The information and opinions expressed below are based on my analysis of price behavior and chart activity

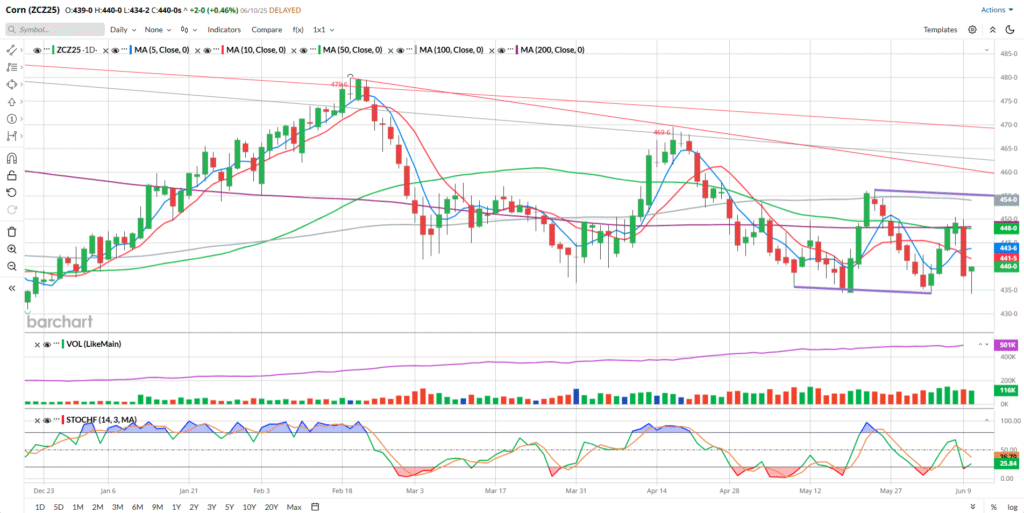

December Corn (Daily)

Today, December Corn close up 2 cents, to settle at $4.40. That mild uptick followed an 11 ¼ cent drop to start the week. Was it just another “Turnaround Tuesday” or is this perhaps something different? To my eye, I think it’s different. Prices rallied last week and closed higher on 4 days, settling above the 200-day moving average (purple, 4.48 ½ today) on Friday. Prices dropped yesterday, as traders digested the weekend weather reports and the planting progress/crop conditions. Planting is virtually complete, with the national number at 97% done. Some of the eastern corn fields (IN, OH, PA, NY, KY, TN) may be too wet to plant, just yet, and time is slipping for a decent crop window. We may see those acres come out of Corn, which should reduce our overall production numbers. I don’t know if the USDA will factor that into this Thursday’s WASDE report, but the possibility is there. If they do adjust production, usage or carry out number, that could be a bullish “surprise.” I’ve drawn a trend channel (purple horizontals) connecting the May 8 – June 3 lows and put the upper extension on the May 22nd high. To my eye, that lower support has held, including last week’s and today’s lows. Today’s activity, a spike low followed by a close in the upper end of the range, is usually a bullish indication. The short-tern averages on this chart, the 5-and 10-day, crossed into bullish territory with yesterday’s trade. Those averages are blue and red, at 4.43 ¾ and 4.41 5/8, respectively and are currently above the price, offering some potential resistance. Corn producers should be hedged, using options, as your risk is still to the downside. I don’t think a futures hedge is warranted, at this time. For example, perhaps a 430/400 Put Spread (closed at 10 ½ today, or $525 before commissions/fees) or a 430/380 Put Spread (closed at 14 1/8 today, or $706.25 before commissions/fees) would be a good choice to cover some, not all, of your unpriced or unhedged bushels. Aggressive and well-margined traders and speculators may do well to consider long futures positions, with a risk/reverse below the 4.34 level. Upside targets could be found at 4.50 (nice big round number) or against that purple trendline, near 4.55. If we get any type of weather scare, I think the April 16th high of 4.69 ½ is also in play. If the tariff nonsense is resolved, foreign demand could also re-emerge, which could also be friendly for prices.

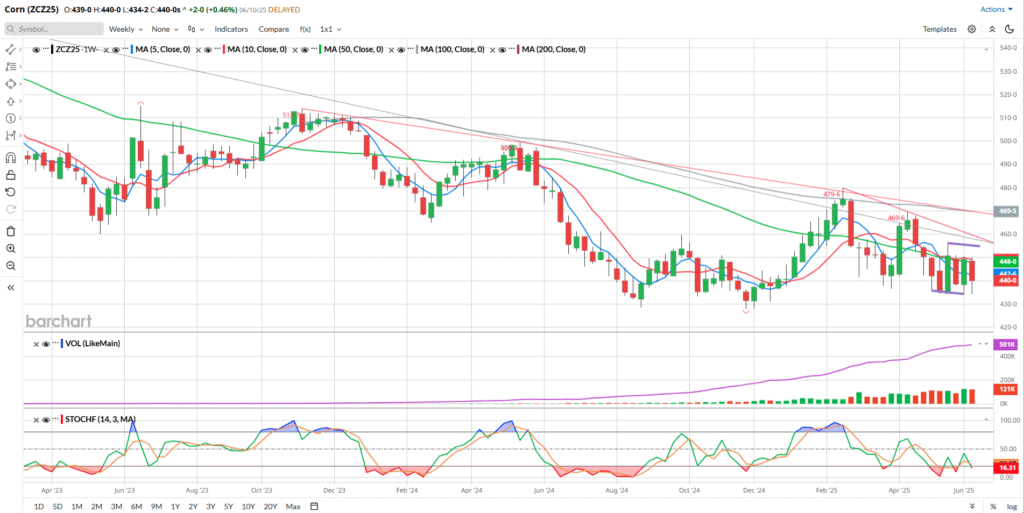

December Corn (Weekly)

This weekly chart of December Corn tells me that prices have been consolidating for the past 6 weeks, or so. It’s easier to see on the daily chart, but you may notice that I’ve drawn a purple trend channel over that time period. The $4.34 mark has served as good support, as of late, with prices seemingly unable to get through that level. Corn producers should be hedged, using options, against a break below that level. According to Seasonal data June is not typically a “bullish” month, unless it was 2021, 2015 or 2012 and to a lesser extent 2020. That’s why I think it’s a wise choice to be hedged, if you’re a producer or farmer. However, I don’t believe that the seasonal patterns have been very helpful over the past 2 years or so, following the covid/war induced rally that occurred from 2020-2022. Since then, I think the market has been coming back down to cost of production and is now searching for a new range or direction. I haven’t seen enough of a technical correction yet to convince me the we’re in a bull market, but I am of the opinion that perhaps the downside is very limited and prices may push higher from here.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.