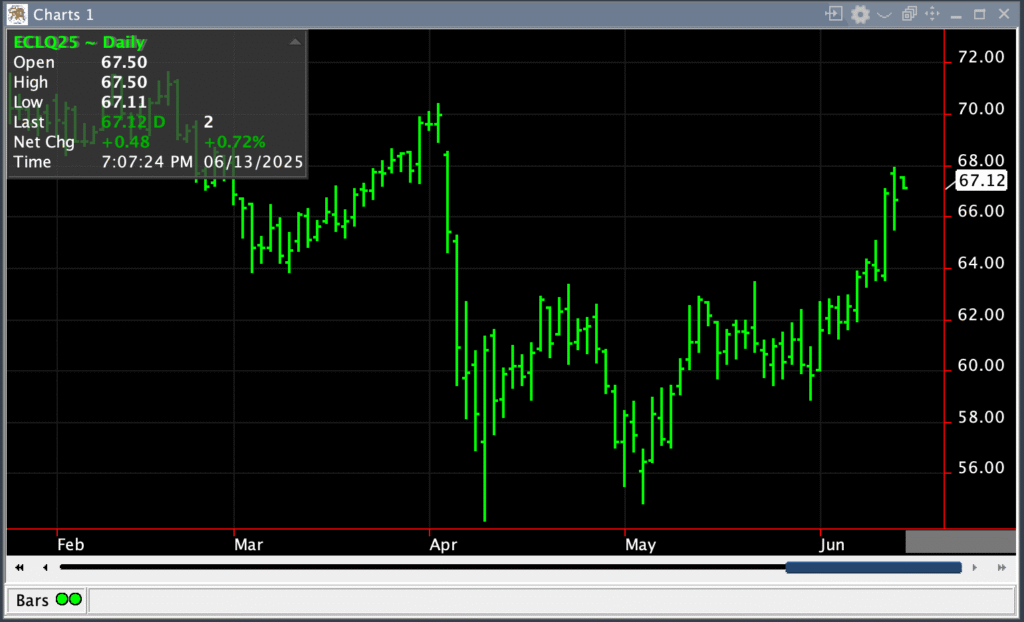

This chart of August crude oil attracted my attention. There are seven days of higher highs. I have noticed that markets typically trend up only three days in a row. Seven days of higher highs point to a trend higher and show momentum higher. The main fundamental behind this is Middle East tensions, specifically with Iran.

Chart courtesy of CQG.

Notice the gap at 68.54 on April 3. Today’s high is 67.93. Markets are very good at filling these gaps, in my opinion. I predict that crude oil will trade at 70 even in the next two to three weeks.

Here is a bullish options strategy, in my opinion. Sell the August crude oil 64 put. Today’s settlement is 194 on that option ($1,940). With that money, buy the August crude oil 70 call. That option settled at 209 today ($2090). This will cost $150. When crude oil trades to 70, sell the call and buy the put back. If crude oil trades down under 64, this option strategy is not working and buy the put back and take your loss. These options expire on July 17. The margin is crude is $6,000 per contract.

The Organization of Petroleum Exporting Countries (OPEC) does two things well: produces oil and manages the market to its advantage. OPEC has taken the view that cutting production and keeping oil prices high is better than selling more barrels at lower prices. So when the cartel — lead by Saudi Arabia — announced a big increase in production, traders and other observers were confounded. Unsurprisingly, this has sent the oil price sinking. A few days ago it was down 15 percent since the beginning of the year to $65 a barrel. Saudi Arabia needs prices above $90 a barrel to balance its budget, according to the International Monetary Fund.

What could be behind the falling prices? Is it a slap on the hands of cartel members who are producing more oil than agreed upon? Might it help lessen the impact of further U.S. sanctions on Iranian oil? Either way, low prices are a gift for American consumers.

OPEC may not have to feel the pain for long. Industry reports suggest that big companies from non-OPEC countries, such as Exxon Mobil, Shell and BP, have found relatively few new oil fields.

I like the strategy mentioned above and in my opinion, crude oil will continue to trend higher this summer.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878-2391 8248

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.