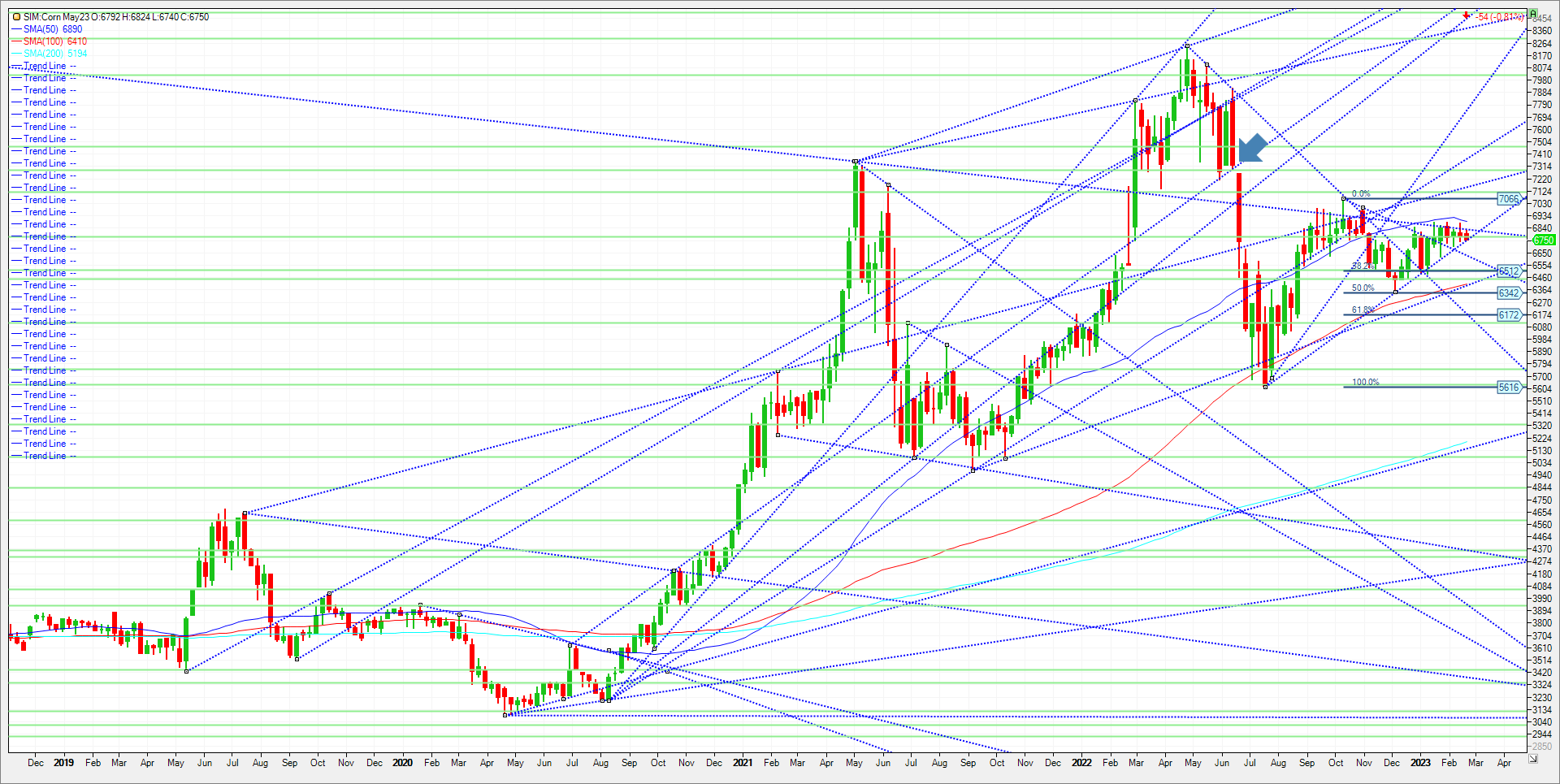

The USDA’s Ag Forum starts tomorrow, and the trade is prepared to receive the government’s best unsurveyed guess of acreage and yield for the coming year in the US. The average trade guesstimate puts the acreage at 90.9 million corn acres and a yield of 179.7 bushels/acre. 90.9 million acres would be a buying of 2.3 million acres versus last year. That increase most likely emerges from the far reaches of the corn belt or fringe areas of SD, ND, KS, and NE as lost acreage due to prevent plant and drought could claw back this season in my opinion. The US dollar index extended gains following the FOMC minutes released this afternoon. Minutes showed that all voting members of the Federal Reserve backed a 25 BPS hike at the last meeting with a few members favoring a 50 BPS hike. Extended gains in the US dollar index may continue to put pressure on corn futures. It is my belief that wheat and soybean weakness weighed heavily on corn futures throughout the session today, pushing corn down into support. Though buyers stepped in toward session lows, preventing further breakdown where selling likely accelerates below last week’s low. Technical levels through next Friday for May corn come in as follows. Consecutive closes under 6.78 could push the market down to 6.61. A close under 6.61 could push the market to 6.45, which represents 5 percent down for the year. Underneath that level is 6.41, the 100-week moving average. A close under 6.41, and its Katy bar the door down to 6.11, (10 percent down for year). To turn bullish, the market needs to close back over 6.82. Should that happen the next level of resistance is at 689.0, the 50-week moving average. A close over and the next level of resistance is 7.12, (5 percent higher for year), and then up at 7.28, the top end of a gap that has never been filled.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me each and every Thursday at 3pm Central for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax