The information and opinions expressed below are based on my analysis of price behavior and chart activity

April Live Cattle

April Live Cattle closed at 203.025 on Friday, gaining 2.30 on the, finishing off the week with 3 consecutive record high closes. That puts the April Fats up 8.750 this month (+4.5%) and if they can hold gains through the end of next week would mark 5 consecutive monthly gains. That’s a pretty good streak, eclipsed only by the 9-month rally in 2022-23 (June-Feb) and the 6-month rally in 2023 (April-September) You have to look further back than 10 years (June ’13- Feb-’14, 9 months) to find a similar streak. According to my thumbnail math, that works out to respective gains of 27%, 16% and 20%, roughly. Our current streak puts the market up 14%. My point here is that even though the market is setting record highs (also happening in the cash markets) there is still potential room to go. Just because prices are high, is not necessarily a good impetus for prices to fall. My daily chart has flipped back to the “buy” side, as shown by the 5- and 10-day (blue and red) crossing over today. Note the blue cross below today’s bar. You’ll also notice that yesterday trade activity caused that signal to turn bearish, before reversing today. Before that, the previous bullish crossover was on December 30th. Todays Cattle on Feed data was released after the close. The total number was 11.823 million head, down 1% from last year, with Placements at 97% pf last year and Marketings at 101%. To my eye, that seems friendly or mildly bullish. We’ll have to see what the rest of the world thinks on Monday morning. Personally, I think that prices will likely remain firm until the US consumer changes their buying habits. Packers are not getting squeezed, as I believe that they are long the market and a big chunk of the large record long position. In other words, the biggest risk to the packer is an increase in price and they’re hedged against that by being long. Producers and ranchers are hedged the other direction, short the market, as their largest risk is that prices go down. Those folks are likely losing on their hedges and are getting subject to some margin pressure. You’ll also notice by looking at the chart above, that today’s volume was very strong, 34,000+ contracts changed hands, the highest since January 10th. Strong price moves on strong volume are typically sustained. Not to say we can’t settle back some, but I think the trend will remain bullish for a bit.

Aggressive and well-margined traders may do well to consider long positions in the futures. The downside risk should be managed with Sell-Stops, however, given the volatility, put options may be a better risk management choice. I say that because there is some concern with placing stops “too close” and getting knocked out due to intraday price swings and watching the market go the direction you thought it should. Put options, with the correct position delta (that’s important!!) can offer the ability to withstand larger price swings without the risk of getting “whipsawed.” Call me if you don’t understand “delta,” as unfortunately, I think most producers and traders don’t. Producers should be hedged, although that’s been a losing proposition lately. Put Options are likely your best choice right now, because the market has been trending aggressively higher and nobody likes margin calls. Put Spreads will reduce your out-of-pocket cost, limiting your potential loss somewhat, but not offer unlimited downside protection.

As we’re setting new highs, upside resistance is difficult to gauge. A Fibonacci extension (not shown) projects resistance at 203.800 and then up to 209.725. The blue channel that you see on the chart above suggests weekly resistance near 206.000 (top line, moved out 5 days) and weekly support near 200.50 (bottom line, moved out 5 days) that corresponds with a nice big, fat, round number of 200.000. The median of those two (dotted blue line) projects to 203.050, basically unchanged for the week, if moved out 5 days. Short term support may show up in the form of the 5- and 10-day averages, at 199.675 and 199.100, respectively.

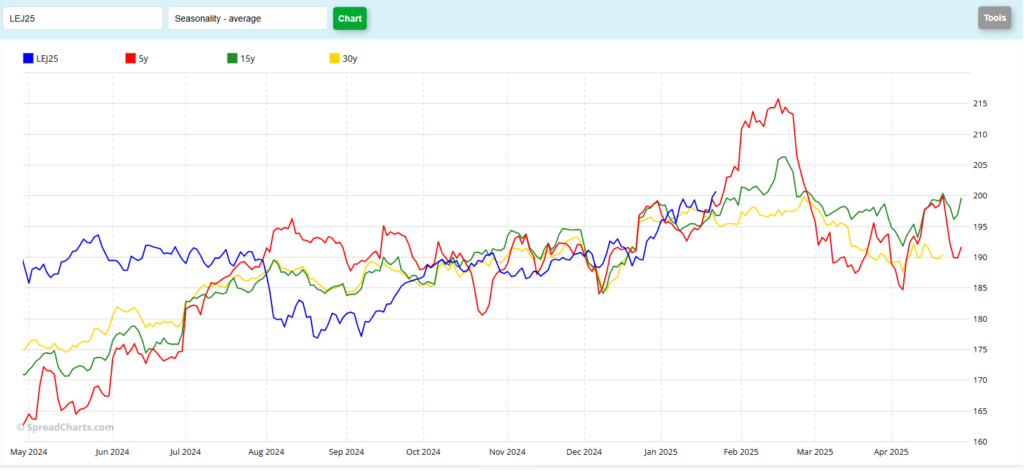

Seasonally, I would expect Live Cattle to stay strong until roughly Valentine’s Day, or perhaps shortly after that. You can see that chart below. To my eye, Live Cattle have been following to their seasonal patterns better than most markets over the past several months, and I would expect that to continue for now.

April Live Cattle (Seasonal)

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.