm Bill that relate to subsidies and trade agreements. USDA programs could influence planting decisions, as risk management tools might provide some protection against price fluctuations.

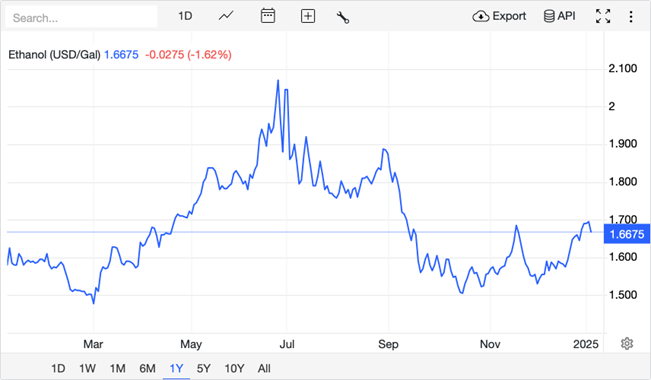

According to the USDA and its Economic Research Service (ERS), strong demand for corn is expected with prices projected between $5.50 and $6.00 per bushel in 2025. Support for high futures prices comes from exports and demand for ethanol.

The USDA forecast the carryover of corn on Sept. 1, 2025, at 1.738 billion bushels, down 200 million bushels from 1.938 billion bushels projected in November. The Department noted 2024-25 US corn exports at 2.475 billion bushels, up 150 million bushels from the prior month’s outlook of 2.325billion bushels, and the highest export forecast since the 2020-21 marketing year. The USDA also raised its forecast for ethanol and byproducts usage to 5.500 billion bushels, up 50 million bushels from last month.

Source: Trading Economics

In a January 3 article in Successful Farming magazine, analyst Bryan Doherty says there are no easy answers to forming a strategy. He says aggressive forward contracting could be a big mistake if prices rally. Forward contracting at the current price levels and buying calls also doesn’t look attractive to Doherty.

Doherty suggests that “exploring options to provide a price floor may be the best bet at this time.” He goes on to explain that purchasing a put establishes a price floor, leaving unlimited upside potential for unpriced grain.

A risk assessment must be undertaken before making decisions. Call me for additional information.

Stephen Davis

Senior Market Strategist, Walsh Trading

Phone: 312-878-2391 or 800-556-9411

Email: sdavis@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.