The information and opinions expressed below are based on my analysis of price behavior and chart activity

February Live Cattle

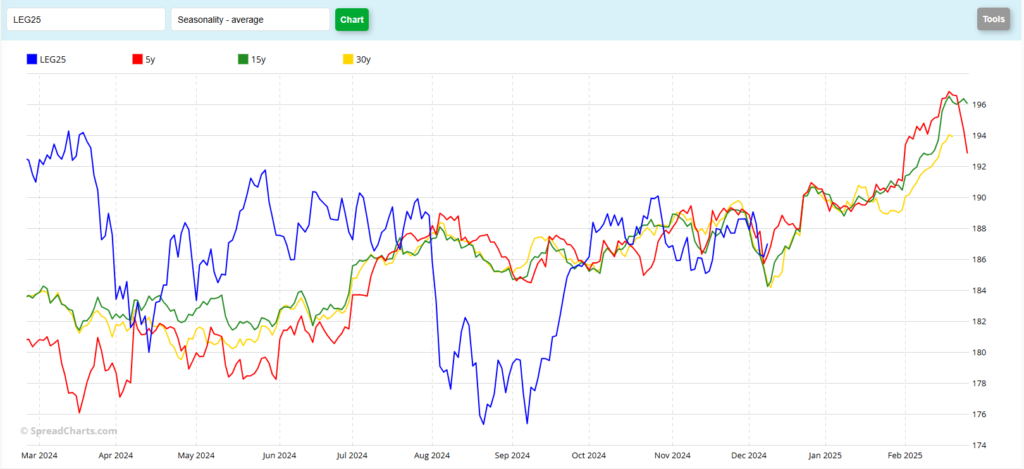

February Live Cattle settled 2.00 higher today, at 189.025, nearly matching the high close from last week. Monday’s trade activity posted a “Bullish Engulfment” on the candlestick charts, which is usually supportive, and traders pushed prices up toward the (red) trendline resistance today. Seasonally (seasonal chart below) prices tend to rally from here on out until contract expiration. Nearly every news item that I see, regarding Cattle, has a bullish bias to it. Cash prices are high (bullish). Retail prices are high (bullish). Overall, animal (supply) numbers are down and we’ve been expecting the declining herd to rebuild for a while now. Allegedly, this is the lowest number of cattle we’ve seen, as a nation, since 1961. When herd contraction began, it was expected to go on a “normal” cycle of about 5 years or so. If we assume that contraction began in earnest when COVID hit in the late 2019-early 2020 time frame, that would have suggested a rebuild of animal numbers starting this year, 2024, or maybe next, in 2025. Now the USDA seems to be projecting that the numbers won’t improve until 2027. Add in the blanket import ban put in place from the one (1) Screwworm case in far southern Mexico, however temporary that may be, and that may put off a herd-rebuild even more. Feedlots that would normally re-fill with cattle imported from Mexico next spring and summer will be behind. Not as dramatically as 2020, but similar in a way that once the pipeline is disrupted, it will take a while to re-establish. Even if that import ban was lifted today, that’s still about 2 weeks of progress lost and missed opportunity. This leads me to believe that higher prices are still ahead and will likely extend well into 2025.

If Fat Cattle are able to close above that resistance line (189.500 or so, today) how high could they go? The first target that appears to my eye is the 190.325 high from Oct 29th. That coincides nicely with the big, fat, round number of 190.000. (readers will understand how I feel about those, if you’re not sure, call me) From there, I would look to the July 5th high, 191.350 and then to the May 28th high of 192.00. Over the past 10 years, by looking at how the Feb contract traded, there have only been a couple of years (2015 and 2020 contracts) where we did not see prices rally from this time frame, and actually saw prices decline. Some years, (2014, 2017, 2019 and 2023) they even rallied to new contract highs between now and Feb. If that were to occur again this year, that would put this current contract up over the high at 199.575 on Sept 20th, 2023, over 10.000 higher that today’s close. Producers should still protect the downside risk. I would suggest using a strategy that implements Put options (good) Put Spreads (better, perhaps, because they can be less expensive) or by using a 3-way spread and sell a Call to pay for it and lock in a sale price (call me for details) More aggressive and well-margined producers may do well to wait a bit before doing that, but be ready and able to get short if the market fails to break through resistance and starts to drop. Speculators may be better positioned to stay on the long side of the market, as the trend has been up since early September and as “they” say “the trend is your friend.” Support levels may be found near the 5-, 10- and 50-day moving averages, or 187.375, 187.880 and 187.575, respectively. The 200-day average is at 186.350 and the 100-day is down near 184.585. If that number gets breached on a closing basis, I would expect an aggressive and fast move toward the contract lows.

February Live Cattle Seasonal Patterns

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.