The information and opinions expressed below are based on my analysis of price behavior and chart activity

Monday, December 2, 2024

March Corn

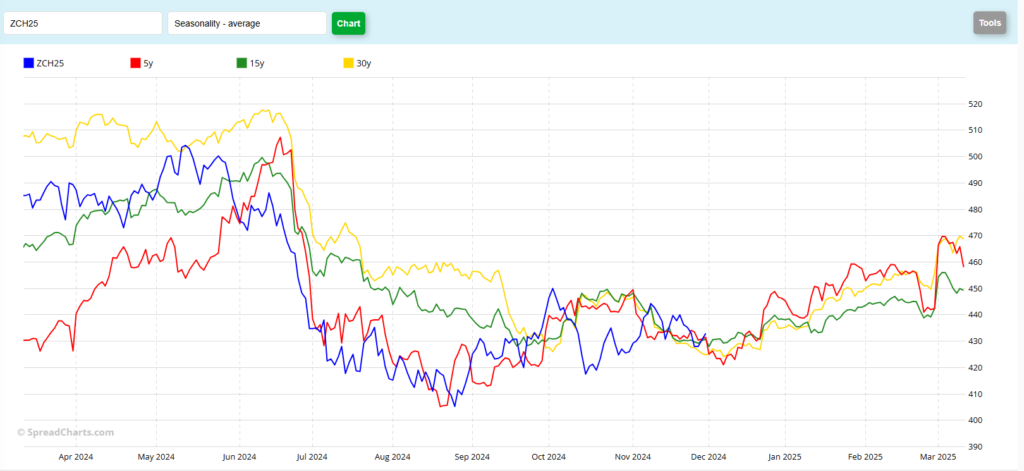

As we start the last month of 2024, March Corn settled the day down ½ cent at 4.32 ½. November saw prices gain by 7 cents, compared to October, but 5 cents of that gain came on the last trading day of the month. The market seemingly ran out of strength at the end of the first full week of the month and prices never re-visited those highs near the 4.47 ¾ print from November 8th. Currently, prices sit closer to the low (4.25 ½ on 11/26) of last month, 7 cents away, than the highs, 15 ¼ cents away. Exports have been decent, as highlighted by today’s Export Inspection report. We currently sit at a little over 11 million metric tons of Corn that has been inspected and is ready to ship. That’s a roughly 30% improvement over this time last year. Some of those shipments might be countries trying to play the “tariff game” and buying grain ahead of Trump’s inauguration, due to fear or uncertainty over what those tariffs might actually be. The market price has come down to trendline support over the past few sessions, as noted by the blue horizontal line drawn off of the lows in August and October. This pullback followed a bullish trendline breakout (red horizontal, drawn off of May/October highs) that occurred during the first full week of November and the market had seemingly held to that red trendline for the past three weeks. So far we’ve seen prices hold the Aug/Oct trendline and also hold above the 100-day moving average (4.27 ¼, today) over the past 4 days. I think these support and trend levels should hold. Seasonally (chart below) March Corn tends to make a “low” this first week of December and then usually rallies until the middle of February. As you can see by the chart below, it does NOT always immediately turn higher just because we flipped a page on the calendar. Sometimes it continues lower before reversing back up toward the end of this week. And in some years, like 2024, it just continues lower until late February. And while I am bullish, I also think it’s unlikely to be a huge rally. We’ve got a very large crop here in the US, and our overseas competition seems to be having few planting issues, at this point in time. For producers looking to get a few extra cents out of their production, I would suggest using March Call Options to re-own bushels that you’re selling. The market is not currently paying enough in carry charges to pay for storage, interest, etc. and to me it makes little sense to hold onto the grain. March 440 Calls settled today at 10 cents ($500 before commissions and fees) which seems like a good value to me, and folks wanting to save a few pennies may do well to consider the March 450’s (6 7/8, $343.75 before commissions and fees) If you choose to buy those calls, I would suggest placing a GTC order to take profit at 2x what you paid. If/when those GTC orders are hit, re-evaluate the market and see if it makes sense to spend the same $500 again. Aggressive and well-margined futures traders may do well to consider long positions, with a risk of last week’s low (4.25 ½) on a closing basis, because we’ve seen this market test support and rebound. and an upside target near the 200-day moving average (purple) at 4.52 ½. That level also coincides nicely with the October high and seems to be a reasonable target.

Seasonal March Corn (Blue-current, red-5 yr avg, green-15 yr avg, yellow- 30 yr avg)

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.