The information and opinions expressed below are based on my analysis of price behavior and chart activity

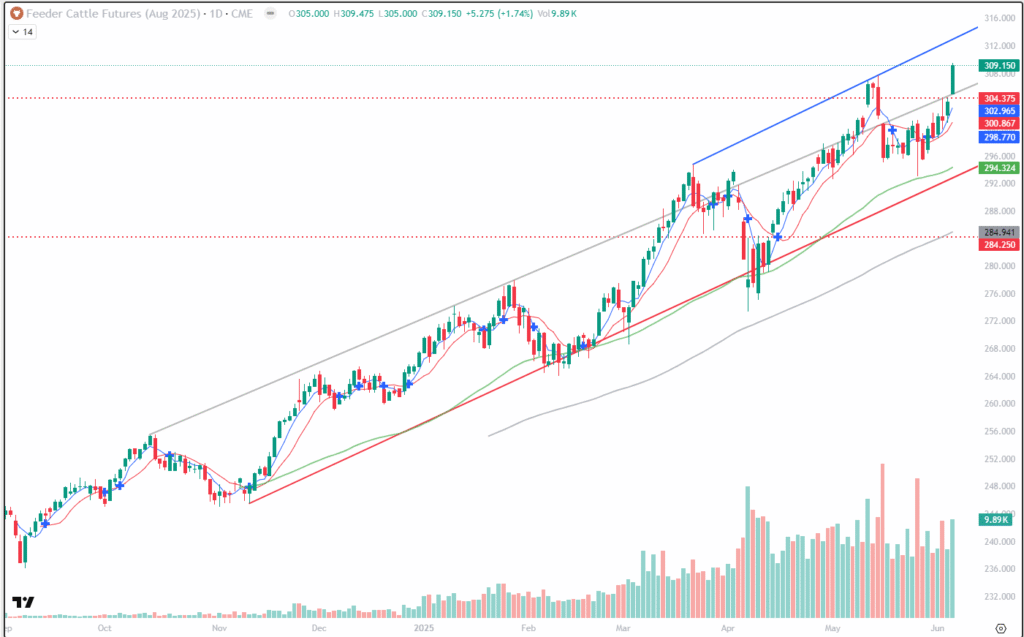

August Feeder Cattle (Daily)

August Feeder Cattle closed at a new contract high close on Thursday, settling at 309.150, up 5.275 on the day. Following a strong close on Wednesday, the futures gapped higher on the open traded higher all session. In fact, the last few trades of the day saw the market setting the highs of the move, which seems bullish to me. Trade volume was the highest since May 27th, eclipsing the high volume from Tuesday of this week. The gap higher means that there are now 2 price gaps remaining on this chart, the first being from April 11th-14th down at 284.250, and the most recent at 304.375, which was yesterday’s high. When that first gap happened, the Feeder market traded higher for a month, before making a high on May 14th. Will that happen again? Only time will tell, but the trend does appear to be very strong, to my eye. You may notice the trendlines on the chart. While the red one under the market certainly seems to have acted as strong support, it’s the grey one and the blue one I’d like to focus on. The upper blue one may offer some resistance, up near the 313.000 level, as that trendline is where the market faded back from previously. However, today’s gap higher open and strong close may negate that. The grey trendline, drawn off of the Oct-Jan highs, had also been a resistance level, although we did trade though it on several occasions. That seems to intersect with today’s lows and may now offer some support, along with the price gap. The 5-and 10-day moving averages are below the market, at 302.965 and 300.867, respectively. Stochastics are indicating overbought status, but this market has spent much more time being overbought, and still going higher, that it has being oversold. Aggressive and well-margined speculators may do well to be long this market, though either futures or call options. Producers and hedgers, I think, should be waiting for signs of trend weakness before considering hedge (short) positions.

August Feeder Cattle (Weekly)

It’s not the end of the week yet, but as of Thursday’s close the August contract has gained some 10.325 this week. Previously, the strongest week that this contract has been able to muster was the 7.025 gain in the first week of March. According to the Seasonal data for Feeders, we’re already 2/3 of the way to what has been the strongest June for this contract, 2014. And today is only the 5th. There’s a lot of month left and a lot can happen in that time. The 5- and 10-week moving averages are both below the market, at 301.250 and 295.305, respectively. (blue/red) and have acted as solid support for most of the contract history. Stochastics are back in overbought territory, but again, it’s been that way for most of the contract life. There is a trendline drawn off the highs from mid-March and mid-May, which equates to roughly 312.650 or so, about 3.500 higher than Thursday’s close. That may offer some technical resistance, or it may turn out not, like the grey trendline, drawn off the Oct-Jan highs. That level may act as support, near the 305.000 mark. I know that cattle producers are both happy with the high prices and also very nervous that it may not last. Currently, I don’t see any sign from the weekly chart that the trend is slowing.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.