The information and opinions expressed below are based on my analysis of price behavior and chart activity

January Feeder Cattle

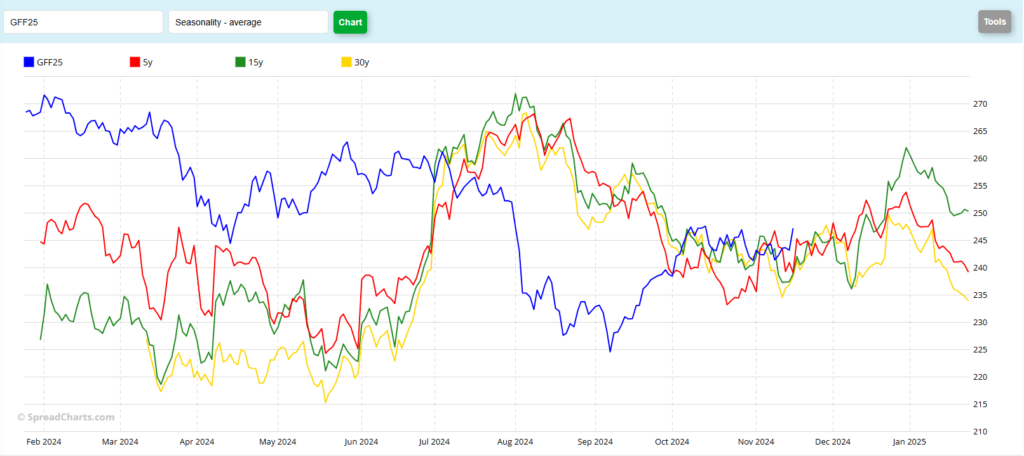

Following Friday’s very strong jump higher and breakout close, Feeders continued to show more strength on Monday. Last week’s close put the Jan contract up 5.80 for the week, with 4.02 of that gain coming on Friday. Today the futures added another 2.27, to close at 249.50. That’s the highest daily close in this market since July 31st. Volume has been strong over the past 2 sessions, indicating to me that new buyers are coming in to support prices. The might be some overhead resistance at the 250.00 level (nice big, fat, round number) and you can also see the 200 day moving average (purple) above that at 250.57 or so. There is also an overhead trendline, which at today’s close, seems to be around the 252.50 level. A close above that trendline, would, in my opinion, confirm a break out higher on the trend for the year, but would not set new contract highs for the year. That is at 272.30, when this contract was just 7 days old. The 5-and 10-day moving averages are well below the market, at 245.43 and 244.15, respectively, offering some levels that traders may be looking to as support. The market has broken out above the (red) trendline of the past few weeks, giving more support to the bullish argument. The long term (100 and 200, grey and purple) moving average are still inclined lower, but the medium term 50 day average (green) is inclined upward. Aggressive and well-margined traders may do well to consider long positions in the futures, especially considering that the 5 and 10 day averages hooked over to the “bullish” side with Friday’s close. The last time that those averages crossed and made a significant move, to my eye, was the nearly month-long period of September 16th to October 17th, a 12.45 gain from close to close on those days. Additional support may be found near the October high at 248.5, although the market held right near there for about an hour today, before it made another leg higher into the close. The MACD indicator (1st subgraph) is pointing toward higher prices and appears as if it has some room to grow. Stochastics (2nd subgraph) got into overbought territory with Friday’s close, but as you can see by looking back on the chart, it stayed that way during most of the Sept-Oct rally. Hedgers/producers should still be protected against downside risk and as prices near the 250.000 mark, that may offer an opportunity to move your option hedges up. Seasonally, I would not expect a large rally until after the first week of December. However, the overall patterns indicate general price strength from now until the end of December. But as you can see from the chart below, the seasonal patterns don’t always hold to specific dates and there can be a large divergence between the 5, 10 and 30 year patterns or trends (red, blue, yellow) and the actual trade (blue)

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.