The information and opinions expressed below are based on my analysis of price behavior and chart activity

March Corn

March Corn futures closed at 4.74 ½ today, down 2 cents. Last Friday, just 2 trading days ago, the USDA “finalized” the current crop, with the release of the January WASDE. In that report, fuel was given to the bulls, sparking a rally from Thursday’s close at 4.56 to today’s high of 4.79 ¾. Corn prices rallied some 23 ¾ cents to that level, before fading back to close lower on the day. Was today just another “Turnaround Tuesday” or is there something else afoot? First off, the USDA lowered US Corn production to 14.867 billion bushels, down from their December estimate of 15.143 by some 276,000 bu. Most surprisingly to me, they cut the national yield by 3.89 bu/acre to 179.3 bu/acre. That’s still an increase over last year’s yields, but the harvested acreage dropped by 3.6 million acres to 82.9 million acres harvested. And since they cut the production, ending stocks were also lowered by nearly 200 million bushels to 1.540 billion. While we still had a very large crop, overall, it is not as large as last year’s was.

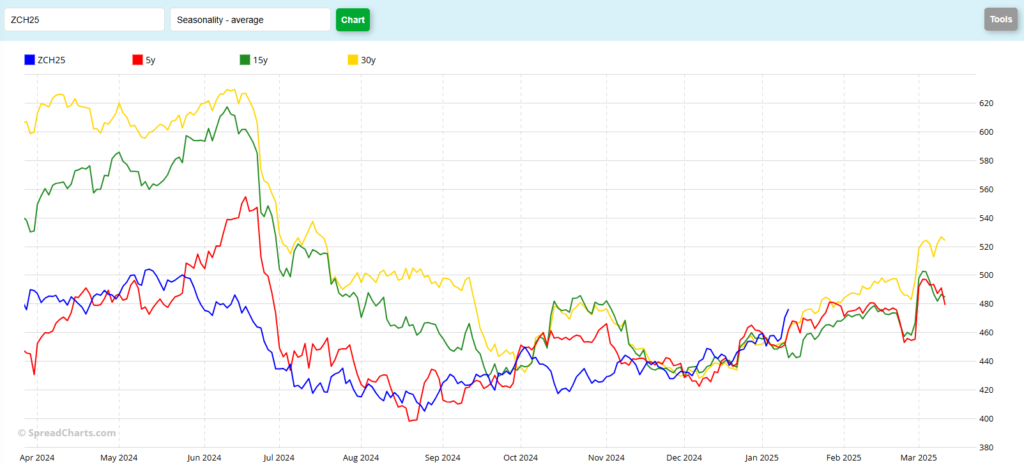

The positive reaction by the market was strong enough to break trendline resistance that had held for long time. The upper red horizontal line is drawn off the June 2023 and May 2024 highs and today appears to be near 4.59 today. That certainly can set up the market for another push higher, although I wouldn’t expect huge rallies, at this point. I might even lean a little toward the bearish side in the short-term right now, as the market has been a bit overbought since just before Christmas (Stochastics, lowest subgraph) and today’s candle or bar is showing some signs of weakness. There does look like there is trendline support (upper blue horizontal) just under the market near 4.73. Below that, I see the 5- and 10-day moving averages, at 4.66 ¼ and 4.61 ½, respectively. Overhead resistance may appear near today’s high, 4.79 ¾, 4.90 (March ’24 highs) and from there to 5.00, perhaps testing the May ’24 high at 5.08 ¼. Demand has been good, but not ragingly bullish. Monday’s export inspection report showed that Corn shipments are still 21% over last year’s pace, which is good. I think we’ll need to see some huge foreign purchases to get this market very bullish. Producers have taken advantage of this rally to sell some additional bushels and clear a little bin space. Those of you that have sold your grain and are worried that you’ll miss out on a subsequent rally, consider using Call Options to re-own the bushels you’ve sold. I wouldn’t get aggressive and shoot for the moon with those, rather, I’d look to take profits if the market lets you double your option premium. Then go out and spend the same amount of money, don’t eat into your profits if you can avoid it, on a Call option further out in price. Aggressive and well-margined speculators may do well to consider long positions, especially if we see a pullback to trend support. Seasonally (chart below) Corn has historically rallied this time of year, typically staying strong until the March options expire at the end of February

March Corn Seasonal

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

[email protected] www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.