The information and opinions expressed below are based on my analysis of price behavior and chart activity

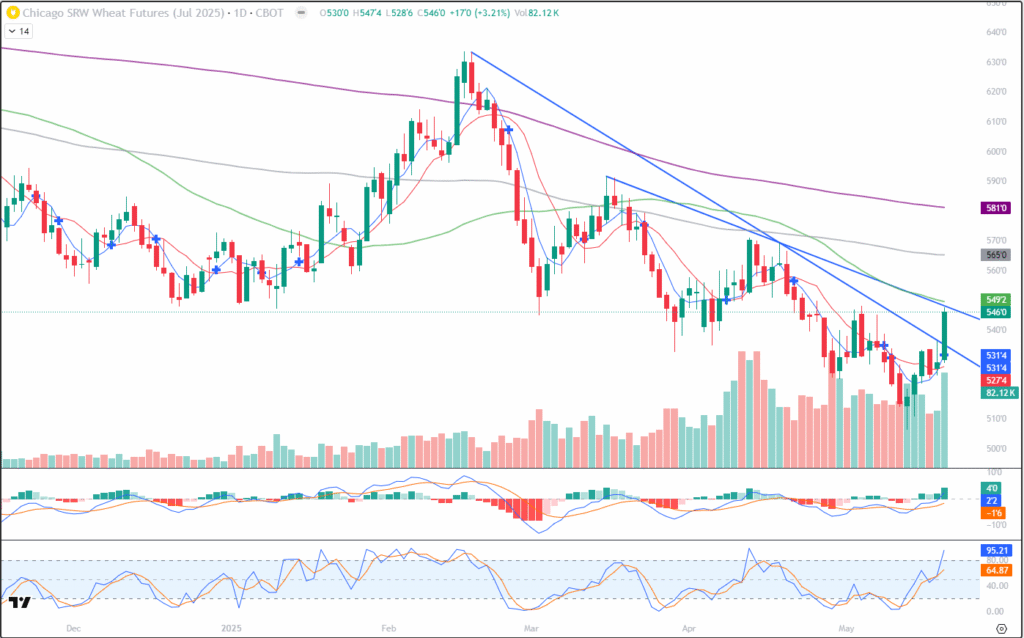

July Wheat (Daily)

Today, July Wheat closed at 5.46, up 17 cents on the day. The 5- and 10-day moving averages also crossed into bullish territory, adding some fuel to the bulls. This marked the highest close since April 23rd, almost 1 month ago! 5 out of the last 6 trading sessions have been “up” days, something this market hasn’t seen since the 1st or 2nd week of April. That period was similar to this one, in that today’s bar seems very much like the large green trade of Aprill 11th. A spike low, followed by a few mild up days, capped off by one large move up, and a selloff to new contract lows. Would you agree with that assessment? The 50-day moving average (green, 5.49 ¼) is just above the market. We haven’t interacted with that average, since 4 days over the middle of March, and then it acted like firm resistance. I have a feeling this might be different. We may see that level act as some resistance later in the week, but the key number, I think, is the 5.50 level. That would signal a close above the 50-day, and would also clear trendline resistance across the Mar-Apr highs. And a close above the 50-day may induce some the funds to start covering their short positions. Aggressive and well-margined traders may do well to consider long positions in the futures, perhaps risking yesterday’s high of 5.36 or the 5-day moving average at 5.31 ½, depending on your entry and risk tolerance. It may seem out of reach, but perhaps targets near 5.65 and 5.80 could be in play. Less aggressive traders may do well to consider July Call options. July options expire in 31 days. The July Wheat 550 Calls closed at 15 5/8 today, or $781.25 plus commissions/fees. I would suggest a profit target set at 2x what you pay for that option. Call Spreads or bullish 3-way option positions may be worth consideration, as well. If you need help with that, give me a call.

July Wheat (Weekly)

So far, for the week, July Wheat is up 21 cents. (I know, it’s only Tuesday) The market is trading above last week’s high of 5.33 ½ and has gotten within ½ cent of the high from 2 weeks ago of 5.48. Currently, it is also about 40 cents off of last week’s contract low of 5.06 ¼. That’s seems like a pretty strong recovery, to my eye, but a glance at the weekly chart above tells me that the market still has a lot of work to do. This chart goes back to February 2023 and I think you’ll agree that it’s been trending down this entire time. Yes, there have been a couple of nice, bullish bounces during that time, but that’s all they’ve been…bounces. Until those long-term averages in the chart start inclining upward, I’ll remain somewhat skeptical of a huge rally. The grey line is the 100-week moving average (6.28) and the green is the 50-week moving average (5.86) And except for a roughly 9-week period last year that 50-week average has been solid resistance. And, except for the first week that the data could compute it, the market has stayed well under the 100-week average. Both of those still appear to be declining. The 5-week and 10-week averages (blue and red, 5.36 ¼ and 5.47 ¼, respectively) are still pointing lower. The Stochastics in the bottom subgraph are just starting to come out of oversold status. Looking back over the chart, it’s been oversold much more than it’s been overbought over the past 2 years or so. I do think it is somewhat bullish that last week’s trade was a “Doji”, opening/closing at or very near the same price and the market is currently above last week’s trade. Also, remember that the funds are net short this market, according to COT data. If/when they decide to lift those short positions, prices will accelerate higher, as I believe this market is starving for a rally.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.