The information and opinions expressed below are based on my analysis of price behavior and chart activity

January Feeder Cattle

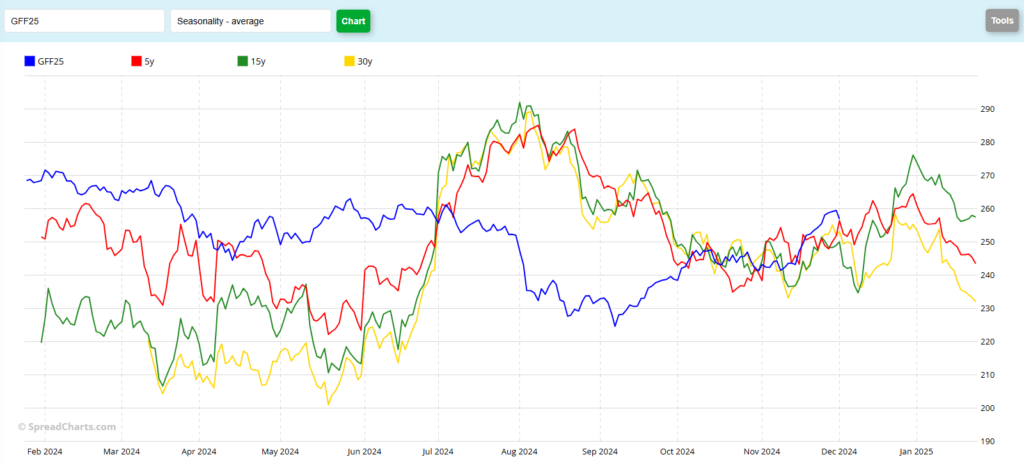

After starting the week off with a drop of 2.625 on Monday, January Feeder Cattle rallied back up by 2.450 to close at 259.30 on Tuesday. Setting aside Friday’s holiday-shortened session, this is the highest close since July 24th. The past 4 trading days have seen the market bump into the 260.000 mark each day, but fail to close above it. Stochastics (lowest subgraph) are still very overbought, showing no real selling pressure, at this point. The MACD indicator, just above that, is slowing its momentum as prices have struggled with the 260.000 mark. Cash markets have remained strong, with the CME’s Feeder Index jumping another 2.81 higher to 257.13 today, and sales are occurring in the country that may indicate another attempt to push through and test the July and May highs at 261.875 and 263.425, respectively. The strong rally during the second half of November broke through the trendline resistance that had held prices in check and now we see the market trading in the range that we last saw in the May-early July time frame. As I noted above, cash markets are strong. As long as beef producers are willing to pay these higher prices for cattle, the strong uptrend should continue. But as soon as that ends, this market may fall rather quickly. Personally, I would be surprised to see the market set new highs for the year (272.30, Feb 2nd) but the trend is up and everything that I see is still pointing toward higher prices. The market is trading above the 5- and 10-day moving averages which are at 258.500 and 256.005, respectively. The 50- and 100- day moving averages crossed into “bullish” territory on November 20th and are both still pointing upward. Those averages are at 246.115 and 242.345 after today’s close. The 200 day average (purple) is at 249.800 today, and that’s probably a decent support level, even though that’s almost 10.00 lower from here. Aggressive and well-margined traders may do well to remain in long positions that I advocated for when I last wrote about Feeders in this space. I would recommend that you use a protective Sell Stop to try and keep profits intact, although you will need to give the market some “space” as this market can be more volatile than some others. Consider setting a profit target near the May 28th high of 263.100. Producers and hedgers may do well to add or replace hedge protection at these price levels in an attempt to keep as much of the recent price gains in your animals. January options give 58 days until expiration. A 259.000 put closed at 4.25 today, or $2,125 plus commissions and fees. If that’s too pricey for you, consider selling a 254.000 put (2.500 today or $1,250 less commissions and fees) to reduce your out-of-pocket expense to 1.75 or $875, plus commissions and fees, at today’s settlement prices. Overall, this market appears to be strong. Seasonally (chart below) this market usually seems to struggle the first week of December, before heading higher into the Christmas/New Year time frame. But as you’ll also notice from the seasonal chart, prices don’t always follow the pattern they’ve established over years prior. In fact, I can make the argument that except for the first 3 months of this year and the last 6-8 weeks, the market has not really followed the seasonal pattern. So far this week, the market isn’t selling off, and prices may continue higher, supported by both the cash trade and the futures trade.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.