Cattle markets rallied today, following through off of a positive price action Friday along with the bullish Cattle on Feed report which showed On Feed down 3%, Placed down 8% and Marketings down 6%. Cash trades, in my opinion, will give the market it’s direction this week especially if there are cash reports with solid volume behind it. The noon beef report today showed Choice cutout value down 61 cents at $271.71, while Select grade fell 57 cents to $255.86. The Choice-Select spread is currently at $15.25. Movement at midday today was 60 loads.

The feeder cattle market saw strong rallies across with board with near term contracts up over $2 today and deferred contracts up over $1 with the September contract settling at 208.30 and the October contract settling at 211.05. A sharp sell of in the grain markets today helped support the feeders as well with reports of good rains in South America. In my opinion, Cow-Calf operators should be looking to protect any downside price risk now should the market lose momentum due to a possible increase in production by the time of the 3rd and 4th Quarter.

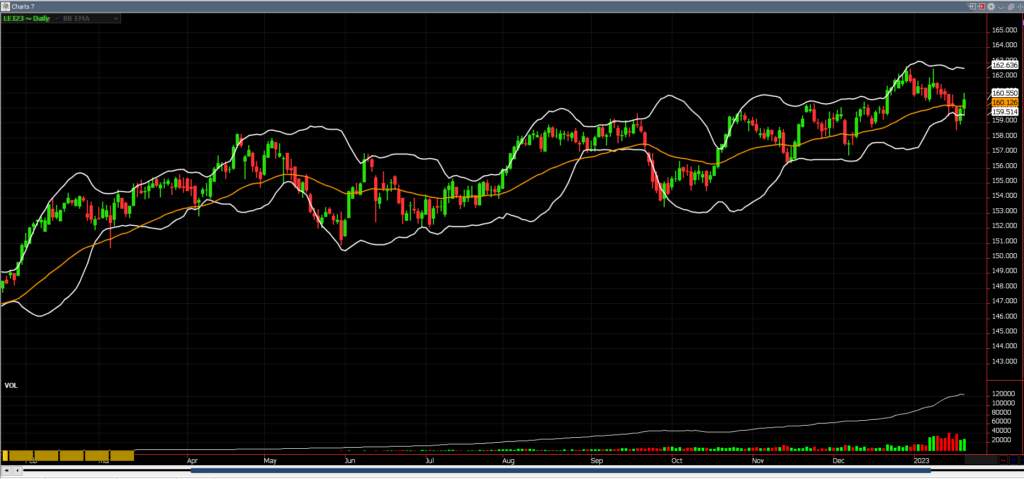

April Live Cattle

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research