The information and opinions expressed below are based on my analysis of price behavior and chart activity

January Soybeans

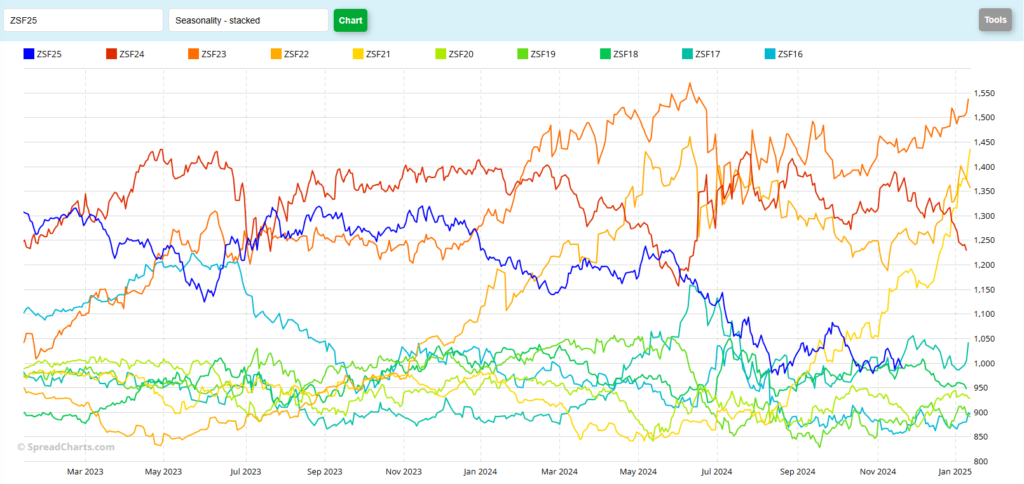

When I wrote about Soybeans last week, I was still very much in the bullish camp. I don’t think I’m bullish anymore. Today’s close of 9.77 ¾ is the lowest close since August 16th. That day was also the contract low close @ 9.76. The contract low was posted on August 14th at 9.73 ½, which is certainly in play now. The market failed to reverse back higher last week and test the November highs, instead going the other direction and setting new lows for the month today. Export Sales have been decent, but not huge, so we’re not seeing any type of demand driven rally, currently. Rather, it seems like traders have been focused on South American weather and planting progress in Brazil. Both of which are progressing well, adding bearish pressure to the market. Traders are also focused on the potential for tariffs and/or trade wars with the new Trump admin. The way I look at it, he won’t be president for another two months and there’s a lot that can happen before he gets inaugurated. Volume today was higher that it’s been for the past 5 sessions and it was a fairly weak close, telling me that more selling or margin liquidation may be on the way. Beans are down 20 ¾ for the week, following the previous week’s loss of 31 ¾, neither of those things look friendly to my eye. Seasonally, Soybeans tend to rally until the January contract goes off the board, but this may be shaping up to be a repeat of last year’s activity, when the contract traded lower from the the end of August through expiration, but that even saw the market rally some during the mid-October to Mid-November time frame. (see chart below) If this does trade in a similar fashion for the next few weeks, I think the market is headed toward the 9.50 level. The trendline support (red) is even lower, roughly 9.38 today. The 5- and 10-day moving averages are in bearish territory, with the 5 day offering some resistance at 9.95 today. Overall, this market looks very “heavy” at the moment, and it appears to me that further weakness is likely. If producers still have unsold or unprotected bushels, I still believe that you should be hedged. Short futures positions will do that on a 1:1 basis, but offer margin risk that some producers may be reluctant to deal with, at this point in the marketing year. Put Options and bearish spreads will also do that for you, but you’ll need to scale up your positions to achieve the proper delta against your price risk. If you’re unsure of what I mean by delta, give me a call and I’ll explain further. The short version is that you’ll need more that 1 option to adequately protect your price risk on 5,000 bushels, unless you’re buying a Put that is really far in-the-money and also very expensive. Aggressive and well-margined futures traders may do well to consider short futures positions, with stop orders near (not at) the 10.00 level to manage price risk, or by using call options instead of a stop order. Look for an opportunity to sell the futures a little higher is there’s a profit-taking rally on Friday or Monday, like there was this past Friday and Monday. Perhaps near Wednesday’s low of 9.85 ¼ or even Monday’s low of 9.89 ½, would be good places to consider selling the futures, if we see a mild rally. For more information or to discuss your personal situation and needs feel free to give me a call.

January Soybean (seasonal) with price activity from each of the past 10 years displayed.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.