The information and opinions expressed below are based on my analysis of price behavior and chart activity

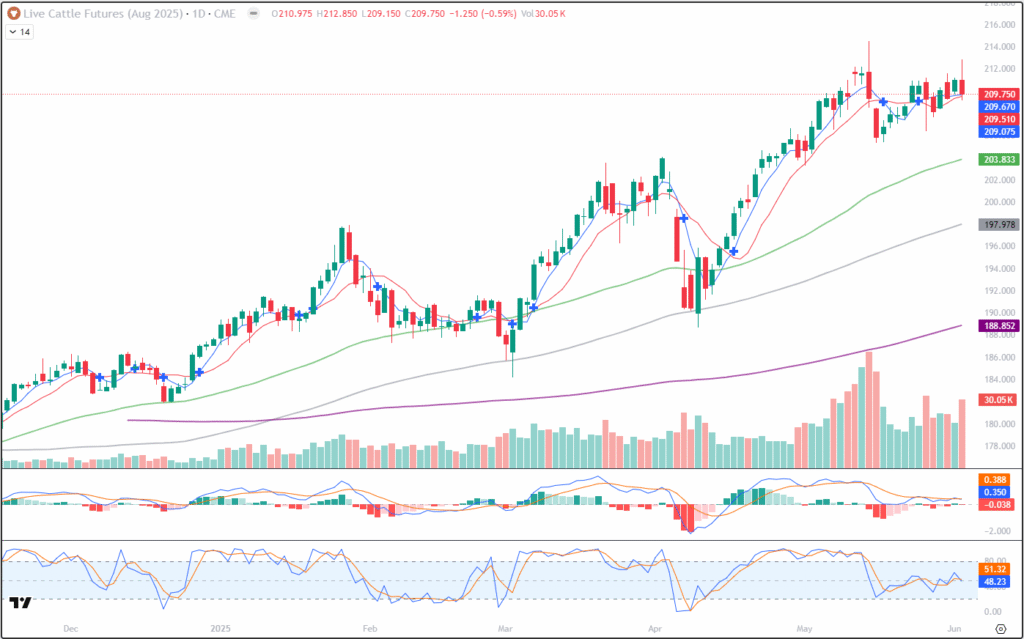

August Live Cattle (Daily)

Today, August Live Cattle closed at 209.750, down 1.250 on the day. It is Tuesday, so this may have been a “Turnaround Tuesday” trade, temporarily reversing the direction of Monday’s trade. We did see a rally today, with a high posted at 212.850, but that rally ran out of steam and prices settle very close to the lows of the day. I don’t think that’s very friendly. Looking back over this chart, you might notice that the 50-day and 100-day averages (green and grey, 208.833 and 197.978, respectively) have been acting as good support over the past 6 months or so. We haven’t seen the market trade anywhere near either of those averages since the middle of April. We could be in a period of price consolidation (see February’s price activity) but this seems a little different to me, as we’re not near any clear support levels that jump out to me. The 5- and 10-day moving averages are both under the market and offering some apparent support. Those averages are at 209.670 and 209.510 and are blue and red, respectively. I know it’s tough to see on the chart, but they’re thisclose to flipping into a bearish configuration. Stochastics (lower subgraph) are midrange but today’s activity did result in a mild crossover which may be a slightly bearish hook. Until we see a breakout of the range established by May 14th and 15th, 214.500 to 205.325, bullish trend traders may want to sit on their hands. The seasonal patterns seem to indicate that prices typically remain firm through June and July (summer grilling season) and I’d be willing to give up a little price movement in exchange for a little more trend or directional clarity. Cattle producers that have livestock to sell may do well to consider using Put options to protect downside risk. Perhaps consider the August 205 Puts (closed at 3.125 or $1,250 before your commissions/fees) or the August 200 Puts (closed at 1.875 or $750 before your commissions/fees) to manage that downside risk. Why buy Puts instead of hedging with the futures? Because the trend has been up, cash markets remain strong and demand has not faltered, and your cash outlay (trade risk) for the options will be less than the margin required for a futures trade. You’ll still have some downside protection, if the market trend breaks, which I think cattle producers are in need of. And if the trend continues up, you’ll be able to take a relatively small loss and reposition your hedges higher and when appropriate. I know that nearly everybody and their brother is bullish cattle these days, and rightly so, for all the reasons I mentioned a sentence or two ago. I haven’t seen enough “poor” technical activity to indicate a change in trend, but I also don’t currently see enough “good” technical activity to recommend a “buy” here either. Remember last week? Prices dropped aggressively on one news article that turned out to be fake. What do you think will happen if the next news article isn’t fake?

August Live Cattle (Weekly)

The weekly Live Cattle chart looks like a market that is running out of momentum, to me. For 5 weeks, futures prices have remained at or near the same price. Yes, we’ve seen prices trade higher (4 weeks ago) and lower (also 4 weeks ago) but for the most part, it seems to me that Cattle traders have been content to trade between roughly 211.000 and 206.000. And for a market that seems to have solidly “bullish” fundamentals (herd contraction, screwworm and grilling season) prices have been reluctant to rally. Support, however, has been holding very well, in the form of the 5-week moving average. (Blue, 209.175) and this market has not yet retraced enough to test the 10-week average (red, 204.524) since the market last interacted with that average in April. Both of those averages appear to have been solid support levels for Live Cattle, since the bullish uptrend began last September. Stochastics (bottom subgraph) are still in overbought territory, and have been for much of the past 8 months. The uptrend is still very much intact, I think, when viewed on the weekly chart. Seasonally, prices do tend to trend higher for the August contract until expiration (grilling season and typically stronger demand) I’m somewhat concerned that the behavior of the market is unusual, in that the trend seems to have been stopped, without any significant or “normal” pullback. It’s not odd to see a market consolidate (see most of April-July last year) it’s just odd to me that it’s occurring when this contract is the “front” or most actively trade month. As of this writing, it’s only Tuesday, what do you think the rest of this week will look like?

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.