Live cattle contracts finished higher today but little change from Wednesday with just a little more cash trades yesterday moving the 5 area weighted average down to 162.37, which is up $1.66 from the figure a week ago. Choice cutout rose ‘just’ 63 cents to $288.54, whereas the select average surged another $2.84 to $276.48. The relatively narrow Choice-Select spread, $12.06, is not indicative of lost currentness on the part of feedyard operators, since today’s weekly slaughter report stated the average dressed weight of steers processed during the week of Feb. 4 at 902 pounds. That marked a six-pound weekly drop and kept the year-to-year difference at 16 pounds, despite a weekly drop of 12 pounds at the same time last year.

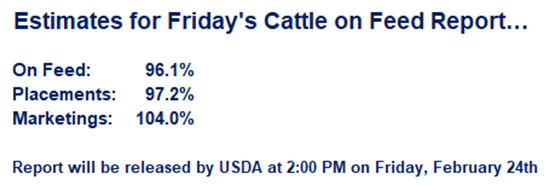

There is a modest premium carried by the April live contract last month and discounts built into the summer month contracts, so we’re all looking to see what tomorrow’s USDA Cattle on Feed report brings. Cattle on Feed report to state January placements 2.9% below year-ago. The strong January slaughter is reflected by the projected 3.9% increase in January marketings. The net of those numbers is another comparative drop in the Feb. 1 Cattle on Feed population, down 3.5% from the year-ago level or approximately 11.772 million head. USDA results near these figures would again look supportive of the price outlook.

Today’s breakout from the recent congestion area gave bulls a stronger short-term technical advantage in March feeder futures. Today’s low places initial support at $187.70, with strong backing from its 10-, 20- and 40-day moving averages at $187.11, $186.21 and $185.35, respectively. Today’s high marked initial resistance at $189.75, with that band of selling likely to extend up to the psychological $190.00 level. A breakout above that point would have bulls targeting the August high at $192.625.

See below for the Cattle on Feed estimates:

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research